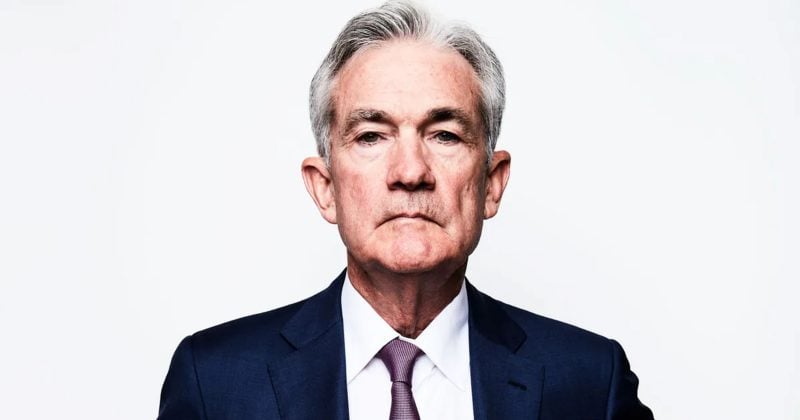

Photo: Nigel Parry

Powell says Fed does not need to ‘be in a hurry’ to lower rates

Powell stresses a measured approach, signaling no immediate rush to adjust interest rates.

Federal Reserve Chair Jerome Powell said the central bank doesn’t need to rush to cut interest rates given the economy’s strength, emphasizing a careful approach to future policy decisions.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell said in prepared remarks for a speech in Dallas.

Powell indicated the Fed would be “watching carefully” to ensure inflation measures stay within an acceptable range.

The comments come as financial markets have been speculating about potential rate cuts.

“The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully,” Powell said, highlighting the Fed’s data-driven approach to monetary policy decisions.

The Fed chair’s stance suggests the central bank will maintain its current elevated interest rates, which have been used to combat inflation over the past two years.

Earn with Nexo

Earn with Nexo