Ethereum resurgence and layer-2 boom define crypto Q2: IntoTheBlock

Spot ETH ETFs boost Ethereum as Bitcoin miners increase sell-off.

The second quarter in crypto was marked by Bitcoin (BTC) and Ethereum (ETH) trending down, BTC miners selling their reserves at a rapid pace, and layer-2 blockchains activity leaping four times, according to IntoTheBlock’s “On-chain Insights” newsletter.

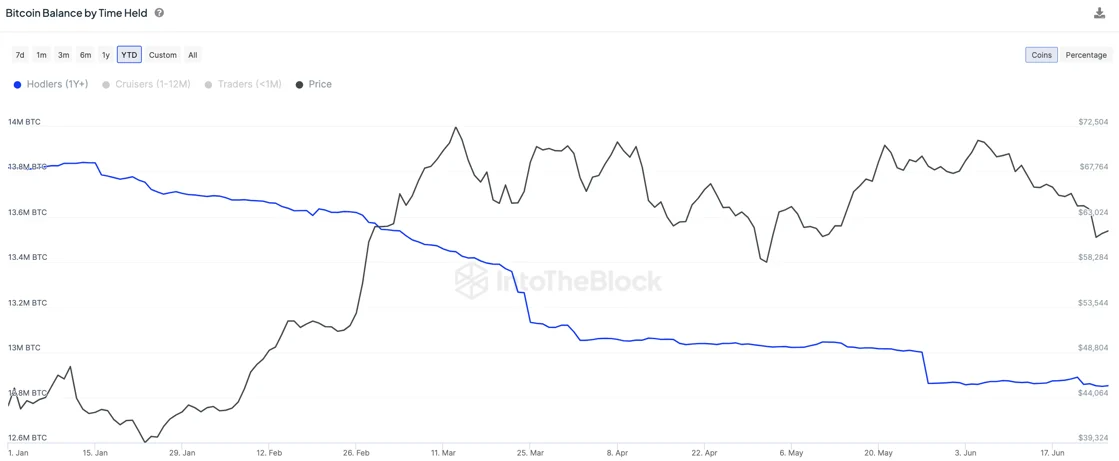

Bitcoin’s price fell by 12.8% following its fourth halving on April 20, and an anticipated price surge caused by a supply shock did not materialize. IntoTheBlock analysts shared that this is likely due to long-term holders taking profits in 2024.

Moreover, miners have offloaded over 30,000 BTC in June alone, which amounts to near $2 billion. Again, the halving could be tied to this movement, as profit margins for miners decreased since then.

In contrast, Ethereum saw a modest decline of 3.1%, a feat made possible by the approval of spot ETH exchange-traded funds in the US, the analysts highlighted. This event boosted Ethereum’s price by over 10%, as those investment products are expected to attract substantial investment, mirroring the inflows seen with Bitcoin’s ETFs.

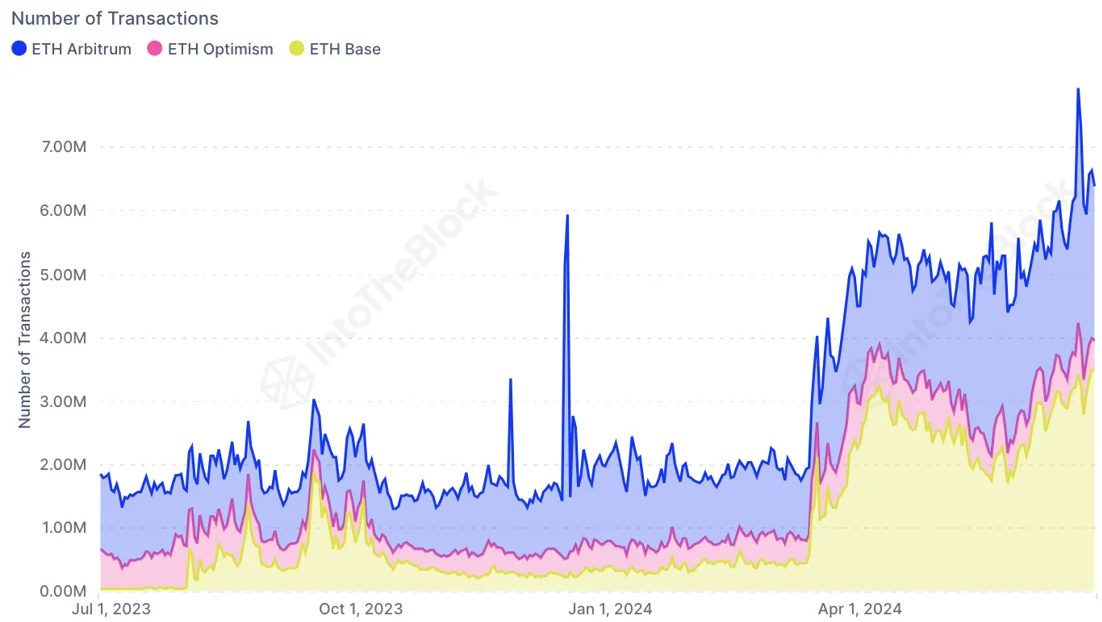

Additionally, Ethereum’s landscape was notably different, with an increase in transactions on layer-2 blockchains like Arbitrum, Base, and Optimism, following the integration of EIP-4844.

This development introduced the “blobs”, which significantly reduced transaction fees for layer-2 blockchains and encouraged greater on-chain activity. Therefore, this potentially prepared the stage for long-term network benefits despite a short-term decrease in fee revenue.