Ethereum ETF, Uniswap V4, and Cardano are major crypto catalysts in Q3

Ethereum ETF, Uniswap V4, and Cardano upgrade aim to enhance market accessibility and efficiency in Q3.

Three major catalysts are set to impact the crypto market in Q3 2024, according to the latest edition of IntoTheBlock’s newsletter “On-chain Insights”. The events include the trading start of spot Ethereum (ETH) exchange-traded funds (ETF) in the US, the Uniswap V4 release, and Cardano’s Chang hard fork.

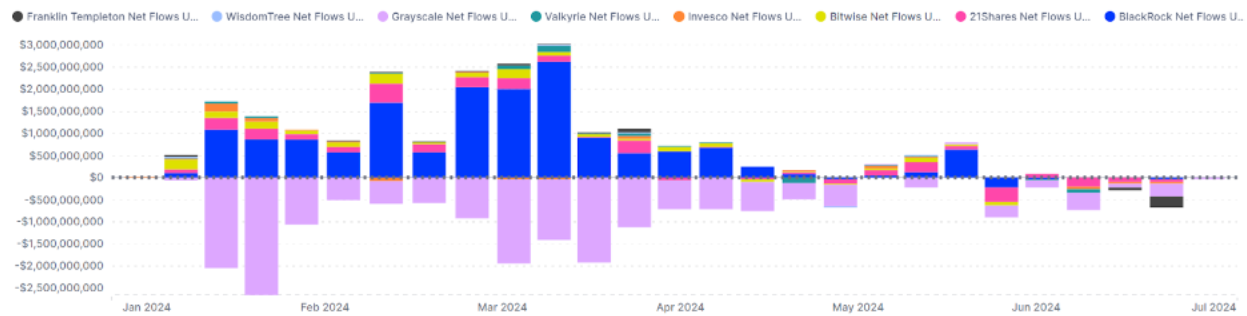

The Ethereum ETF is expected to launch this quarter, potentially attracting institutional investors. Analysts at IntoTheBlock predict ETH ETF inflows could reach 30% of those seen during the Bitcoin ETF introduction, which saw $5 billion in net inflows over its first five months.

As reported by Crypto Briefing, asset management firm Bitwise’s CIO predicted that Ethereum ETFs could attract $15 billion by the end of 2025.

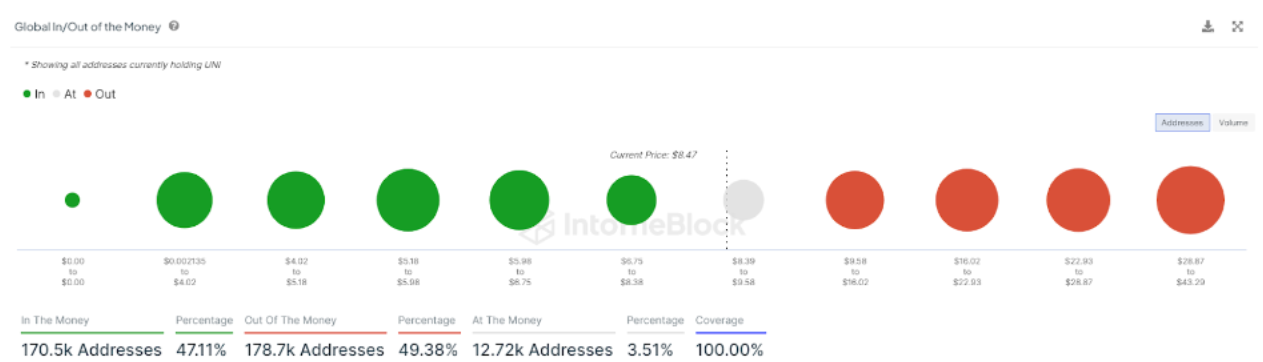

Uniswap, the largest decentralized exchange by total value locked, plans to release its V4 version. This is the second development in crypto seen by IntoTheBlock analysts as a potential catalyst for prices in Q3.

Notably, the V4 update introduces “hooks” for customization, dynamic fees, on-chain limit orders, and time-weighted average market maker functionality.

Moreover, Cardano aims to implement the Chang hard fork by the end of July, introducing decentralized, community-run governance. The Chang upgrade will proceed once 70% of stake pool operators have tested and updated their systems.

This is also a development in crypto that could boost prices in this quarter, the analysts pointed out.

These developments follow historical trends of catalysts boosting asset values. During the month leading up to Cardano’s last hard fork in September 2021, ADA’s price increased by 130%, rising from $1.35 to $3.10.

The On-chain Insights newsletter also mentions the application for a Solana ETF made by Bitcoin ETF issuers VanEck and 21Shares, further expanding institutional crypto access. Although it is unlikely to get approved in 2024, much less in Q3, this movement could boost investors’ sentiment.