Shutterstock cover by Pikoso.kz

Solana, Fantom Recover From Dip to New All-Time Highs

Investors appear to have taken advantage of the recent flash crash to buy Solana and Fantom at a discount.

Solana and Fantom have quickly recovered from the market’s recent flash crash. Both assets now sit at crucial support levels that could propel them into higher highs.

Layer 1 Coins Post V-Shaped Recovery

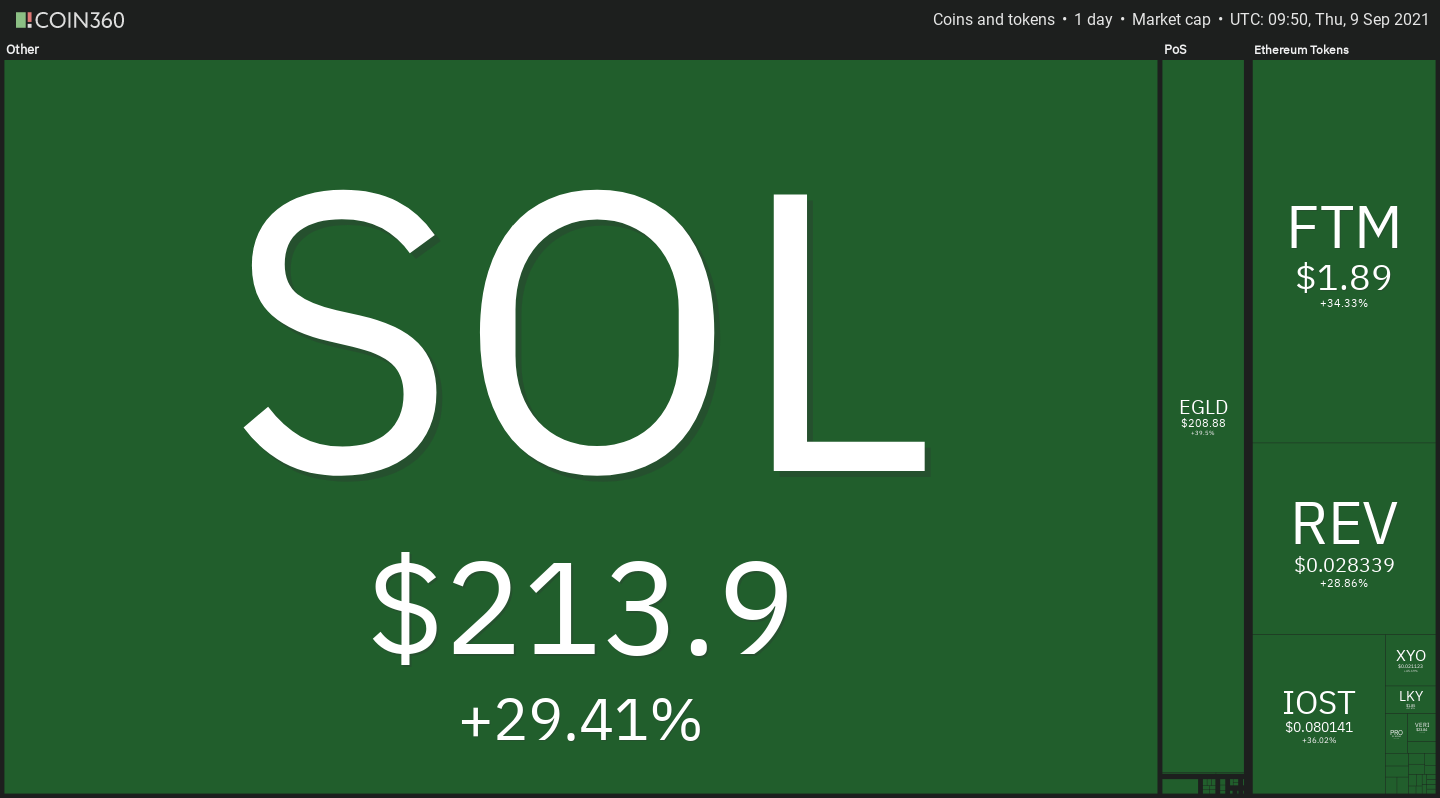

Solana and Fantom are among the altcoins that have gained pace since the cryptocurrency market experienced one of its steepest flash crashes of the year.

Although more than $3.5 billion in liquidations were generated across the board after the market dipped Tuesday, some investors appear to have taken advantage of the correction to buy tokens at a discount. Behavior analytics platform Santiment has pointed out that mentions of “buy” and “dip” together have skyrocketed, suggesting a bullish bias among retail investors.

The significant increase in buying pressure has allowed several digital assets to recover to new all-time highs.

Both of the Layer 1 projects have surged by more than 30% in the last 24 hours, registering a V-shaped recovery. SOL was able to reach a new milestone at $216, while FTM recorded a new all-time high of $1.94.

Further buying pressure could see both digital assets make higher highs.

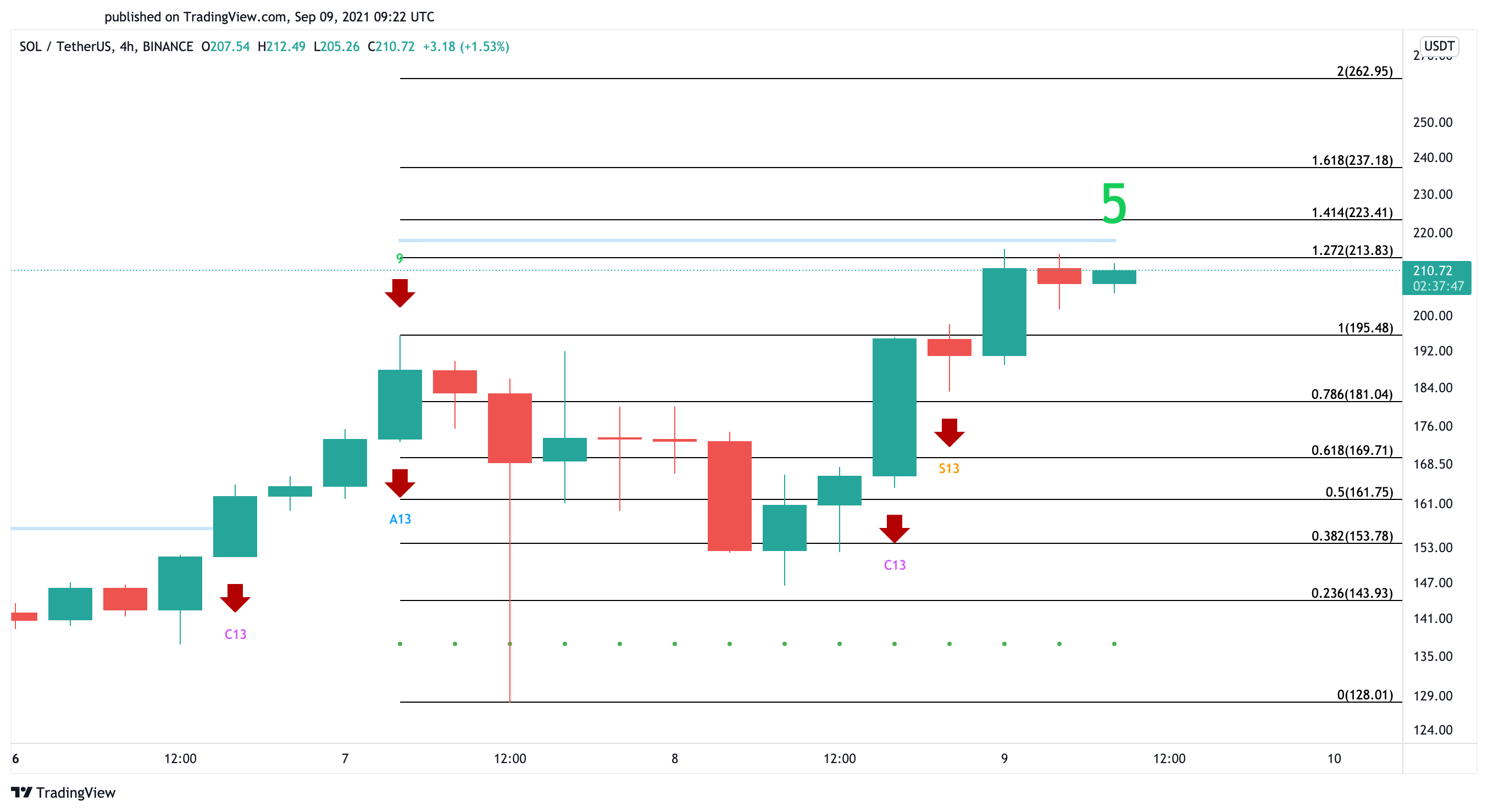

Solana in Price Discovery Mode

The four-hour chart suggests that Solana is trying to overcome a psychological resistance level that lies between $213 and $218.

Given the significant gains that this cryptocurrency has posted over the last few months, it seems that investors remain cautious about a potential spike in profit-taking. Only a four-hour candlestick close above this barrier would signal the continuation of the uptrend.

By slicing through the $213 to $218 region, Solana might attract a new wave of buyers that push prices further up. Based on the Fibonacci retracement indicator, SOL could target $237 or even $263 upon the break of the overhead resistance.

It is imperative to watch out for the $195 demand wall, as any downswing below this price point would indicate an incoming bearish impulse. If Solana loses this underlying support level, a steeper decline towards $170 to $160 could be imminent.

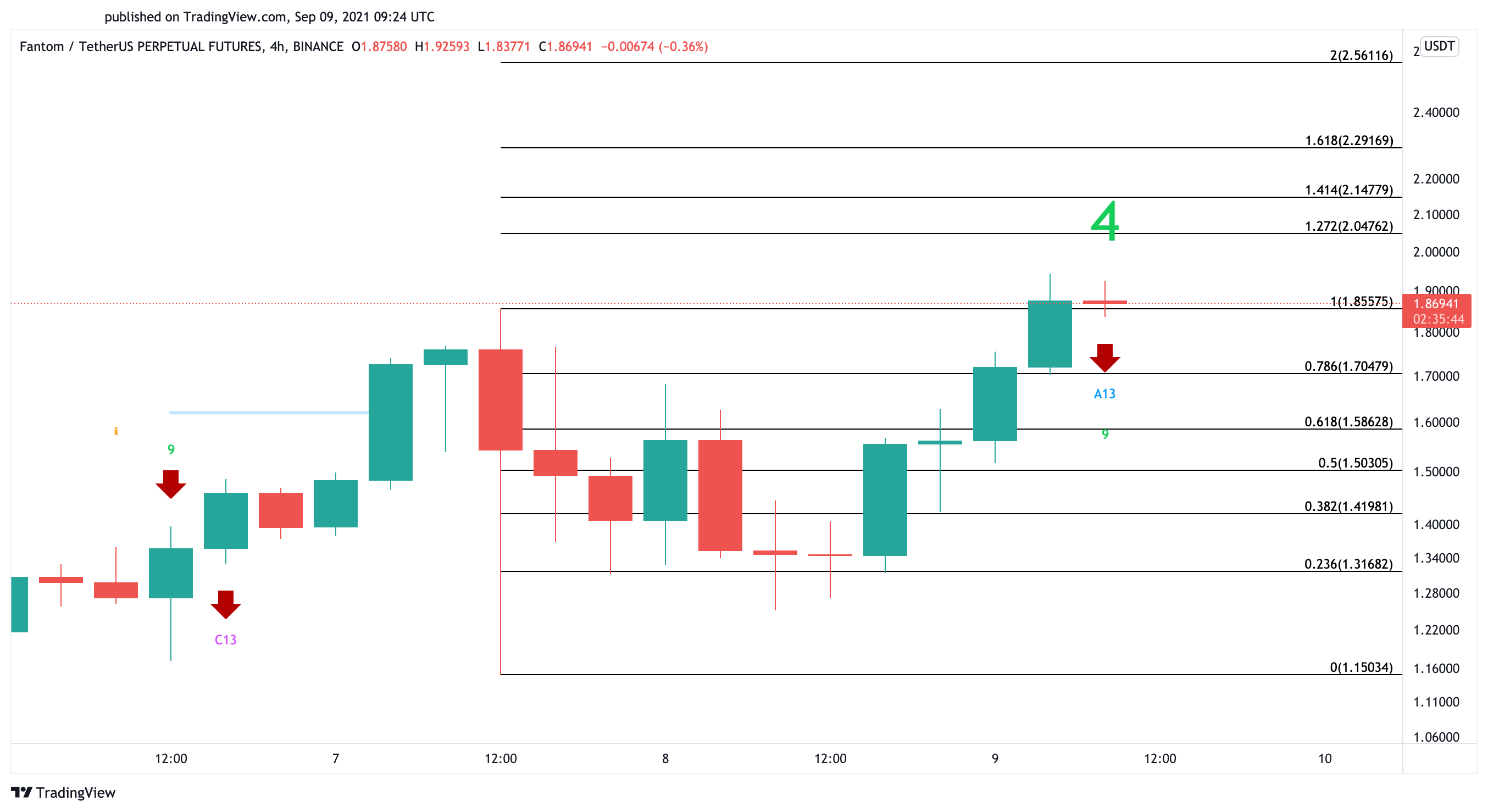

Fantom Lures Investors

Fantom bounced strongly off the $1.15 support level after taking a 38% nosedive. The bullish impulse was significant enough to push FTM to a new all-time high of $1.94. Now, the Tom DeMark (TD) Sequential indicator has presented a warning signal to investors looking to buy in.

The TD setup flashed an aggressive 13 candlestick on the four-hour chart, which can be considered a sell signal. A spike in selling pressure could push Fantom toward the 61.8% or 50% Fibonacci retracement level. These support levels sit at $1.58 and $1.50 respectively.

Regardless of the bearish formations, the $1.86 level would play a vital role in Fantom’s uptrend. A four-hour candlestick close about this price point could mark FTM’s entry into price discovery mode. Under such unique circumstances, investors should prepare for an upswing to $2.30 or even $2.56.