Shutterstock cover by Zenik

Solana Could Soon End Corrective Period

Solana looks primed for an upward impulse as the technicals turn bullish.

Solana has not recovered the lost ground from its peak despite the bullish momentum seen in other Layer 1 tokens. Still, the technicals forecast that SOL’s trend could soon reverse to the upside.

Solana Prepares to Recover

Solana could finally be ready for an upward move.

The Layer 1 token is currently in a downward spiral, but several technical indicators suggest its trend might be improving.

After declining from its Nov. 6 peak, SOL is almost 70% short of its all-time high. That’s a stark contrast to other Layer 1 tokens such as Terra’s LUNA, which has shaken off rocky market conditions and broke a new all-time high Wednesday. SOL, meanwhile, is lagging. Still, there are a few reasons to believe that Solana’s corrective phase could soon reach exhaustion.

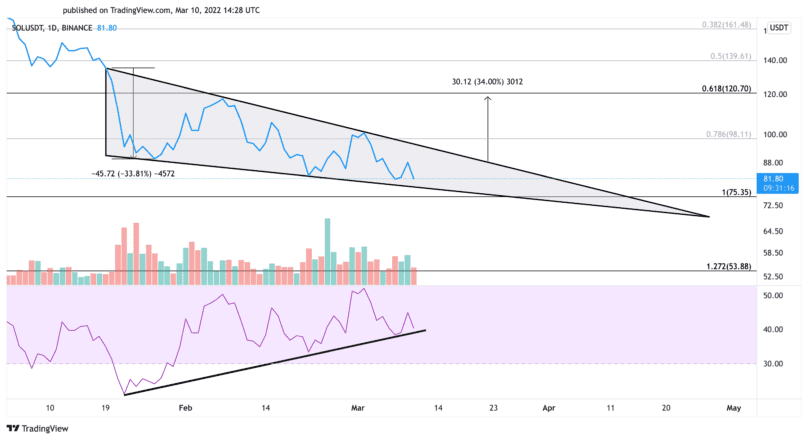

SOL’s price appears to be forming a bullish divergence against the Relative Strength Index on its daily chart. While it continues to make a series of lower lows, the RSI has been making a series of higher highs. Such market behavior indicates rising upward momentum, hinting that a break from oversold territory could be near.

Moreover, the recent downward price action appears to have led to the formation of a falling wedge on Solana’s daily chart. As SOL moves closer to the pattern’s apex, it could be preparing to break through resistance. A decisive close below the wedge’s upper trendline could result in a 34% upswing toward $120.

Given Solana’s poor performance over the past few months, it remains to be seen whether it will be able to gain the strength it needs to breakout. Breaching the $75 support level could show further signs of weakness, encouraging market participants to exit their positions. A spike in sell orders could invalidate the optimistic outlook and result in a steep correction to $54.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.