USDC gains ground in DeFi as competition with USDT intensifies: Keyrock report

Gini coefficient reveals USDC's more balanced distribution in DeFi protocols compared to USDT.

Tether USD (USDT) and USD Coin (USDC) are leading the stablecoin market, each carving out distinct niches in the crypto ecosystem, according to a recent Keyrock report. USDT maintains its dominance as a trading pair standard on centralized exchanges, leveraging its first-mover advantage. Meanwhile, USDC is making significant inroads in decentralized finance (DeFi) applications, offering a more diverse portfolio of use cases.

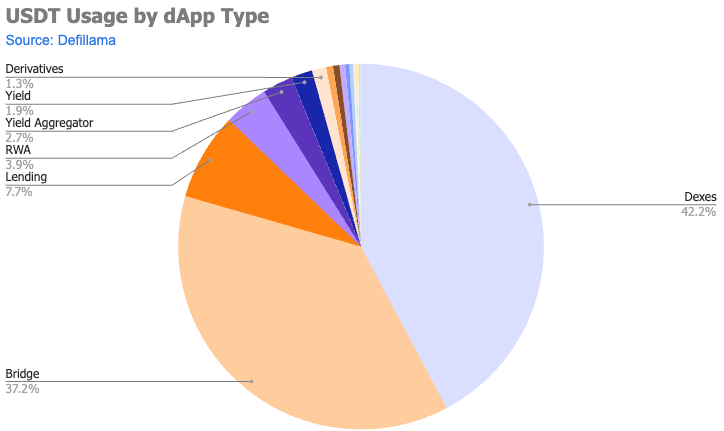

Approximately 11.5% of USDT’s total market cap, or $12.8 billion, is held within smart contracts across 10 different chains, the lowest percentage among major stablecoins. USDT’s usage is primarily concentrated in bridges and decentralized exchanges (DEXs), reflecting its historical role in the crypto ecosystem.

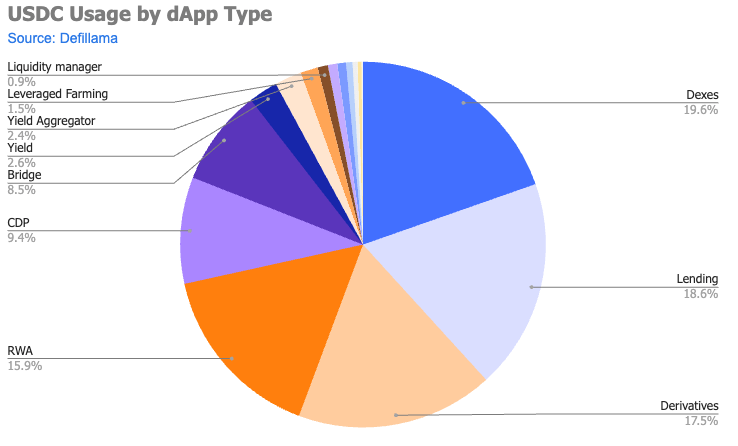

In contrast, 20% of all circulating USDC, or $7 billion, is in smart contracts, nearly double that of USDT. USDC has gained traction in derivatives, real-world assets (RWAs), and collateralized debt positions (CDPs). It has approximately $1 billion locked in derivative trading protocols, more than six times that of USDT.

Moreover, USDC’s distribution among dApps is more balanced compared to USDT, as evidenced by their respective Gini coefficients for TVL distribution across the top 150 protocols: 0.3008 for USDC versus 0.6695 for USDT.

While USDT remains crucial for trading pairs and price discovery, USDC appears better positioned to drive future DeFi innovations fueled by its versatility. Nevertheless, “it is unlikely” that USDT will lose its lead market cap-wise at the current rate of new stable printing, as highlighted by the report.

Notably, the stablecoin landscape continues to evolve, with newer entrants like PYUSD and experimental models like USDE demonstrating the potential for rapid growth and high-yield offerings in the sector.