Stellar Lumens Burn As Nano Pries Open Kraken’s Door

Price soars as Stellar lumens burn.

From 105 to 50 billion. That was the net result of the Stellar Development Foundation’s decision to burn 55 billion XLM tokens. All of the Stellar Lumens burned were in the possession of the foundation, with only 20 billion in circulation.

Why The Burn-off?

The Stellar Development Foundation (SDF) appears to have made a cautiously considered decision. As the SDF explained at a conference at the Meridian in Mexico City, “… in time and after a lot of thought, we’ve come to realize they’re [the SDF’s allocations] too large,” in reference to the 17 billion in SDF’s operating fund and 68 billion set aside for giveaway programs. “SDF can be leaner and do the work it was created to do using fewer lumens,” the foundation goes on to say, noting the muted effect airdrops and giveaways were having.

The SDF considered a number of options for what it saw was an excessive supply of XLM. Working backward from the number of lumens already in supply made no sense. In the end, the foundation’s view was that they needed to act in such a way that took into account the idea that, “we should only keep what we’re confident we can actually use. And use relatively soon, at that–in the next ten years.”

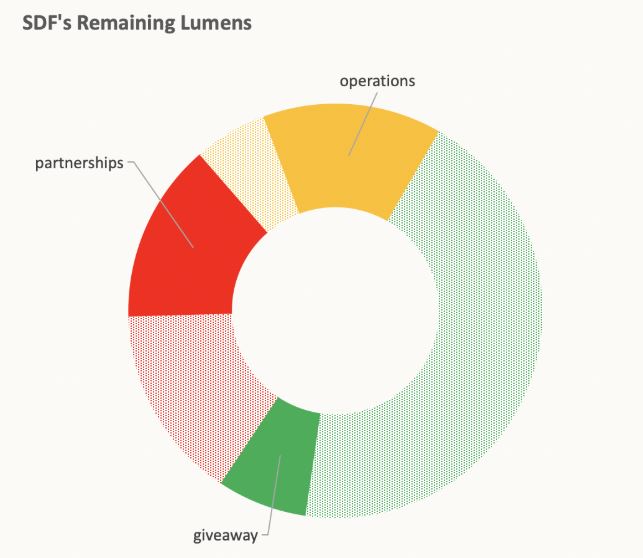

The SDF’s burn allocation was not homogenous, with the portion dedicated to giveaways seeing the biggest change – from 43 to 6 billion. Others were not quite as dramatic, with the operations and partnerships budgets being cut from 17 to 12 billion, and from 25 to 12 billion, respectively.

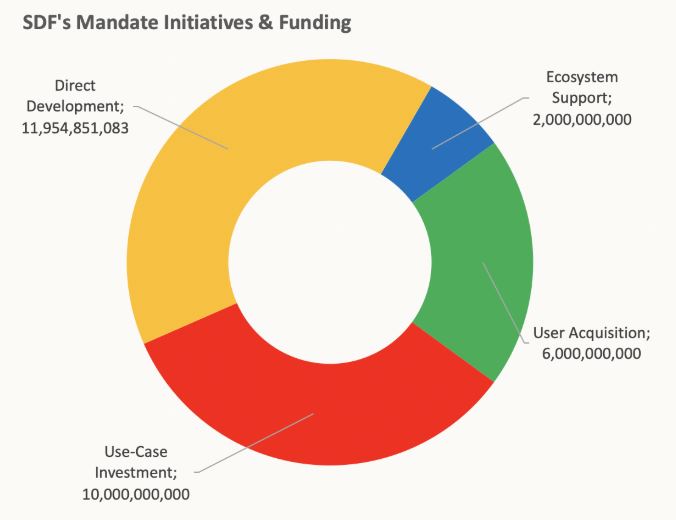

After the Stellar lumens burn, the Foundation has reassigned the remaining tokens into four new categories of direct development, ecosystem support, user acquisition, and use case investment. The latter has the second largest allocation at ten billion, with 80% of that set aside to acquire companies or fund enterprises in return for equity. Grants will be made from half of the ecosystem support allocation.

Destruction Follows Community Vote To End ‘Inflation’

Cryptocurrency foundations and developers use the word ‘inflation’ to mean growth in the supply of the number of tokens, often over the sound of classical economists turning in their graves. Inflation is actually defined as prices going up due to an imbalance between monetary supply and underlying economic value. Printing money can result in inflation, if the economy does not grow to compensate it. With that said, Stellar XLM’s annual inflation rate (in the parlance of lingua crypta) was one percent.

At the end of September the Stellar community voted to cease inflation after year-long discussions. The foundation was in support of the decision. The SDF argued that inflation was not beneficial to XLM, saying they “envisioned an incentive mechanism whereby account holders would collectively direct inflation-generated lumens toward projects built on Stellar.”

Five years on, natural human incentives seem to have undermined the goal of inflating the supply of lumens weekly. “Rather than sending inflation to projects building on Stellar,” the SDF discovered, “the majority of users join pools in order to claim that inflation for themselves.”

Another economist turns in his grave at the suggestion that this outcome was never considered a possibility.

Market Reaction

The market’s immediate reaction to the news was highly positive, with XLM jumping almost twenty percent within an hour of the announcement, according to Coinmarketcap.

That bounce appears to have been limited to the post-announcement reaction, with the price now stabilizing at its new levels.

On The Topic Of Microtransaction Cryptocurrencies…

The Stellar lumens burn wasn’t the only positive news for markets. Kraken has announced support for NANO, formerly RaiBlocks, with trading to begin instantly. The San Francisco-based exchange will offer trading pairs of NANO/USD, NANO/EUR, NANO/XBT, and NANO/ETH.

Stellar’s microtransaction-friendly properties are shared by other cryptocurrencies, with NANO being one. Using its unique block lattice Directed Acyclic Graph (DAG) infrastructure to make transactions fast and fee-free, NANO is considered a “next-generation decentralized network and cryptocurrency designed to solve instantaneous peer-to-peer payments without fees or the need for expensive computational resources.”

NANO isn’t actually fee-free, with transactions costing around $0.002, representing the cost of the electricity used to fuel the proof-of-work required to process a transaction.

Markets have reacted positively to the news, with NANO up almost thirteen percent for the day. The project team would no doubt welcome the development, having never recovered from the BitGrail meltdown that saw it fall from all-time highs of over $37 at the beginning of 2018. It is currently trading for $1.02.

Both of these market reactions are similar in that they were based on anticipation: none of the burned lumens were actually in circulation, while Nano is a typical case of a listing pump which Stellar previously experienced with Coinbase.