Bitcoin proxy Strategy acquires 6,911 BTC, now holds 506,000 BTC

The company plans to secure $711 million in net proceeds through a preferred stock offering to buy more Bitcoin.

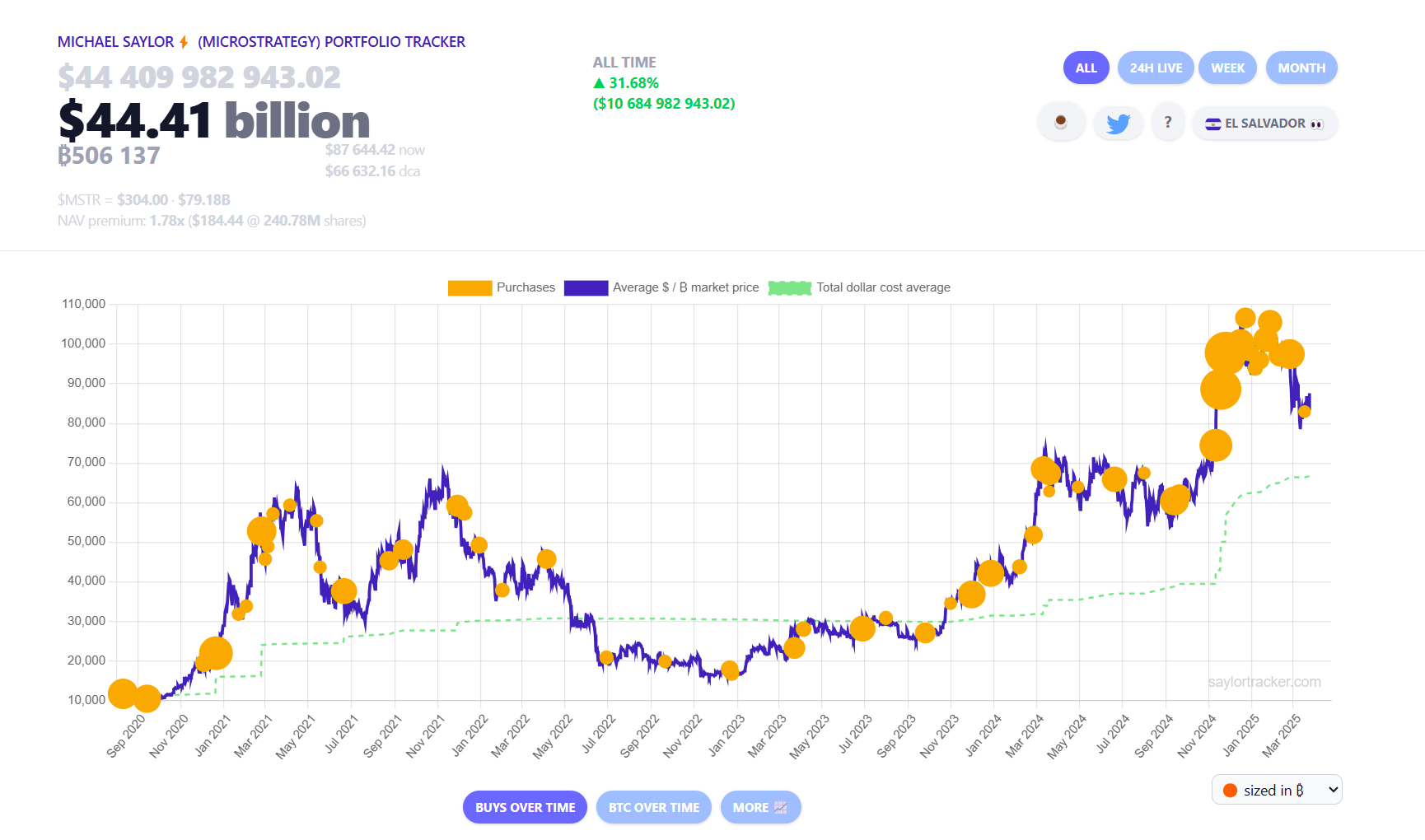

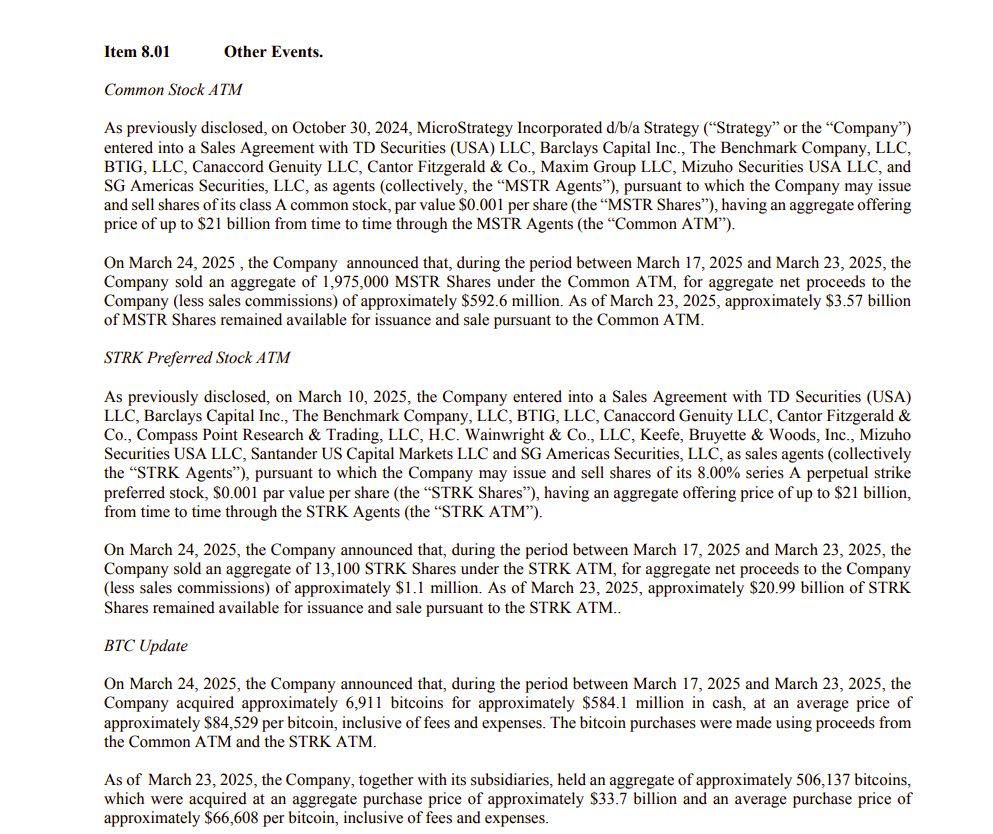

Strategy, led by Michael Saylor, announced Monday the acquisition of 6,911 Bitcoin between March 17 and 23 at an average price of $84,529 per coin. This newest purchase increases the company’s total Bitcoin holdings to around 506,000 BTC, valued at roughly $44.4 billion at current market prices.

Strategy has acquired 6,911 BTC for ~$584.1 million at ~$84,529 per bitcoin and has achieved BTC Yield of 7.7% YTD 2025. As of 3/23/2025, we hodl 506,137 $BTC acquired for ~$33.7 billion at ~$66,608 per bitcoin. $MSTR $STRKhttps://t.co/oM30PS9yqa

— Strategy (@Strategy) March 24, 2025

According to a Monday filing with the SEC, Strategy funded the latest BTC purchase using proceeds from its “Common ATM” and “STRK ATM” programs.

Between March 17 and March 23, Strategy sold 1,975,000 shares of its Class A common stock, yielding net proceeds of approximately $592 million, and 13,100 shares of its 8.00% Series A perpetual strike preferred stock, resulting in over $1 million in net proceeds.

The acquisition came after the Tysons, Virginia-based firm disclosed plans to issue 8.5 million shares of its ‘Series A Perpetual Strife Preferred Stock,’ an increase from the originally planned 5 million. The offering aims to finance additional Bitcoin purchases and support working capital needs.

The Series A Perpetual Preferred Stock carries a 10% annual dividend rate, payable quarterly in cash. Unpaid dividends compound quarterly at escalating rates, up to a maximum of 18% annually. This structure enables Strategy to raise capital without diluting the voting rights of common shareholders.

The stock offering was underwritten by major financial institutions, including Morgan Stanley, Moelis & Co., Citigroup Global Markets, and Barclays Capital.

Since its first Bitcoin purchase in 2020, Strategy has steadily expanded its holdings, cementing its status as the largest publicly traded corporate holder of the cryptocurrency.

Despite Bitcoin’s well-known volatility, the company’s position has appreciated by 32%, representing an unrealized gain of over $10.6 billion.