Tokens rise 34% on average after being unlocked for private investors: Report

Prices usually slump seven days before large unlocks for private investors, as retail users fear a sell-off.

Share this article

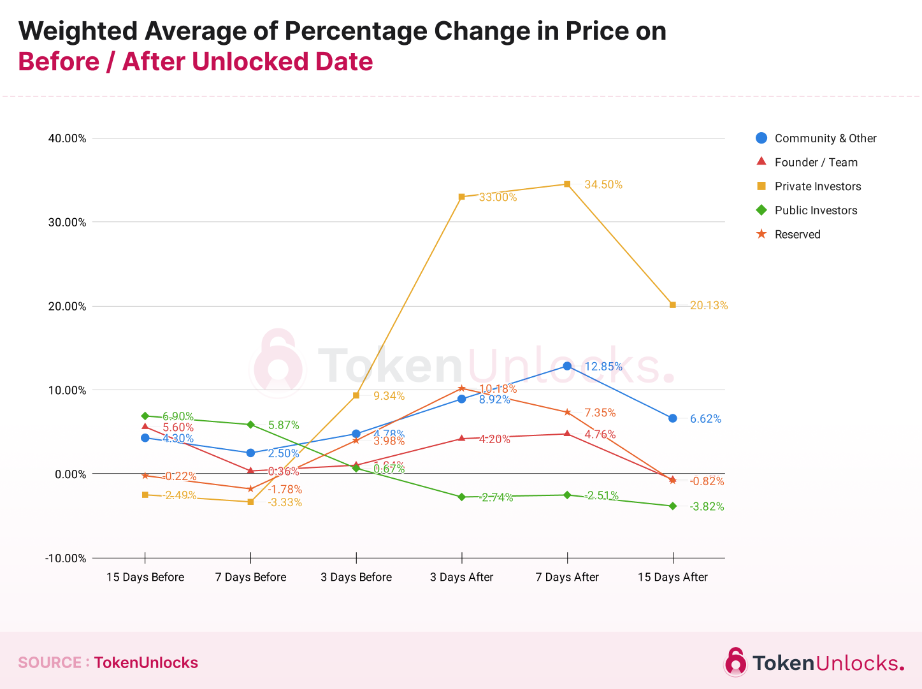

Tokens prices show a 34,5% average leap seven days after the unlocking for private investors. The “Annual Report 2023: Unlock Revolution” by data platform Token Unlocks shows that, contrary to common sense, tokens usually lose value before large sums of crypto get unlocked for private investors, potentially fueled by retail fears.

Findings indicate that, generally, token prices tend to increase both before and after unlock dates across most allocation categories. However, tokens allocated to Public Investors, the retail, often see a price decrease post-unlock. In contrast, the Community & Other category, despite having a high ratio of unlocked tokens to circulating supply, shows higher prices before the unlock date than on the date itself.

The report analyses nearly 600 token unlock events, excluding initial token generation events (TGEs), and how they impact token prices. Five types of different unlocks were objects of study: Community & Other, Founder/Team, Private Investors, Public Investors, and Reserved.

The study classified each event based on predefined allocation criteria, examining price movements 15, 7, and 3 days before and after the unlock date, in relation to the number of tokens released and their proportion of the total circulating supply at the time.

The analysis reveals that unlock events vary widely, with some releases as small as 0.5% and others as large as 50% of the circulating supply. Consequently, the impact on token prices is adjusted based on the size of the unlock, calculated as the ratio of the unlocked amount to the circulating supply.

Contrary to popular belief, data suggests that unlocks in the Founder/Team category do not lead to price declines. Instead, prices tend to be higher both before and after the unlock date compared to the unlock date itself.

Particularly noteworthy is the trend observed in the Private Investors category, where prices typically drop 15 and 7 days before the unlock, possibly due to concerns among non-private investors about potential sell-offs by private investors, who often acquire tokens at lower prices and in larger quantities. Following the unlock, however, prices for this category show a significant increase, more so than in other categories.

For tokens in the Reserve category, which are usually transferred to a protocol’s decentralized autonomous organization (DAO) or a multisig wallet, community voting is required before any expenditure, leading to mixed price movements both before and after the unlock date.

Share this article