Ethereum funds attract $35 million in inflows following ETF approvals

US crypto ETPs hit record high with Ethereum leading the charge.

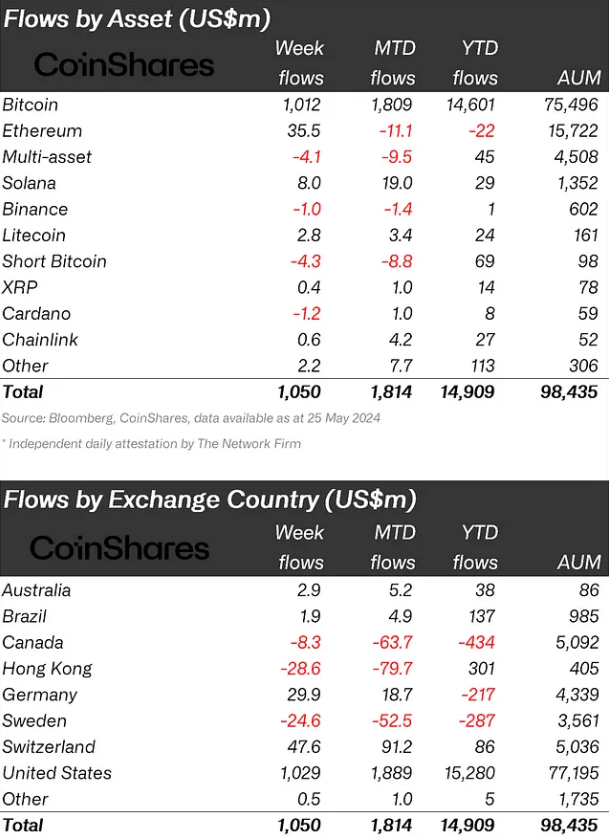

Digital asset investment products experienced over $1 billion in weekly inflows last week, marking the third consecutive week of inflows, as reported by asset management firm CoinShares. Ethereum (ETH) funds registered $35.5 million of inflows in the same period, its most substantial intake since March, and reduced the month-to-date outflows to $11 million.

The recent uptick in prices has propelled the total value of digital asset exchange-traded products (ETP) to a remarkable $98.5 billion. Alongside this growth, weekly ETP trading volumes have seen a 28% increase, amounting to $13.6 billion.

Bitcoin ETPs dominated the inflow charts, attracting $1 billion. Conversely, short Bitcoin positions continued to see outflows, this time totaling $4.3 million, indicating a shift towards a more positive market sentiment. This optimism is partly attributed to investors’ interpretation of the Federal Open Market Committee (FOMC) minutes and recent macroeconomic data as leaning towards the dovish side.

Solana also witnessed a positive trend with inflows of $8 million, followed by Litecoin ETPs’ $2.3 million inflows.

Regionally, the US has been at the forefront of these inflows, with a significant $1.03 billion directed into its market. Grayscale, a major player in the space, reported a substantial decrease in outflows, which now stand at just $15 million for the week.

Germany and Switzerland also contributed with inflows of $48 million and $30 million, respectively. However, after a promising start, Bitcoin spot-based ETFs in Hong Kong experienced a setback with outflows of $29 million last week.