Shutterstock photo by VladyslaV Travel

Whales Buy Ethereum After Other Investors Panic Sell

Large Ethereum investors continue to accumulate more ETH at a discount.

Ethereum has stabilized above a massive support wall following the recent crypto market crash. Data shows a spike in the number of “whale” investors, which could help ETH rise to $3,000.

Ethereum Whales Bought the Dip

A recent downturn in the cryptocurrency market has led many investors to panic sell their previous investments.

According to the Crypto Fear and Greed Index (CFGI), the optimism among market participants dropped to the lowest levels recorded in more than a year. As prices tumbled across the board, the CFGI dropped to a value of 27, which is considered as “fear.”

However, negative investor attitudes generally provide other investors with an opportunity to profit, and large “whale” investors took advantage of the uncertainty to buy Ether at a discount.

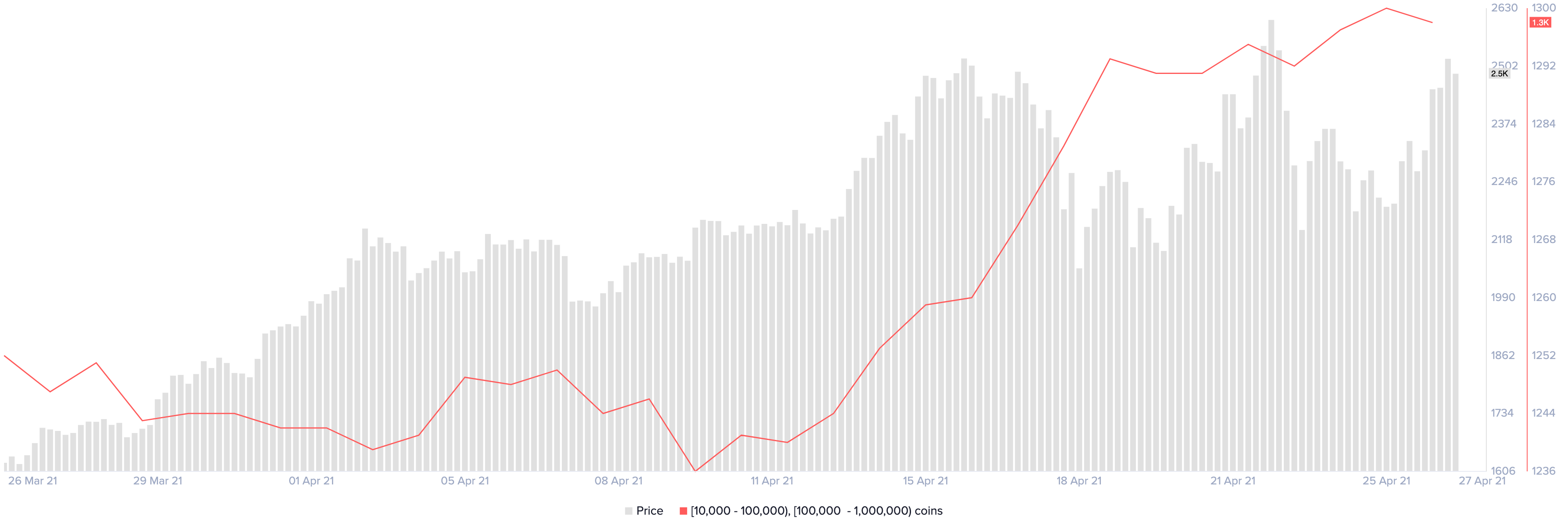

Ethereum’s supply distribution chart shows that the number of addresses with 10,000 to 1,000,000 ETH rose by 0.70% over the past week. Roughly nine whales joined the network within that period.

The growing number of whales may seem insignificant at first glance. However, when considering that high-net-worth individuals hold between $25 million and $2.5 billion in ETH, the sudden spike in buying pressure can translate into billions of dollars.

Sitting on Top of Stable Support

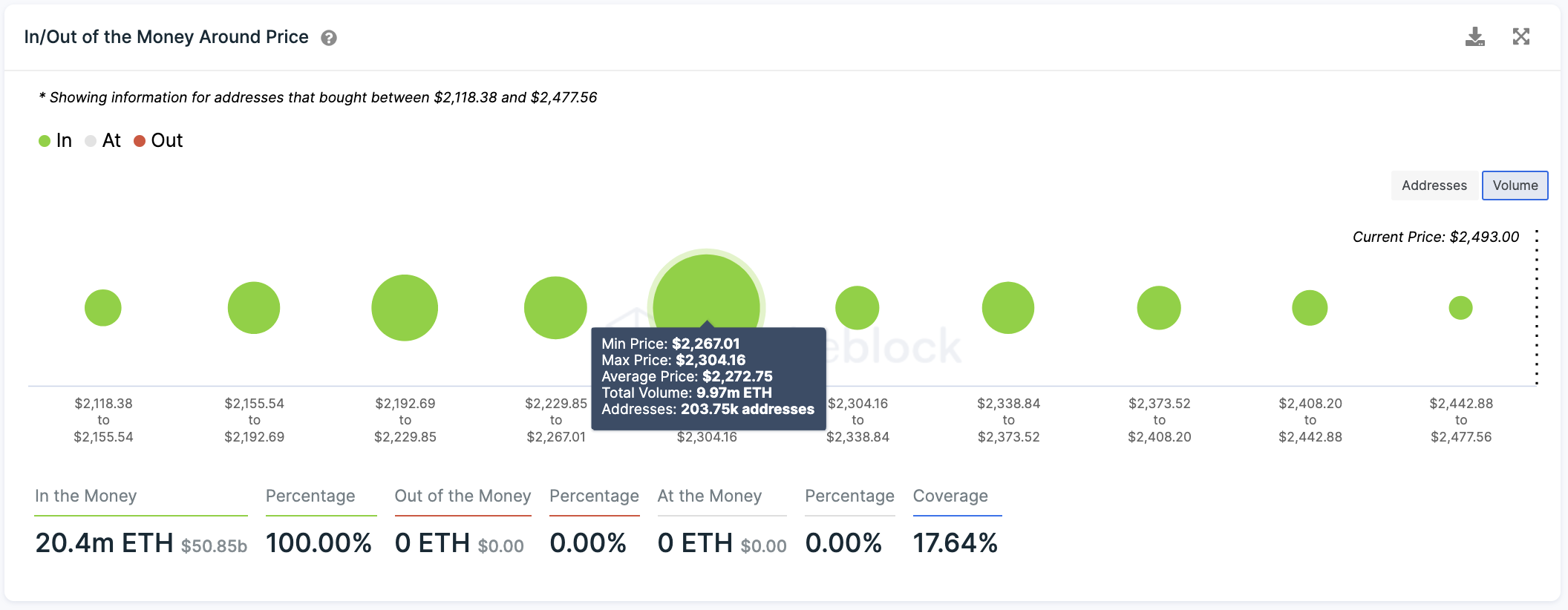

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that ETH is currently trading above stable support. Based on transaction history, more than 200,000 addresses previously purchased nearly 10,000,000 ETH between $2,270 and $2,300.

This massive demand barrier could absorb any further downward pressure, as holders within it may do anything to prevent seeing their investments going “Out of the Money.” They might even buy more tokens to help prices rebound in the event of a downswing.

As long as the $2,270-$2,300 support zone holds, Ethereum will likely rise toward the psychological resistance level of $3,000. But if this hurdle breaks, a retest of the $1,900 level is imminent.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Earn with Nexo

Earn with Nexo