Whales Buy the Dip, Pushing Ethereum to New All-Time Highs

Whales took advantage of the recent flash crash to buy the Ethereum dip and send it to new all-time highs.

Key Takeaways

- Ethereum hit a new all-time high of $2,575.

- The bullish impulse seems to be fueled by a large number of whales that bought ETH at a discount.

- Further buying pressure could see Ether replicate Bitcoin’s price action and rise to $4,300.

Share this article

Ethereum has risen to a new all-time high, and technicals suggest that this could be the beginning of a new uptrend.

Ethereum Makes New All-Time High

The second-largest cryptocurrency by market capitalization, Ethereum, saw its price crash to $1,900 over the weekend.

The incident was caused, among other bearish events, by a power outage in Xinjiang, China, that forced a large number of Bitcoin miners to shut down. As BTC’s hashrate fell by half, all cryptocurrencies, including Ethereum, reacted quickly.

As a result, more than $1.16 billion worth of long and short ETH positions were liquidated across the board. But large investors seem to have taken advantage of the downward price action to buy Ether at a discount.

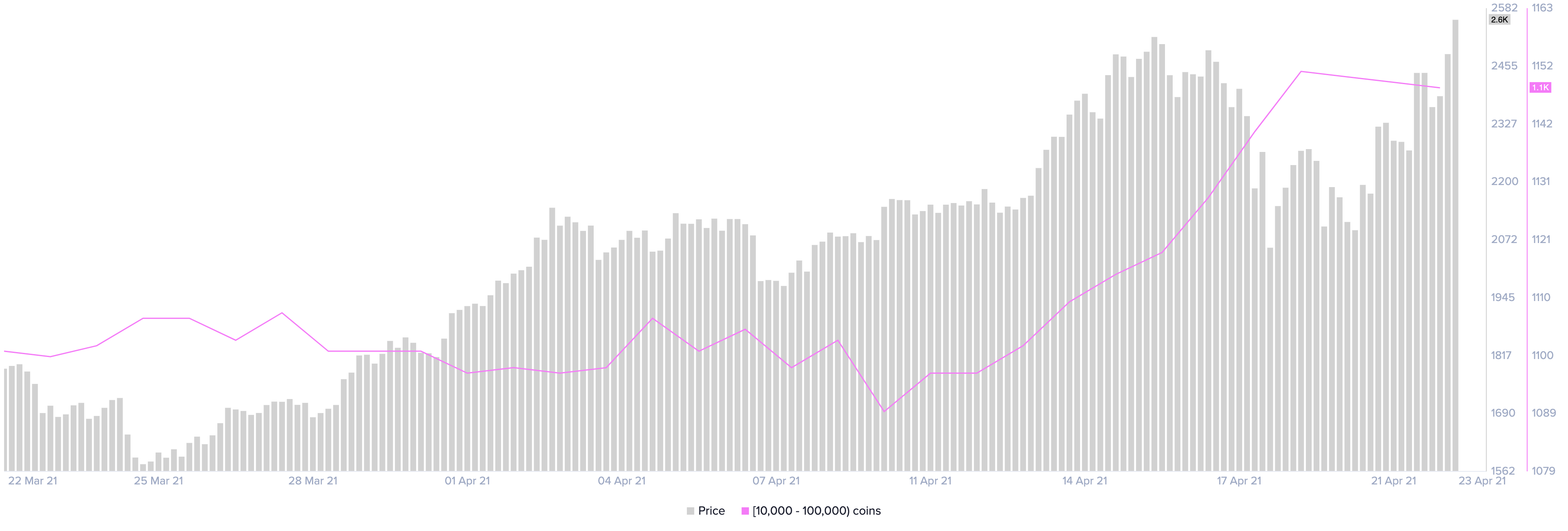

Behavior analytics platform Santiment recorded a significant spike in the number of whales on the network while prices tumbled. Roughly 23 addresses with 10,000 to 100,000 ETH were created between Apr. 17 and Apr. 19.

When considering that these whales hold between $25 million and $250 million in ETH, the massive spike in buying pressure seems to have quickly translated into prices. Ethereum recovered all the losses incurred and rose to a new all-time high of $2,575 recently.

Now that Ether has reentered price discovery mode, it has plenty of room to go up.

The cryptocurrency education platform IncomeSharks maintains that Bitcoin rose by 3x from its 2017 all-time high after breaking the $20,000 barrier. The firm now believes that Ethereum would likely do the same, which sets a $4,300 target.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Share this article