XRP Faces Prompt Recovery Despite Legal Uncertainty

XRP has fallen into the "opportunity zone," and its price could soon recover lost ground.

While the crypto community remains uncertain about Ripple’s future following the SEC’s recent lawsuit against Ripple, several on-chain metrics estimate that XRP is bound for a bullish impulse.

XRP Tumbles Following SEC’s Charges

XRP has seen its price crash over 65% in the past two months.

That sell-off came after the U.S. Securities and Exchange Commission (SEC) filed an action against Ripple. The regulatory watchdog claims that the company raised over $1.3 billion through an unregistered and ongoing digital asset securities offering.

“We allege that Ripple, Larsen, and Garlinghouse failed to register their ongoing offer and sale of billions of XRP to retail investors,” said Stephanie Avakian, Director of the SEC’s Enforcement Division. That deprived investors of XRP disclosures and other protections, she says.

Following the announcement, several cryptocurrency exchanges decided to suspend XRP trading activity due to the SEC’s charges. The move added fuel to the downward pressure that began on Nov. 24, pushing this cryptocurrency’s price to a low of $0.17.

Despite the uncertainty around XRP, it was able to rebound and test the $0.33 barrier. Now, several on-chain metrics suggest that as long as the $0.22 support continues to hold, prices might recover some of the lost ground and break through the overhead resistance.

On-Chain Metrics Turn Bullish

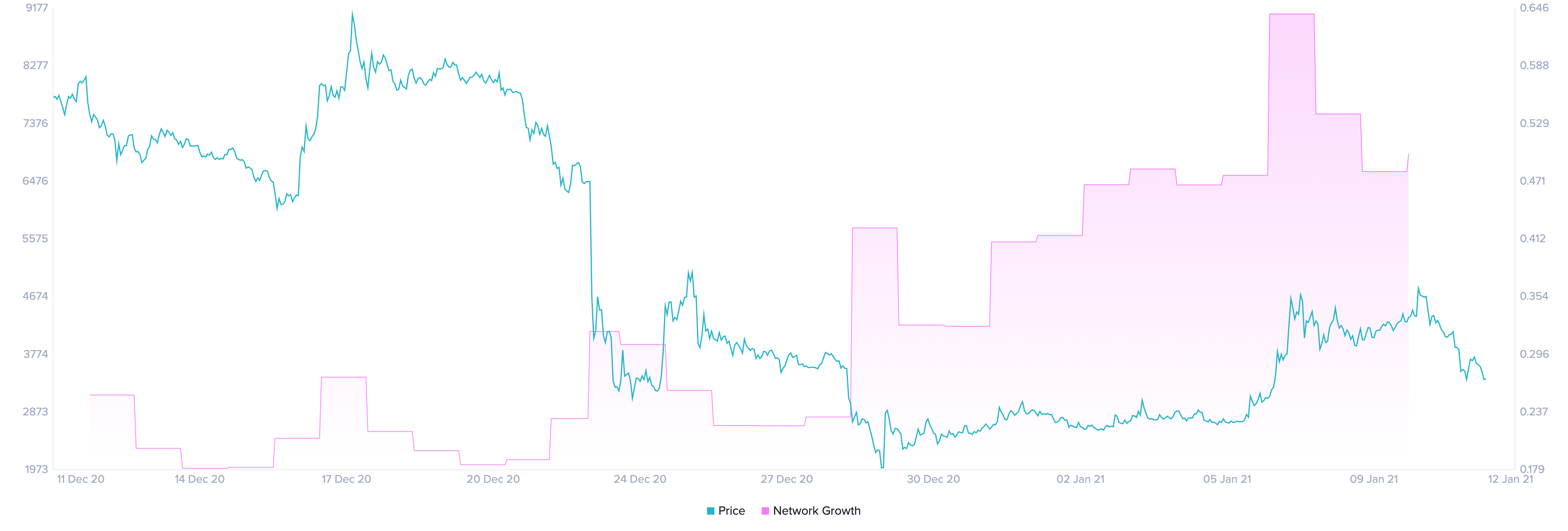

When looking at XRP’s network growth, the bullish thesis holds.

Since late December, the number of new daily XRP addresses has steadily increased. At that time, roughly 2,050 addresses were joining the XRP network on a daily basis around. This number has skyrocketed by nearly 240% to hit a high of 6,900 as of Jan. 11.

The network’s ongoing expansion is a positive sign for price recovery in the near future. Usually, a sustained increased in the number of new daily addresses is a leading indicator of appreciating prices.

More Whale Investors

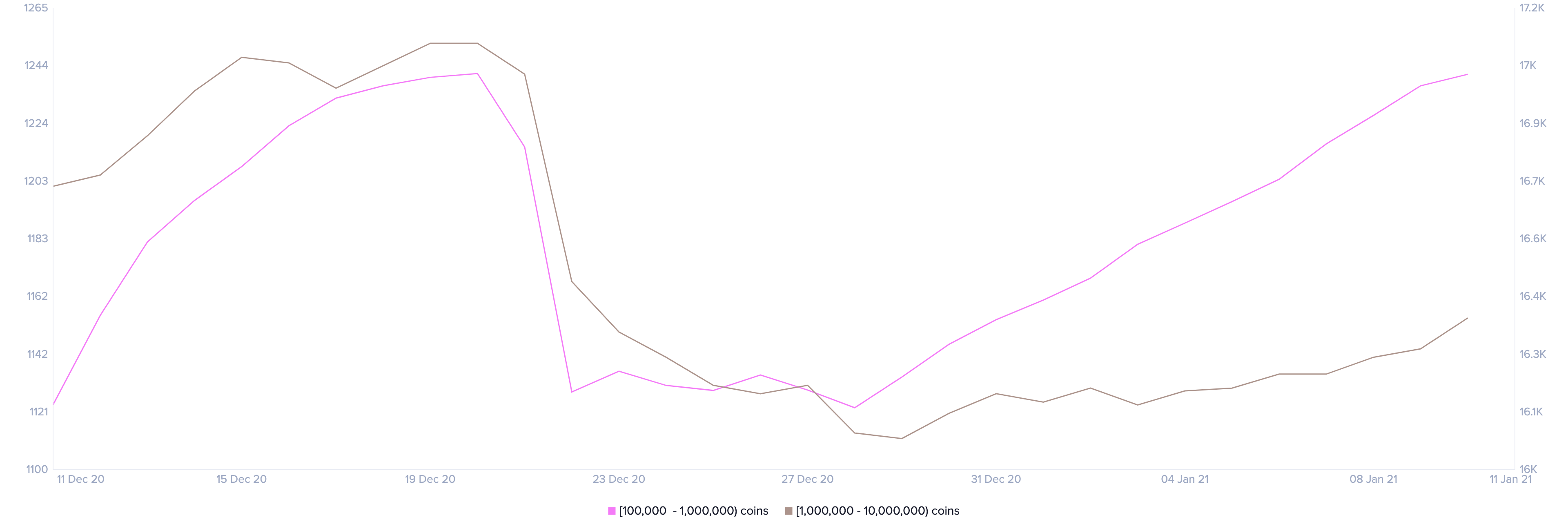

Such a significant increase in network growth seems correlated with the rising number of XRP whales.

Santiment’s holder distribution chart recorded a spike in buying pressure behind this altcoin while prices crashed down. Indeed, the number of addresses holding 100,000 to 10,000,000 XRP surged by nearly 5.30% in the last two weeks. Roughly 908 mid-sized whales have joined the network over this short period.

The sudden upswing is quite important when considering these investors hold between $28,000 and $2.8 million worth of XRP.

If buy orders continue to pile up at the current rate, prices will likely recover and move past the $0.33 resistance barrier. Turning this critical supply wall into support may see XRP aim for $0.45.

It is worth noting that the Market Value to Realized Value (MVRV) index adds credence to the optimistic outlook. Each time the MVRV dropped below -11.50% over the past year, it served as a buy signal.

This indicator recently entered the “opportunity zone” and is currently hovering around -11.50% after recovering from a low of -54.30%.

Such low levels suggest that XRP’s downtrend is approaching exhaustion, making the $0.33 resistance a significant area of interest.

Only a daily candlestick close above this price hurdle will confirm the bullish outlook, but breaking below $0.22 will lead to further losses.

Disclosure: At time of writing, this author owned Bitcoin and Ethereum.

Earn with Nexo

Earn with Nexo