Zimbocash: A Digital Currency For Zimbabwe

Zimbocash is a crypto startup whose founders are trying to create a new digital monetary system for Zimbabwe.

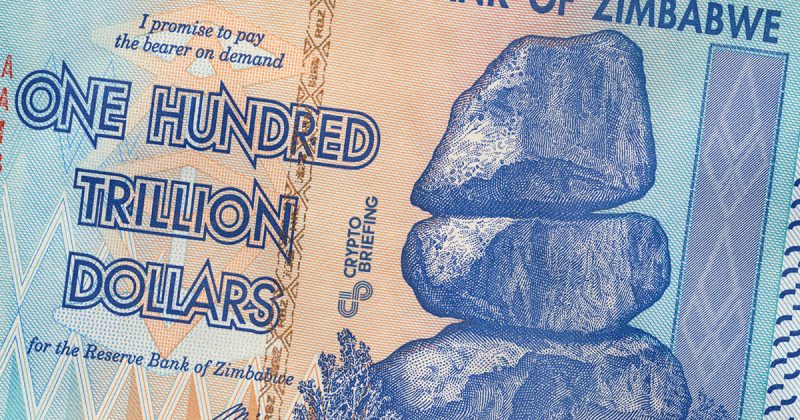

Hyperinflation has become synonymous with Zimbabwe, and the African nation’s monetary system has been on a roller coaster for the past decade. Its national currency, the Zimbabwean dollar, lost so much value that by 2015 it was practically useless. In mid-2015, one hundred trillion were only worth 40 U.S cents. Just as an illustration of how devalued the currency was, Zimbabweans would carry cash with duffle bags just to buy a loaf of bread.

Many Zimbabweans blamed the land reforms program, enacted by then-president Robert Mugabe in 2000. This program sparked off a series of forced and often violent seizures from white land owners. Consequently, the agricultural sector collapsed. It also led many Western nations to impose endless sanctions against the country. It has never been the same since.

The country recognized the U.S dollar and South African rand as legal tender to help fight against the runaway inflation. In time, it recognized the Chinese yuan, Japanese yen, the Indian rupee and Australian dollar as well, and ditched its national currency for the U.S dollar.

A New Narrative

One startup is striving to change it all. Zimbocash is a crypto startup whose founders believe they can help Zimbabwe write a different monetary narrative. And for one of the founders, it’s not just giving a new lease on life to the country – it could also make Zimbabwe a new global banking powerhouse.

Quite an ambitious goal, but Philip Haslam believes that it’s achievable.

Haslam is one of the founders of Zimbocash. Born in South Africa, he became interested in Zimbabwe when he was conducting research for his book, “When Money Destroys Nations.” In the book, he warns of the dangers that come with governments printing money to pay national debt and bail out banks. Incidentally, this is the very challenge that has plagued Zimbabwe for over a decade.

Haslam, an economist by profession, was fascinated by decentralized currencies and was convinced that they could solve Zimbabwe’s challenge. In a recent podcast, he explained:

“So, in a nutshell, cryptocurrencies and blockchain are enabling the people to say that, ‘Look, we no longer want money that’s devaluing and losing its value on a regular basis. We want a movement towards a currency system where we are protected. A system that practices monetary justice.”

Why Zimbocash?

Zimbabwe is by far the best country to implement a national digital currency, Haslam believes. This is because the people and the government are open to the idea of a new monetary system. The past two decades have been unbearable for the country, and have left everyone yearning for change. This is unlike more stable countries in which the monetary system, though fatally flawed, works as it is.

And while Bitcoin seems like the most logical choice, Haslam believes that it isn’t the best fit for Zimbabweans. This is because it requires people to cash in their fiat currencies in exchange for Bitcoins. And therein lies the problem – Zimbabweans don’t have much cash.

“Because of the flawed currency and banking system over the past 20 years, there’s very little money in the country. And so Bitcoin, Monero, Ethereum and these other cryptos haven’t quite penetrated the market. They do have a role to play, but there’s a process of people needing to acquire them. The users have to use the same defunct currency and banking systems to acquire them, the same systems they are trying to escape.”

For Zimbocash, the users don’t have to purchase the tokens. This gives the startup an edge over the other existing cryptos in the market, Haslam believes. All you have to do is register on the Zimbocash website and you get your free tokens. Every new user is awarded 100,000 Zimbocash tokens.

However, the registration period is divided into four stages, one for each quarter of 2019. For the first stage, which ended just days ago on March 31, new users get 100,000 tokens. This number is halved with every quarter, with new users in the current quarter getting 50,000 tokens. But don’t get too excited, only Zimbabweans are eligible.

The Network Effect

The approach by Zimbocash is quite unique, especially during this age of ICOs. In the crypto market, startup founders aim to raise money from the onset by selling the tokens. Some have raised more than a billion dollars, a clear indication of just how enticing this method is.

Not for Zimbocash. The startup firmly believes adoption should come first and then everything else can come later. In addition to the signing reward of 100,000 tokens, enlisting other users comes with 10,000 tokens for every new user. Users also get unique links to share on their social media pages and for every click on this link, the user gets an extra 100 tokens.

The startup is counting on the principle of network effect, which states that every new user of a good or service adds value to that product for every other user. By distributing the tokens for free, the startup will bring onboard more users and this will give the currency value.

“It’s kind of like Whatsapp,” Haslam explained. “If you were the first Whatsapp user, you wouldn’t be able to send a message to anyone. But as more people get added to the network, each additional user adds value to everyone else.”

And despite receiving the tokens for registering, there are restrictions to ensure the users don’t dump them. Zimbocash will strive to list the crypto on an exchange where market economics will determine the price of their tokens.

However, for a user to sell 10 percent of their holdings, they’ll have to send the tokens to at least six unique addresses. To sell another 10 percent on an exchange, another six transactions are required and so on.

This will ensure that the users don’t end up dumping the tokens on the first day of trading, which can drive the price to the ground. Moreover, it will ensure that the users are making transactions in Zimbocash tokens. This ensures that even if they end up selling the tokens, they have experience transacting, spurring the growth of the network.

Future Plans

‘Think big, start small and move quickly.’ This is how Zimbocash plans to take over the Zimbabwean market. For now, the startup is fully focused on onboarding users. They are doing this through extensive media campaigns and through ambassadors and influencers. They are also educating users on the benefits that come with the use of cryptos over fiat currencies.

Once the network grows substantially and begins to see sufficient transactions, Zimbocash will also target the remittance market, a market into which other cryptos such as XRP have made inroads. Zimbabwe receives $1 billion every year in remittances.

This market is very ripe for Zimbocash, Haslam believes. He also sees Zimbocash dominating transfers between Zimbabwe and her neighbors, especially South Africa which is one of her main trading partners.

The challenges will be plenty, from internet connectivity to restrictive crypto regulations. However, Haslam and his team are more than ready to take the challenges head on and deliver the people of Zimbabwe.

The author is not invested in digital assets.

Earn with Nexo

Earn with Nexo