Shutterstock cover by CodedeatH33

Algorand, NEAR Rally as DeFi Activity Increases

Algorand and NEAR have surged as more users jump into DeFi.

The alternative Layer 1 networks Algorand and NEAR have surged as new users jump into their DeFi ecosystems.

Alternative Layer 1s Rally

Algorand and NEAR’s native tokens are outpacing the rest of the market.

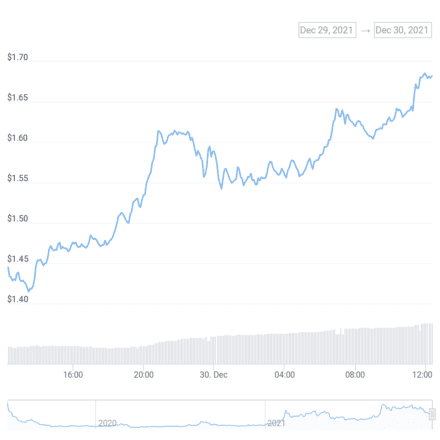

Algorand led the crypto market Thursday, rising 17.6% while Bitcoin and Ethereum lagged. The ALGO token bounced from a low of $1.43 late Wednesday to post a strong recovery, trading at $1.68 at press time.

Algorand’s solid price action is likely fueled by the launch of a $3 million liquidity mining program to drive DeFi adoption on the network. Algofi, a lending and borrowing protocol similar to Ethereum’s Aave, has partnered with the Algorand Foundation to distribute ALGO token rewards to early users.

DeFi on Algorand is growing quickly. The network’s first decentralized exchange, Tinyman, has already secured over $40 million of total valued locked and sees daily trading volumes of over $5 million. Additionally, an Ethereum and Bitcoin bridge called Algomint launched its own liquidity mining program last week, incentivizing users to bridge their funds onto the network.

NEAR Protocol is another standout today, with its native token climbing 10% over the past 24 hours. Like Algorand, NEAR has also seen DeFi activity pick up on its network. According to data from DeFi Llama, the total value locked on NEAR has increased 19.24% over the past week to more than $133 million.

NEAR also received a boost earlier in December when it partnered with fellow Layer 1 network Terra, kicking off its current rally. The partnership means that Terra will deploy its UST stablecoin to the NEAR and Aurora ecosystems, opening up new DeFi strategies.

While activity on Algorand and NEAR is still low compared to more prominent Layer 1s such as Avalanche and Solana, DeFi on these networks is growing fast. Investors are likely speculating that these alternative networks will see increased valuations following the explosion of Layer 1 chains earlier this year in August. Only time will tell if this Layer 1 trend will continue into 2022.

Disclosure: At the time of writing this feature, the author owned LUNA, SOL, and several other cryptocurrencies.