Why Altcoins Are Rising: Maker, Holochain, BNB And Chainlink News

Is it alt season, or just a coincidence?

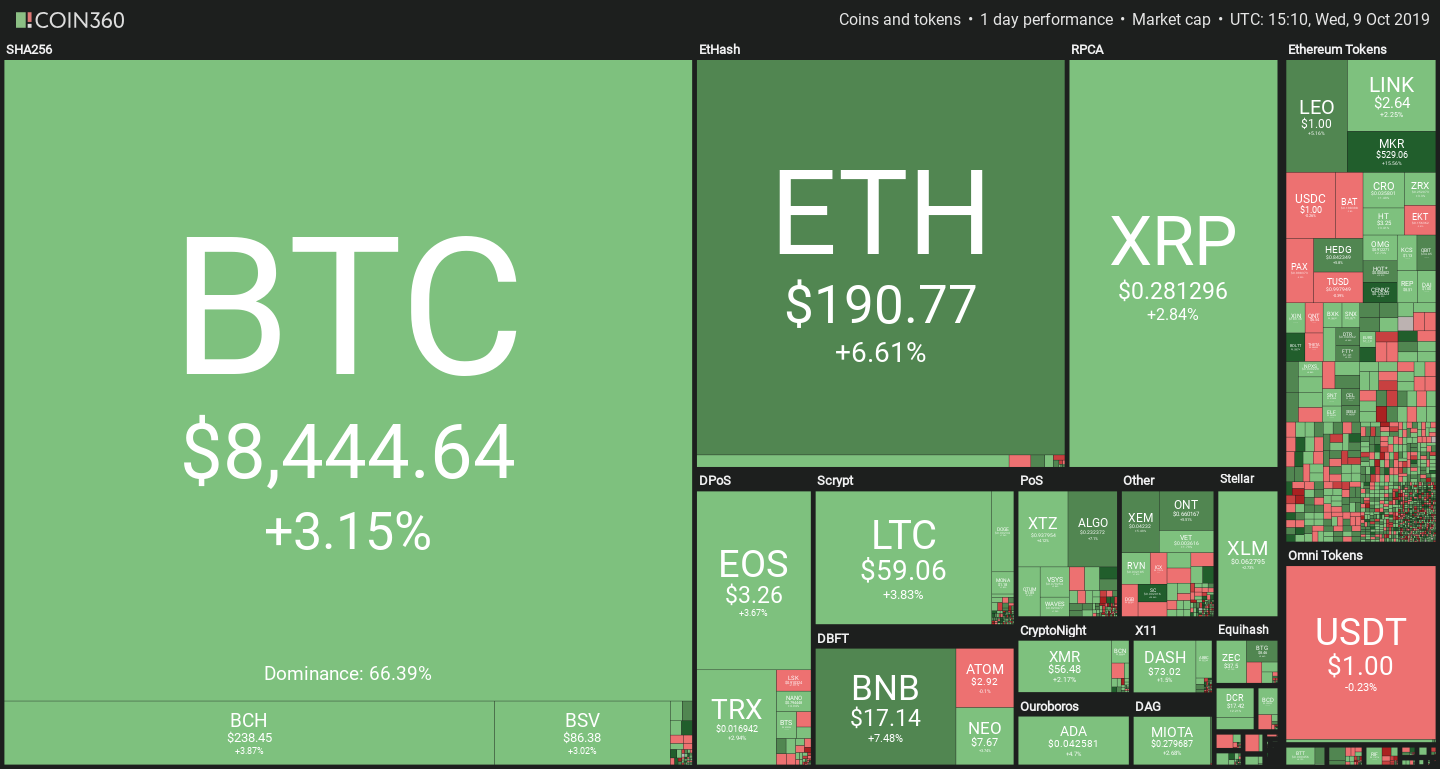

Altcoins are back in style. As the price for one bitcoin has increased to trade around the $8,450 level, several top altcoins are posting double-digit gains against a generally-green backdrop, while Ethereum is on a roll – gaining almost 6% over the last 24 hours.

BNB, Maker, Holo and Chainlink are benefiting the most, posting gains of 8%, 9%, 11% and 14% respectively. But privacy and not-so-much privacy coins are seeing moderate losses, with Monero, Dash and Zcash performing at -0.6%, -1.8% and -1.1%.

While today’s woes may derive from coincidental market fluctuations, pressure from the FATF Travel Rule may cause investors to hold off from privacy coins for now.

What’s behind these impressive gains?

BNB

… the sudden surge appears to be caused by a rumor that was later confirmed by CZ: Binance will start offering a fiat-to-crypto on-ramp in China through an integration with Alipay and WeChat. The news was falsely reported by numerous media outlets this morning as being a direct partnership.

Together these are the largest digital wallet providers in China, with adoption comparable to that of credit cards in the U.S. The news will have a profound effect on markets, in light of the ban of all native Chinese cryptocurrency exchanges in 2017, which left mainland traders scrambling to find ways of buying crypto.

Maker

…rise can be attributed to the announcement of a release date for Multi Collateral DAI. Due to Maker’s governance structure, the community will still need to vote for the proposal on November 15, with the CEO of Maker Foundation Rune Christensen urging all participants to do so. The first tokens to be evaluated for additional collateral will be ETH and BAT, with a full risk assessment provided to the Maker community for consideration.

Chainlink

…shows no signs of slowing down. After a variety of announcements that fueled its growth recently, the project delivered the final stroke: the Trusted Computation Framework, a collaboration with Intel, Hyperledger and Ethereum Enterprise Alliance.

The framework is designed to solve scalability issues affecting blockchains by moving computational and private data processing off-chain. Chainlink’s oracles will be providing the bridge between the two worlds, allowing the offloading of very resource-intensive operations without compromising on security. While the news was released two days ago, the daily sentiment for LINK remains ‘very high’ at 83%, according to data from thetie.io

Holochain

… the rise may be due to a preview of HoloPort, although it is largely an interface update. Sentiment is also neutral.

VanEck publishes investment case for Bitcoin

VanEck, one of the two companies that submitted an ETF proposal due for deliberation this month, before subsequently withdrawing it from consideration, has published a comprehensive investment case for Bitcoin.

The report is prefaced with a definition of Bitcoin’s value. The company distinguishes between two different types of value for traded assets, categorizing stocks, real estate and commodities as ‘Intrinsic Value’ assets.

On the other hand gold, art, precious stones and bitcoin are categorized as having ‘Monetary Value,’ which arises from “Behavioral economics, heard behavior, etc.”

Based on these descriptions and other aspects of monetary theory, the report goes on to make a case that Bitcoin is a store of value and can be considered as digital gold.

Curiously, the report highlights some of the same concerns that the SEC has about Bitcoin ETFs; namely the lack of custodians, prime brokers, settlement entities and others, which are preventing significant institutional exposure.

Nevertheless, VanEck argues that increasing adoption figures, the upcoming halving, and increasing development momentum all make for a convincing reason to allocate a part of investor portfolios to Bitcoin.

Nathan Batchelor On Bitcoin

Bitcoin has consolidated in a narrow range over the last twenty-four hours, with bulls maintaining the BTC/USD pair above the $8,000 support level. It is worth reiterating that the SEC is deciding on the Bitwise Bitcoin ETF this week, so trading volumes could remain light up until the decision.

In the near-term, the Choppiness Indicator and the Balance of Power Indicator show that short-term BTC/USD buyers are still in control of the cryptocurrency.

The four-hour time frame shows that Choppiness Index is still pointing to further upside. Interestingly, the Choppiness Index has also reached its most overbought reading since October 2018 on the daily time frame.

A higher reading indicates that the medium-term bearish trend is very weak, and suggests that the next directional move in the BTC/USD pair could be explosive.

In my opinion, I believe that the current bearish trend is weakening, and the chances of a rebound back towards the $9,000 level are very strong if the $8,500 level is broken.

The Balance of Power Indicator is also showing that BTC/USD buyers are gaining back control over the short-term. The Balance of Power Indicator is a simple indicator to use, as it shows the strength of buyers against sellers.

A reading higher than zero shows that buyers are in control, while a reading below zero shows that sellers are in control. The four-hour and daily time frames are currently providing positive Balance of Power readings.

* ‘The bullish short-term case is strengthening while the BTC/USD pair holds steady above the $8,100 support level’. *

SENTIMENT

Intraday bullish sentiment for Bitcoin has remained steady, at 65.50%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency has stabilized, at 61.50%.

UPSIDE POTENTIAL

The early week advance has helped to form a potential double-bottom formation across the lower time frames. According to the upside projection of the double-bottom pattern, the BTC/USD pair could rise towards the $9,200 level if the $8,500 level is breached.

Bitcoin’s 200-day moving average is rising, which should be taken as a positive sign as it indicates growing upside momentum. The BTC/USD pair’s 200-day moving average is currently located around the $8,580 level.

DOWNSIDE POTENTIAL

The BTC/USD pair’s weekly pivot point is the strongest form of near-term technical support, around the $8,100 level. If sellers breach the $8,100 level we should expect a drop towards at least the $8,000 level.

Bitcoin will have to recover fast if price dips under the $8,000 level or the cryptocurrency will likely face a raft of short-term technical selling back towards the September monthly trading low.

Earn with Nexo

Earn with Nexo