Bitcoin Awaits Major Breakout as Price Pressure Builds

Bitcoin remains stagnant, but data shows that investors are optimistic about what the future holds.

Bitcoin remains stuck in a no-trade zone despite the price action it saw over the last week. Nevertheless, BTC futures indicate optimism for the coming quarter.

Bitcoin Loses Monday’s Gains

Bitcoin kicked off the week with a bang as its price surged over 3% on Monday. The buying pressure seen after the weekly open spilled over to the rest of the week as the pioneer cryptocurrency rose to a high of nearly $9,500. However, this resistance level rejected a further BTC advance, triggering a 2.8% correction.

Since the beginning of June, the flagship cryptocurrency appears to be contained within a descending parallel channel, from a technical analysis perspective.

Since then, each time BTC rises to the upper boundary of this technical formation, it pulls back to the middle or the bottom, and from this point, it bounces back up. This behavior is consistent with the characteristics of a parallel channel.

Given the past month’s price movement, Bitcoin could be on its way down to the middle or the bottom of the descending parallel channel. These critical support levels sit around $8,900 and $8,400, respectively.

A Pivotal Point On the Trend

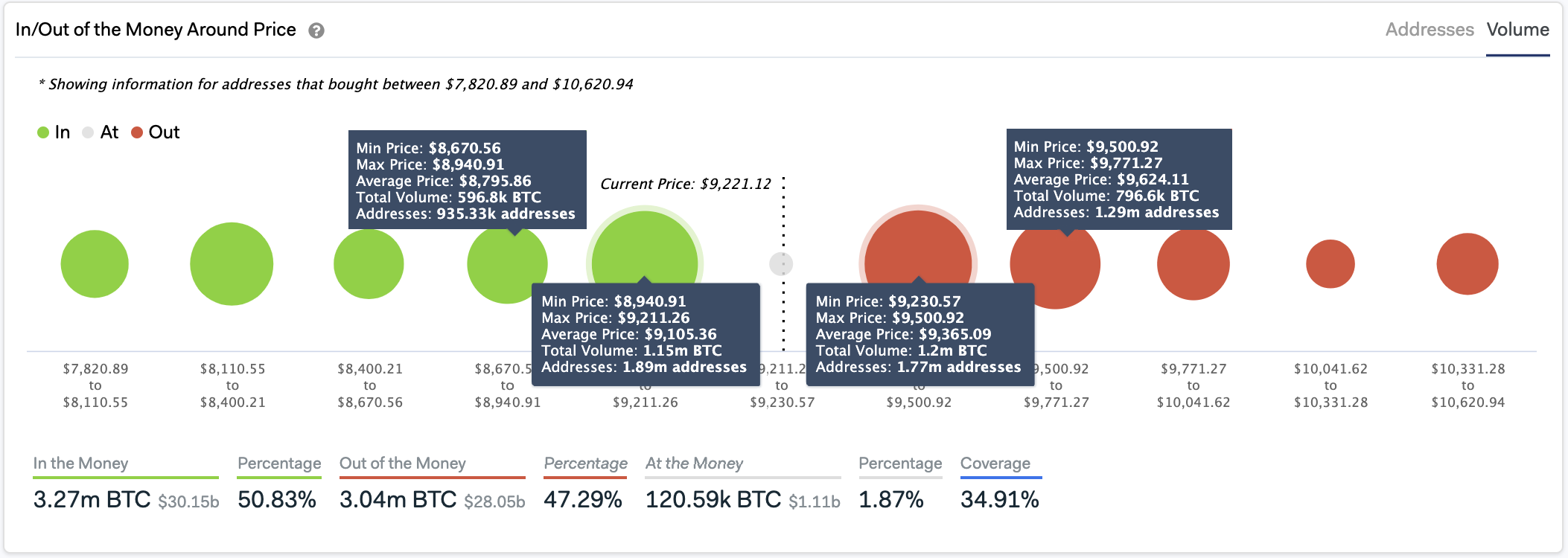

Regardless, IntoTheBlock’s “In/Out of the Current Money Around Price” (IOMAP) model adds credence to both the $8,900 support and the $9,500 resistance level. Based on this fundamental index, moving past any of these critical supply zones will determine where Bitcoin is headed next, but doing so will not be easy.

The IOMAP cohorts reveal that roughly 3 million addresses bought around 2 million BTC in each of these price zones. Holders within the low range will try to remain profitable in the event of a correction while the ones who bought higher may try to break even when Bitcoin rises. These two groups will compress the price action into a narrower trading range until one side breaks.

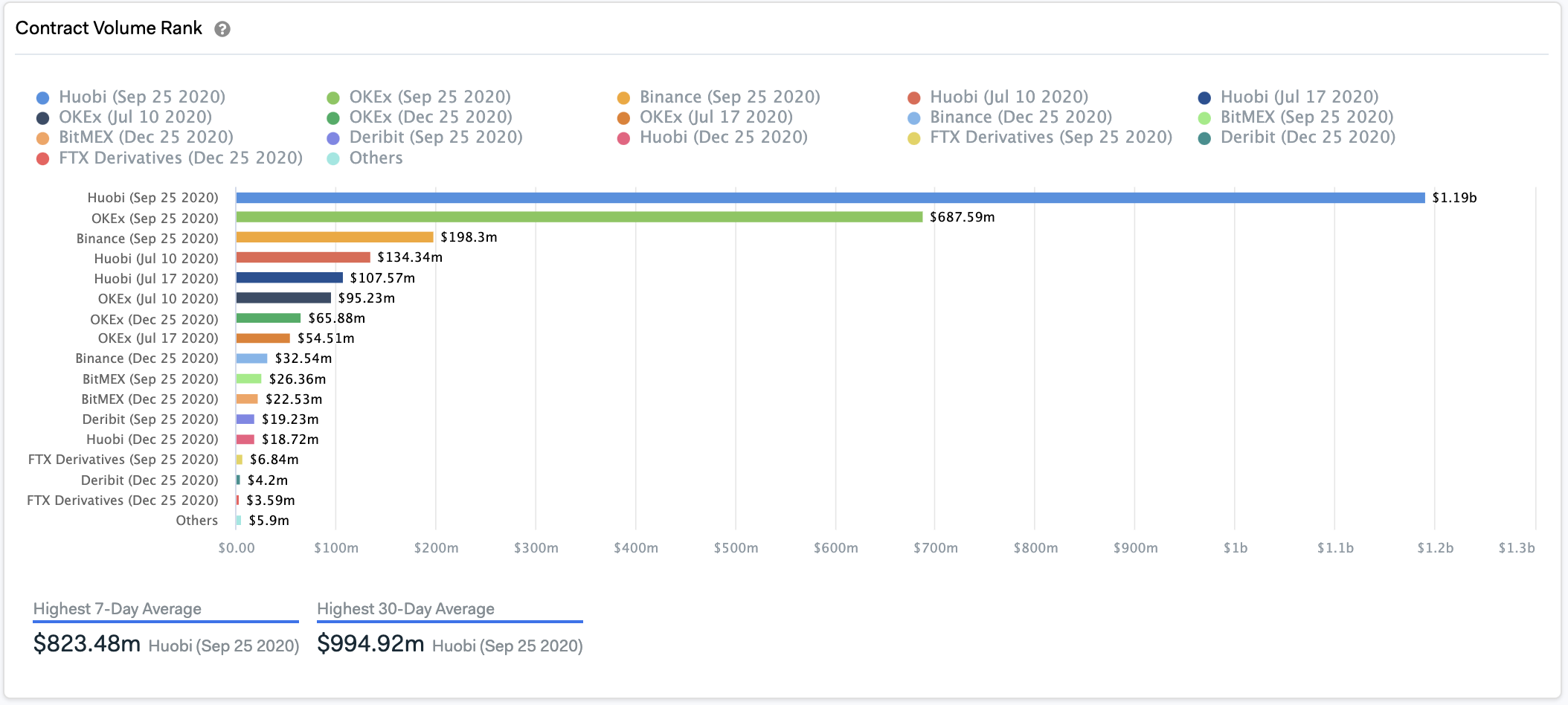

Despite the ambiguity, Jesus Rodriguez, CTO at IntoTheBlock, affirmed that market participants are still optimistic about what the future holds. A look at the different futures exchanges reveals that one of the most popular contracts is for Sept. 25.

These financial products are currently trading higher than the current BTC price, which is a positive sign, according to the analyst.

“The most popular contracts at the moment are for September 25th and those are in contango which means that they are trading at a premium compared to the current Bitcoin price. This signals some optimism for the next few months,” said Rodriguez.

Even though investors remain confident about Bitcoin’s upside potential, traders must watch out for a potential break of support or resistance. Only a daily candlestick close below or above these levels will determine BTC’s next big move.

Earn with Nexo

Earn with Nexo