Bitcoin and Ethereum HODLers Step in to Save Market

A rebound looks imminent for the crypto market as investors see the recent correction as an opportunity to buy at lower valuations.

Market leaders Bitcoin and Ethereum are setting the stage for a comeback as data indicates that investors are accumulating BTC and ETH.

Clear Trend Ahead?

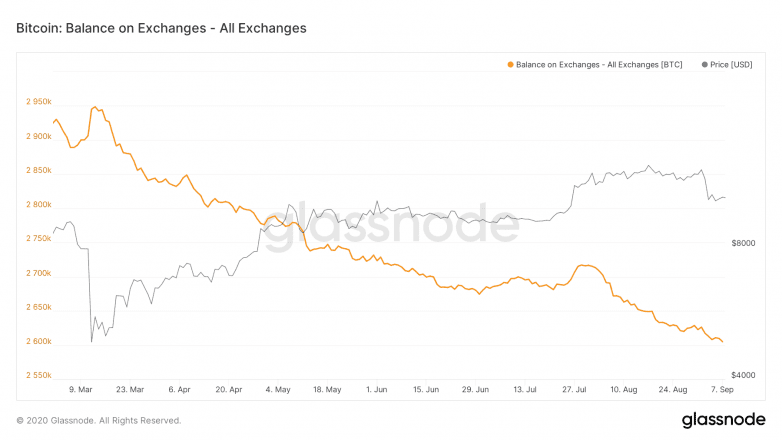

The balance of BTC on centralized exchanges has been in a consistent downtrend since the March selloff.

While it was expected that BTC’s move above $11,000 would entice investors to take profits, this hasn’t been the case. According to Singapore-based QCP Capital, Bitcoin’s latest crash was a result of miner selling.

Jack Tao, the CEO of Bitcoin derivatives exchange, Phemex, told Crypto Briefing:

“Amid the recent DeFi craze we’ve also witnessed one of the strongest Bitcoin sell bars in the last six months. The rapid fall from the $12,000 level could be caused by a number of reasons, including the actions of whales and miners. The price spill occurred against the backdrop of a sharp increase in trading volumes, indicating strong pressure from sellers.”

Despite this, the digital asset’s hash rate hasn’t budged one bit.

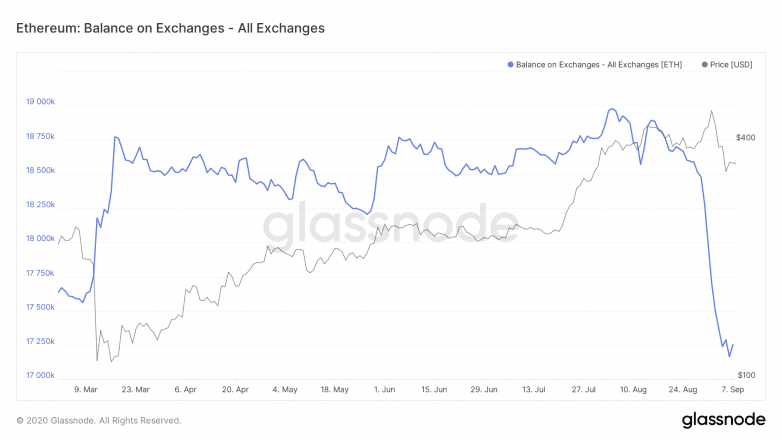

Ethereum’s relationship with exchange flows is a little more complicated. DeFi is an additional source of demand for ETH, pulling in over 6% of the crypto’s supply. However, ETH on exchanges hit a six-month low, per Glassnode.

Whether these tokens are moving into DeFi or cold wallets is irrelevant, so long as they aren’t sold.

Investors were seemingly waiting for ETH to pullback so they could load up on the smart contract leader.

Indeed, investors aren’t selling their BTC or ETH. They’re doubling down with conviction during this correction.

This doesn’t necessarily mean the crypto market has bottomed out. But it does mean sellers are running out of steam, and buyers are ready to scoop up their favorite assets at cheaper prices.

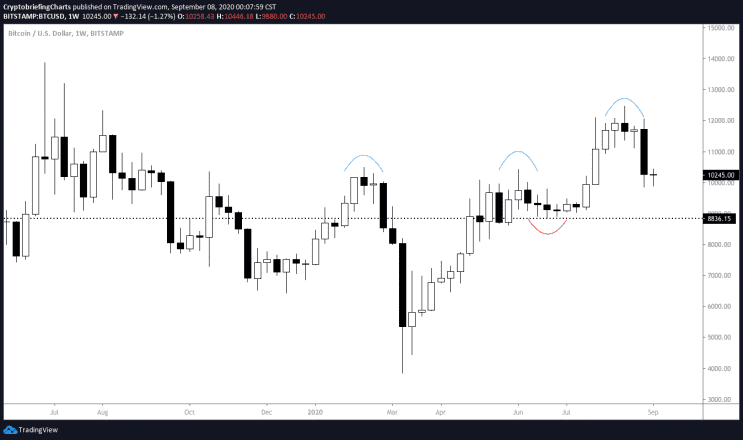

Longer-term price charts indicate the trend is still bullish. And it will remain so until there’s a weekly candle that closes below $8,800.

Given the response to the recent correction and investor sentiment, this scenario is unlikely to unfold. Tao added,

“This price correction is a normal phase for the market after such a long period of growth. I think that despite the current bearish trend, Bitcoin will definitely bounce back to [$12,000] if not more. When? Only the market will tell.”

Earn with Nexo

Earn with Nexo