Bitcoin Headlines Sour as Leading Cryptocurrency Corrects

Bitcoin approaches overbought territory despite bullish sentiment in the cryptocurrency market.

Key Takeaways

- Bitcoin holders have grown overwhelmingly bullish, which is a negative sign form a counter sentiment perspective.

- A well-known technical indicator among institutional investors adds credence to the pessimistic outlook.

- If sell orders begin to pile up, BTC could see its price retrace towards $14,000.

Share this article

Bitcoin sits a few hundred dollars shy from new all-time highs, but several on-chain metrics and technical indexes suggest that the latest correction may steepen.

Crypto Enthusiasts Grow “Extremely Greedy”

Bitcoin made headlines after climbing above $19,000 for the first time since December 2017. The chatter around the flagship cryptocurrency skyrocketed as prices surged over 80% in the past two months.

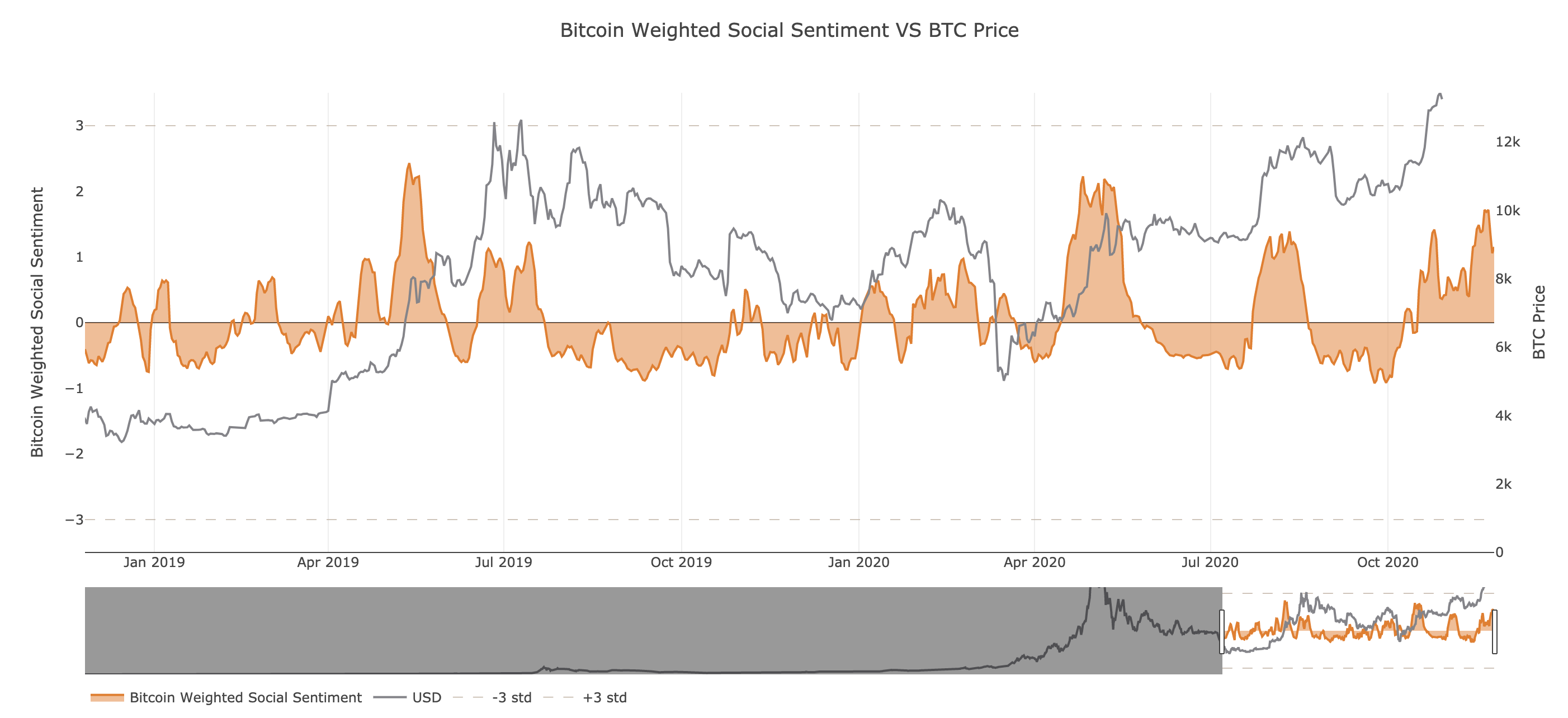

Data from Santiment reveals that the number of BTC-related mentions across social media networks surpassed 1.3 billion. Meanwhile, Bitcoin’s weighted social sentiment peaked at the highest positivity level since June.

“The crowd is still quite positive currently, and we consider this to be confidently bearish territory based on history,” said Brian Quinlivan, Marketing and Social Media Director at Santiment.

The positive social engagement metrics coincide with the extreme levels of optimism recorded among market participants.

Historically, Bitcoin’s price tumbles when social perception is high. The question now is defining the depth and duration of an incoming correction. Some, like Quantum Economics analyst Jason Deane, told Crypto Briefing that:

“Some technical indicators do show that Bitcoin is currently overbought and I think it is entirely possible that there will be a minor correction quite quickly after the ATH is breached. However, because Bitcoin’s fundamentals are strong, its supply is fixed and institutional interest shows no sign of slowing down, my view is that I’d expect any correction to be shallow and short-lived before resuming upwards price discovery.”

Bitcoin Prepares for Retracement

The TD sequential indicator adds credence to the pessimistic outlook. This technical index presented sell signals in the form of green nine candlesticks on BTC’s 1-week and 3-day charts.

The bearish formations forecast a one to four weekly candlesticks retracement before the uptrend resumes.

A spike in sell orders around the current price levels may be significant enough to validate the TD setup’s outlook. If this were to happen, one of the most significant support levels underneath Bitcoin sits at $11,500.

But before prices can fall to this point, there are two other demand areas that this cryptocurrency must break. These support levels lie at $16,000 and $13,500, respectively.

It is worth mentioning that if the bellwether cryptocurrency manages to close above December 2017’s high of $19,900, the bearish outlook will be jeopardized.

Trading veteran Peter Brandt believes that moving past this resistance barrier could even see BTC rise towards $56,000. The 127% and 161.8% Fibonacci retracement levels may serve as potential hurdles on the way up.

These areas of interest sit at $24,500 and $30,200, respectively.

Share this article