Bitcoin Targets Record Highs After "Strongest Dip-Buying" of the Year

Bitcoin seems to have concluded a two-week-long corrective period as the buying pressure returns.

Key Takeaways

- Bitcoin gained over 2,500 points since today's opening on the news about crypto mainstream adoption.

- The selling pressure seen over the past few weeks was met with buying from large BTC whales.

- Now, the flagship cryptocurrency faces little to no resistance ahead that will impede it from rising to new all-time highs.

Share this article

Despite the overwhelmingly bearish sentiment in the crypto markets since mid-March, Bitcoin opened the new weekly trading session with a bang.

Bitcoin Whales Continue to Accumulate

High-net-worth individuals are accumulating BTC en masse, adding fuel to the bull market.

Bitcoin kicked off Monday, Mar. 29, on a positive note after Visa Inc. announced that it would allow the use of cryptocurrencies to settle transactions on its payment network. Although the multinational financial services corporation will only rely on USD Coin (USDC), the move was perceived by investors as a sign of mainstream adoption.

The pioneer cryptocurrency has staged a 2,500-point turnaround since the weekly trading session started, gaining over 4.60% in market value.

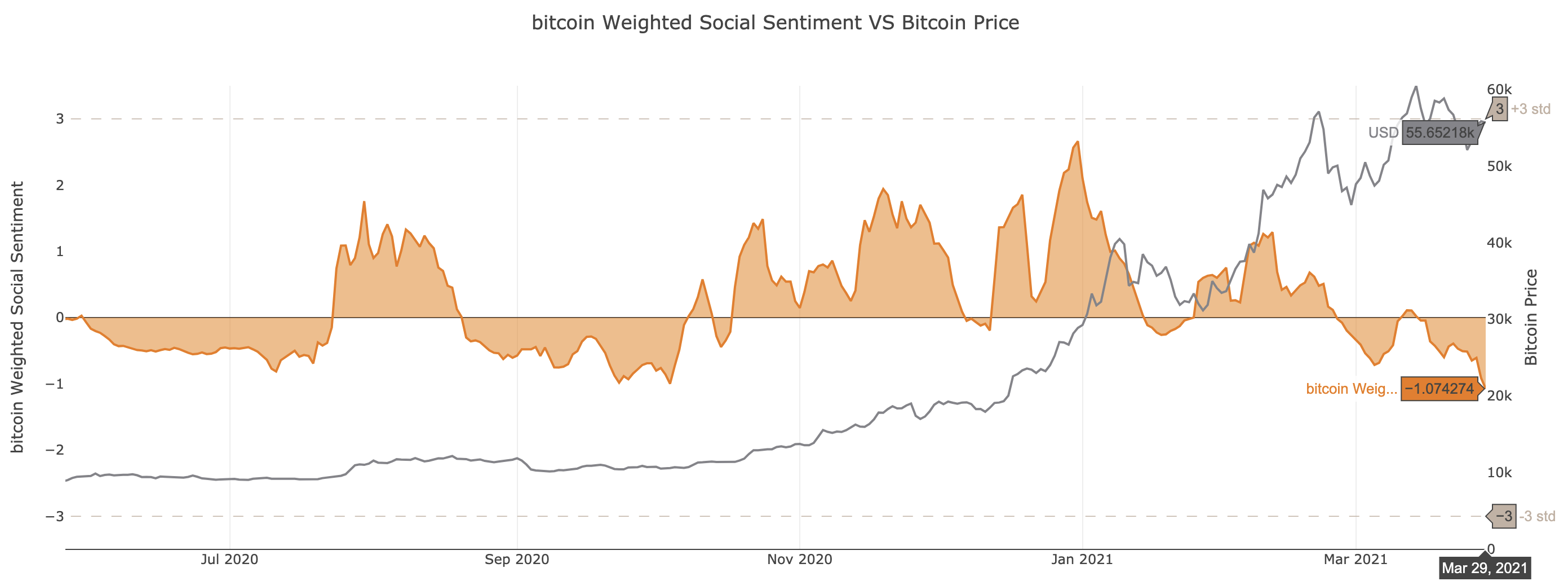

Many were surprised by the bullish impulse as confidence in BTC’s future price action deteriorated following two consecutive red weeks. Bitcoin-related social sentiment experienced a substantial decline, reaching the lowest levels since October 2020.

The quarterly rebalancing of institutional investors seen over the past few weeks has raised concerns that a deeper correction was in the cards.

Willy Woo pointed out that the selling pressure from funds rebalancing was met by equally bullish buying.

The on-chain analyst maintains that addresses with 100 to 1,000 BTC showed a net accumulation as prices tumbled, indicating that Bitcoin is “undergoing the strongest dip-buying of 2021.”

Behavior analytics platform Santiment also recorded a similar increase for the combined number of tokens located in addresses holding between 100 and 10,000 BTC.

Santiment’s SEO manager, Dino Ibisbegovic, said that this whale cohort has a significant impact on the market. When considering these individuals grew by 50,000 BTC since Mar. 22, it was only a matter of time before prices followed suit.

“What’s also noteworthy is that this group of investors has previously offloaded roughly 40,000 BTC between March 13-14, signaling an uptick short-term profit-taking that coincided with a -11.2% correction and demonstrating the potential impact that these addresses may have on the market,” said Ibisbegovic.

With the excess in money printing from central banks worldwide, it seems like Bitcoin is becoming the ideal inflation hedge.

Thus, further capital influx can be expected, especially when considering that the recent U.S. stimulus checks have yet to pour in.

Primed for New All-Time Highs

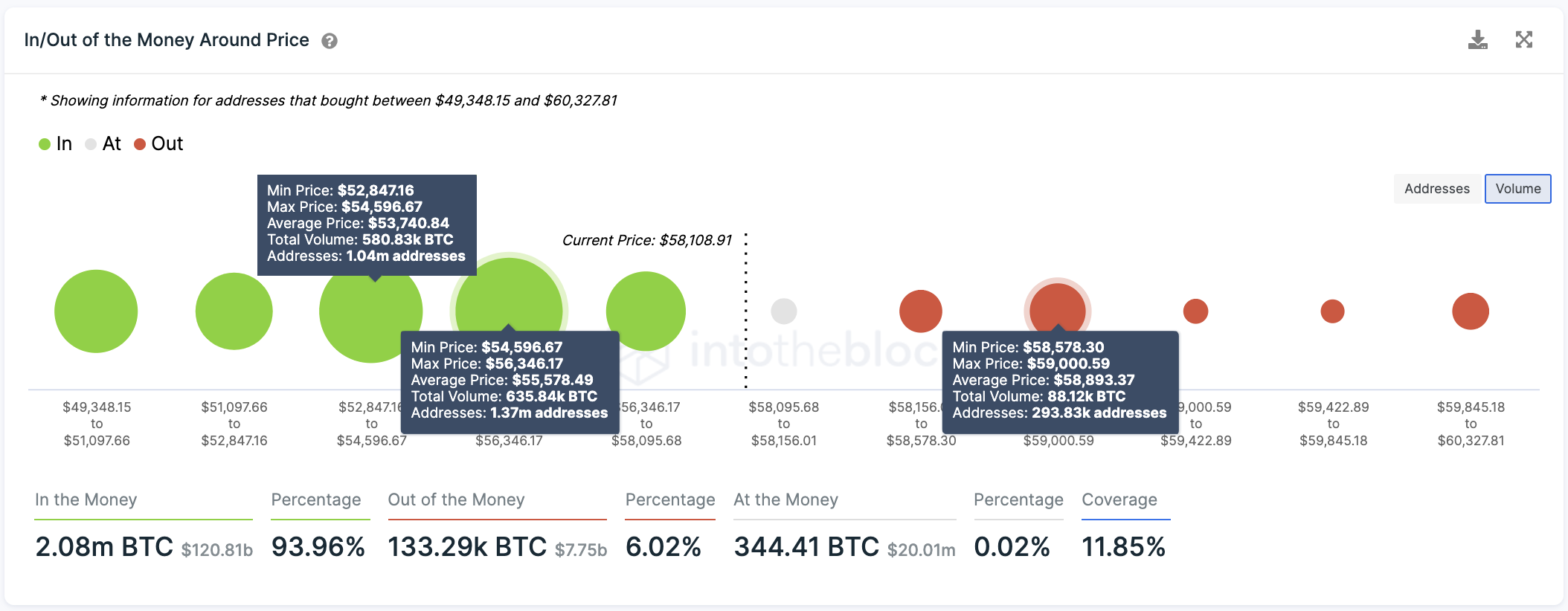

Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP), Bitcoin seems to have built a price floor between $52,850 and $56,350. Here, more than 1.40 million addresses purchased roughly 1.22 million BTC.

As long as this support level holds, another increase in buying pressure presents many possibilities for another leg up now that prices are far from being overheated.

The IOMAP cohorts show that Bitcoin only faces one supply barrier ahead. Nearly 300,000 addresses bought 88,000 BTC at $58,900.

Moving past this resistance wall would signal the correction’s end and the beginning of a new uptrend to $70,000 or higher.

Only a daily candlestick close below $52,850 would pause the optimistic outlook. Under such unique circumstances, investors may panic sell their holdings pushing Bitcoin towards the next critical support area at $47,000.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Share this article