BOOM: Komodo Prepares To Drop AtomicDEX

Komodo reveals its Manhattan Project

Komodo is undergoing a massive rebrand and a revamp of its entire ecosystem. The platform is taking a major step forward with the Antara framework, along with preparations for a cross-chain atomic swap decentralized exchange, AtomicDEX.

Now in beta, AtomicDEX allows seamless trades between multiple currencies, blockchains and exchanges, which could start a chain reaction in the crypto market. Kadan Stadelmann, Komodo’s Chief Technical Officer, told Crypto Briefing why his team views the new in-wallet exchange as a game-changer for digital assets.

Let’s Talk About CEX, Baby

Most traders use centralized exchanges (CEX), like Coinbase or Binance, in order to move value between cryptocurrencies. But these exchanges have some serious limitations. Users need to jump through many hoops, such as KYC/AML requirements, and are vulnerable to central points of failure that can result in hacked accounts or lost assets.

The fact that the average CEX has relatively high trading fees doesn’t help either.

A “DEX” Isn’t Always A DEX

One possible solution is emerging in the form of decentralized exchanges (DEXs). Instead of relying on a third-party intermediary, these exchanges allow peer-to-peer trades via smart contract, without having to deposit funds.

But most existing DEXs only distribute elements of the exchange process, while leaving other components centralized. Some so-called DEXs are merely non-custodial exchanges, where the platform does not hold user assets. Others require the user to comply with KYC regulations, or even geo-block users from certain regions.

The ability to limit users raises serious questions as to how “decentralized” a marketplace may be. In reality, many of these exchanges are at least partially centralized when it comes to their actual functionality.

There are other limitations as well. Ethereum-based DEXs like IDEX, ForkDelta and EtherDelta only allow trading between Ethereum and ERC-20 tokens. Users miss out on trading with Bitcoin and other UTXO-based assets like Litecoin, Ravencoin, or Decred, while the exchanges suffer from poor liquidity due to these limitations.

Sweet Atomic Swap Tech

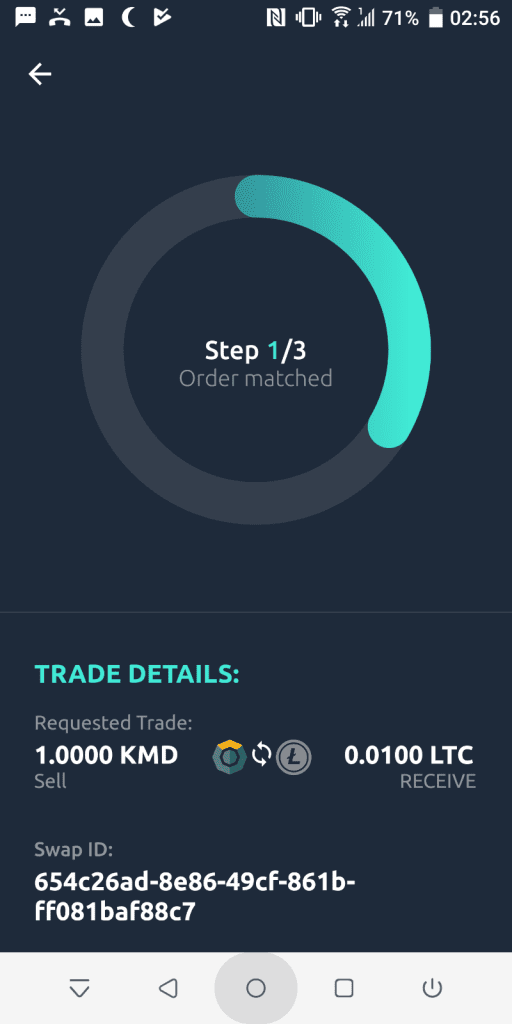

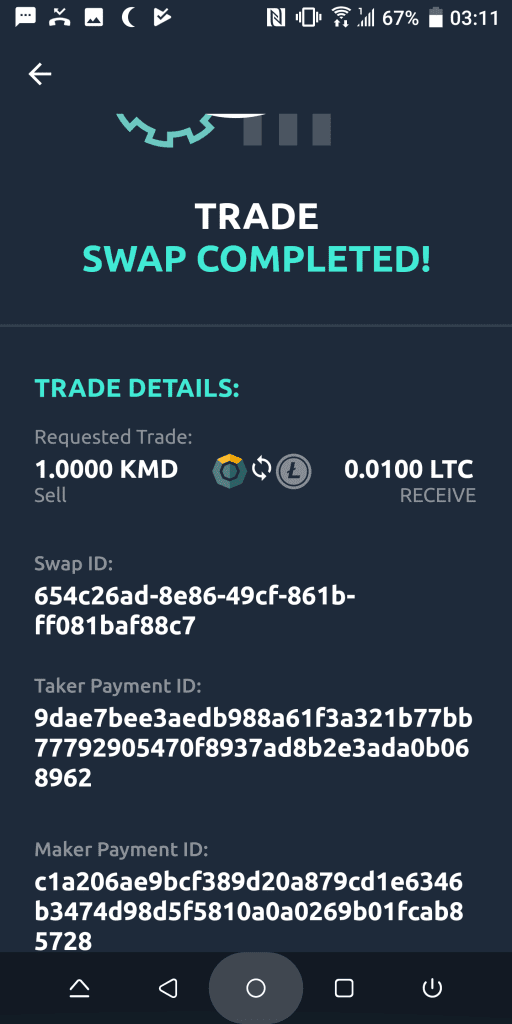

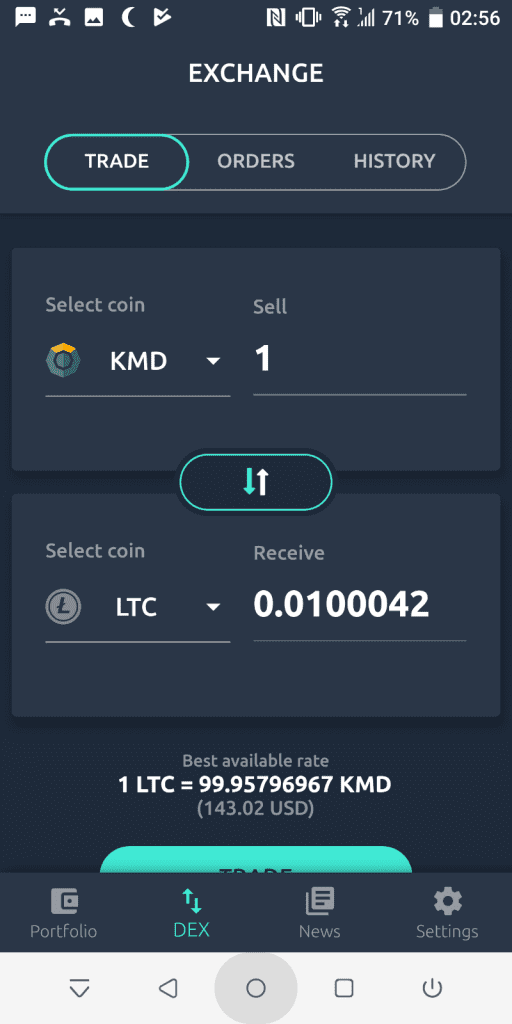

Using atomic swap technology, the Komodo platform’s AtomicDEX allows users to exchange tokens directly without intermediaries. Each trade is executed directly on the blockchain, making the process completely trustless and eliminating the need for custody. Users always have control of private keys, and no sensitive information ever leaves the client side of the wallet.

According to Komodo, that means the blockchain itself enforces the rules and protects trading parties. “You don’t have to trust us or the party you are trading with,” explains Komodo CTO Kadan Stadelmann. “The blockchain enforces the rules and makes sure no one can be scammed.”

By allowing users to move between a variety of cryptocurrencies without a custodian, Komodo’s AtomicDEX takes decentralization to the next level, Stadelmann says. Trades between blockchains are also supported, via cross-chain atomic swaps.

“[O]ur decentralized exchange trading implementation covers different blockchains with different protocols, meaning you can atomic swap any Bitcoin protocol-based cryptocurrency with any ERC20 token, for instance,” Stadelmann noted.

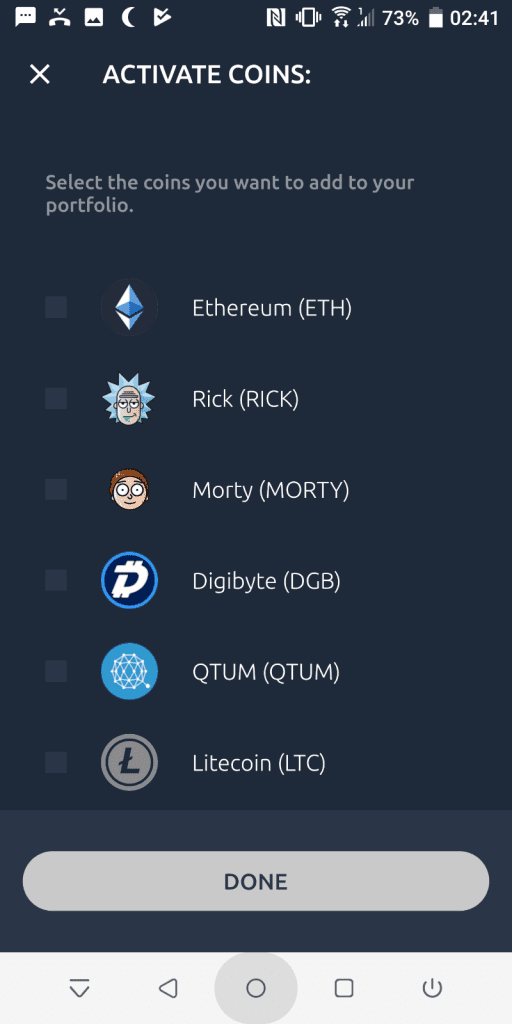

Ethereum is also covered, and Komodo engineers are working on adding more coins like EOS and Tezos. AtomicDEX will also support stablecoins, starting with Circle’s USD Coin (USDC). As with all supported tokens, users can permissionlessly swap any coin into the stablecoin or vice-versa.

From BarterDEX To AtomicDEX

In 2013, Tier Nolan created the concept of the atomic swap protocol, which was eventually utilized on Komodo’s first decentralized exchange platform, BarterDEX.

Nolan has since developed more efficient implementations of DEX technology, Stadelmann explains. By removing some unnecessary layers, it was possible to implement atomic swaps with fewer transactions, thereby reducing the transaction fees for cross-chain trades. In the new AtomicDEX, trading fees account for only 1/777 of the transaction volume in a given trade, much less than typical CEX trading fees.

The Problem Of Liquidity

Many DEXs also have issues of liquidity, with too few users to have a truly efficient market. AtomicDEX also aims to improve the range of available trades, by connecting users to multiple marketplaces.

“We have the technical capabilities of attaching two centralized exchanges for individual users,” Stadelmann said. “So users can use their API key in order to grab order books. You can be listening to all order broadcasts in the network.”

That means users can arbitrage between exchanges, fetching coins off a CEX and setting up a sell order when there appears to be unfulfilled demand. “When there are buy requests that don’t get fulfilled, your node will be able to track this unsatisfied demand, grab coins from a CEX at a tiny margin and put an order up in the DEX,” Stadelmann explained. “People in the DEX will be buying from you.”

Komodo is exploring further layers for added liquidity, including the addition of institutional liquidity providers. “We’ve been testing support for institutional traders to jump in and provide liquidity for global demand really easily,” the CTO added. Right now, Stadelmann admits, this does utilize some centralized technology, but “centralized and decentralized technologies will co-exist.”

Even an OTC desk can act as a liquidity provider. AtomicDEX is capable of running private trades between two traders, much like a traditional OTC trade, maintaining the privacy of both parties. Users can use a subnet in the DEX network that is isolated from other traders to maintain private trades. “You can even add a sort of whitelist,” Stadelmann added, “where you specify a trading partner by public key for private trades.”

A Liquidity Melting Pot

In the future, Stadelmann envisions a world where exchanges are connected in a unified pool of liquidity for all traders. Different DEXs and CEXs will link to each other in a hybrid system, optimizing trade while improving user experience.

“The optimal scenario would be that all centralized and decentralized exchanges would eventually use the same liquidity pot,” he predicted. “Crypto would get to a level of market adoption that is currently unimaginable.”

Changing The World One Person At A Time

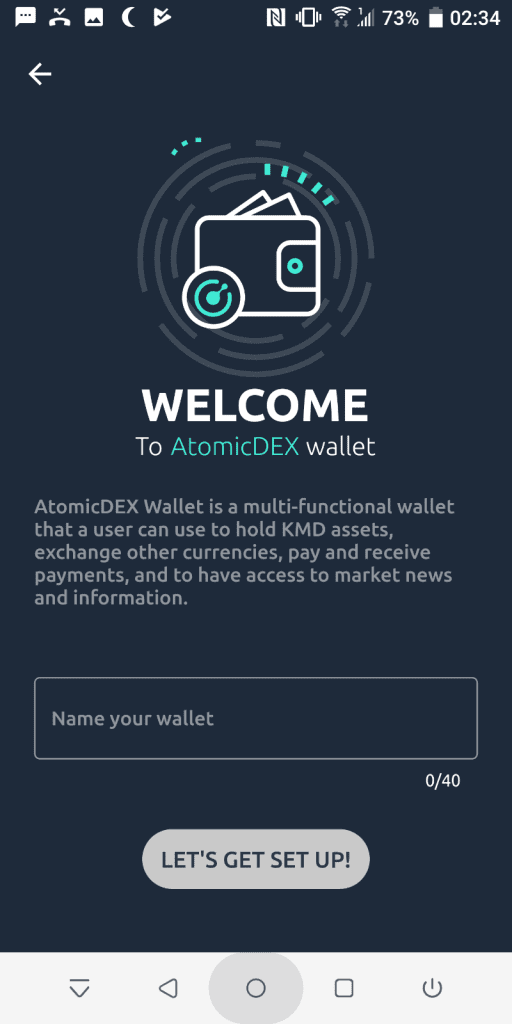

The AtomicDEX wallet is an open-source technology, with a multi-client wallet that supports a broad crypto portfolio and built-in atomic swaps. These characteristics are expected to make the technology truly accessible.

“[A]nyone should be able to join regardless of their environment or even regardless of their device,” Stadelmann said, emphasizing the possibilities for poor and under-served communities. “We’ve tested this on old mobile devices with simple processors and 500 megabytes of RAM, and it is stable.”

That means AtomicDEX could make cryptocurrency accessible to unbanked people around the world. “Look at countries in Southeast Asia, Latin America, where there are hundreds of millions of unbanked people,” Stadelmann said. “[T]his technology won’t just benefit everyday crypto traders and communities, but humans around the world who will have the chance to get attached to the first world and to be banked using this base layer.”

By allowing users in any country, or at any economic level, to easily buy and trade cryptocurrencies, Komodo hopes the AtomicDEX can reduce economic barriers and help more people attain prosperity. “That’s how you change the world,” Stadelmann said. “By helping one human have a better life tomorrow.”