Cardano Brings on 500 Stake Pools Day After Shelley Launch

Half of Cardano's testnet pool operators have already migrated to the mainnet.

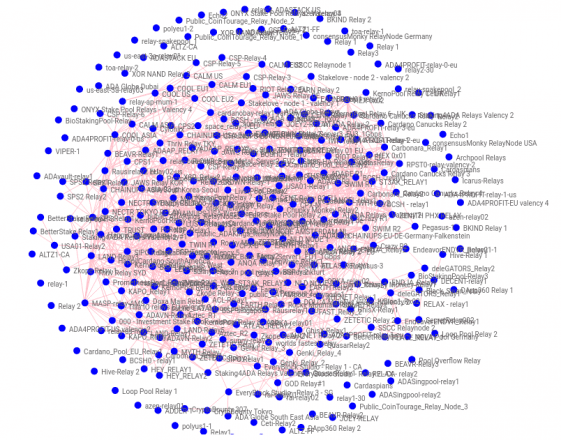

Cardano’s Shelley upgrade has seen fast growth, with hundreds of stake pools joining the network within 24 hours of its July 29 launch. Users can delegate their ADA cryptocurrency holdings to these various independent pool operators and earn staking rewards.

Staking Surges After Launch

At its post-launch peak, Cardano had 481 stake pools in operation, according to a press release. However, that number is constantly changing, and it currently has 416 active stake pools at the time of writing, according to AdaPools.org.

Cardano’s testnet statistics may predict future participation on the blockchain. As of June 22, the testnet had 1061 registered pools, 986 active pools, and 12.9 billion ADA ($2.4 billion) at stake.

It seems likely that those 500 other pools will migrate from Cardano’s old testnet to the current mainnet in the near future. Furthermore, the fact that the mainnet is more widely available could encourage more users and pools to participate in staking. This period’s rewards have not yet been paid out; however, current estimates suggest that users could earn as much as 5.1% per year. Numbers from Cardano estimate average returns around 4.6%.

Decentralization Is the Goal for Cardano

Charles Hoskinson, CEO of IOHK, writes that “decentralization is at the core of everything IOHK does.” In this case, Cardano aims to achieve maximum decentralization by encouraging the community to distribute its wealth across a large number of stake pools.

In this regard, Cardano’s closest competitor might be Tezos, which has about 425 active “bakers” with whom coinholders can stake their crypto with minimal effort and maintenance.

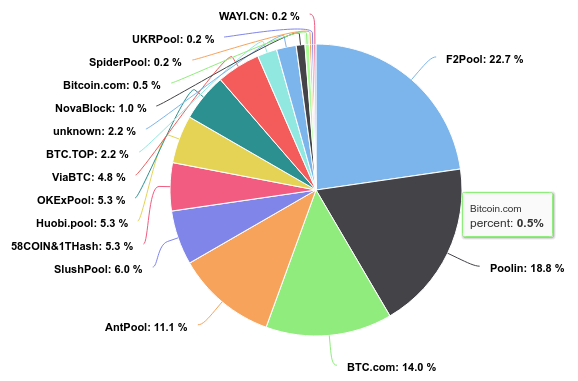

Meanwhile, IOHK argues that mining-based blockchains do not have this sort of decentralization. On Bitcoin and Litecoin, for example, miners are concentrated within a few small mining pools.

It’s not clear whether stake- and delegation-based blockchains are superior to mining-based blockchains. Regardless, Cardano hopes that its decentralization features will attract dozens of app and token developers to the platform within the next year.

Earn with Nexo

Earn with Nexo