Shutterstock cover by Gorev Evgenii

Cardano Coinbase Pro Listing Sets Stage for Price Rally

Cardano is the latest cryptocurrency to earn a Coinbase Pro listing. Its price has risen sharply following the announcement, and may surge further still.

Cardano has stolen the crypto spotlight after Coinbase revealed it would list the token on its retail platform, with ADA prices surging by 25%.

Coinbase Announces Support for Cardano

Cardano, one of the so-called “Ethereum killers,” is on a tear after Coinbase Pro revealed that it would be listing the token on its retail platform on Thursday, Mar. 18.

The price of ADA had been consolidating within a parallel channel for more than two weeks before the news was revealed. This narrow trading range was defined by the $1.03 support level and the $1.19 resistance level. But after Coinbase Pro’s announcement, the token broke through the channel’s upper boundary to hit a high of $1.30.

The fourth-largest cryptocurrency by market capitalization could now be preparing to enjoy more of the “Coinbase Effect,” which has turned market participants overwhelmingly bullish about its future price action.

Another spike in buying pressure could fuel the hype around Cardano. It will increase the odds of an upswing towards the $1.40 mark before ADA encounters any sort of resistance.

The bullish target is determined by measuring the height of the parallel channel and adding that distance to the breakout point.

Sitting on Top of Massive Support

The good news for those buying into hype is that Cardano currently sits on top of a massive support barrier.

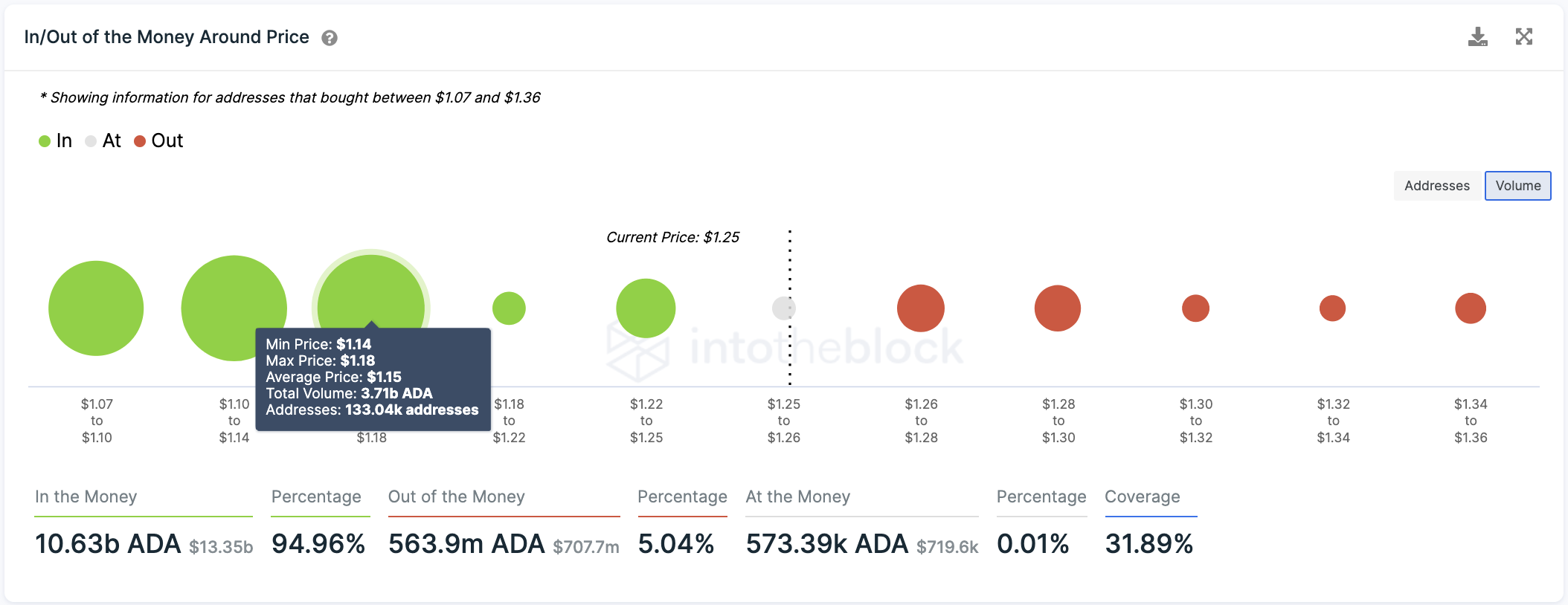

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that more than 133,000 addresses had previously purchased over 3.7 billion ADA at an average price of $1.15. Such a significant interest area will likely have the strength to absorb any downward pressure in the event of a sudden sell-off.

Moreover, the IOMAP cohorts show that nearly 95% of all ADA tokens in circulation were acquired at a lower price than the current market value. Only 5% of these coins were bought at a higher level.

These figures indicate that the majority of investor base behind Cardano is “In the Money” and it will take a significant amount of selling pressure to push prices lower.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.