So-Called "Coinbase Effect" Is Overbought, Says New Research

Analysis shows the Coinbase Effect may be much less effective at boosting a token’s price than broader market conditions.

Key Takeaways

- The Coinbase Effect could be more folklore than fact.

- Market conditions are highly influential on the impact of a Coinbase listing.

- A Coinbase nod in a bear market is unlikely to lift a coin out of the doldrums.

Share this article

Although OmiseGo (OMG) enjoyed a hefty 144% boost in price after earning a listing on Coinbase, the same cannot be said for other digital assets. New research from CoinMetrics suggests the so-called “Coinbase effect” may not have the powerful impact on token price as previously thought.

Coinbase Listings Tend to Coincide With Price Surges

When Coinbase listed OmiseGo (OMG) on May 19, the price of OMG exploded amid a broader market sell-off.

More than doubling in a week, the phenomenon was put down to the Coinbase Effect – the triggering of demand pressure after Coinbase lists a project or announces an exploratory pre-listing phase.

MakerDAO’s Maker (MKR) token enjoyed a similar impact. When Coinbase announced it would list the token, it lept 40%. Upon its listing, it spiked by 30%.

Overall, the price action around Maker during the period attributable to the Coinbase Effect was around 110%.

Yet research by CoinMetrics shows those gains are more often the exception than the norm. In Maker’s case, the Coinbase Effect’s contribution to that price action has been called into question.

The CoinMetrics analysis finds the Coinbase Effect to have contributed a mere 16% to the price of MKR.

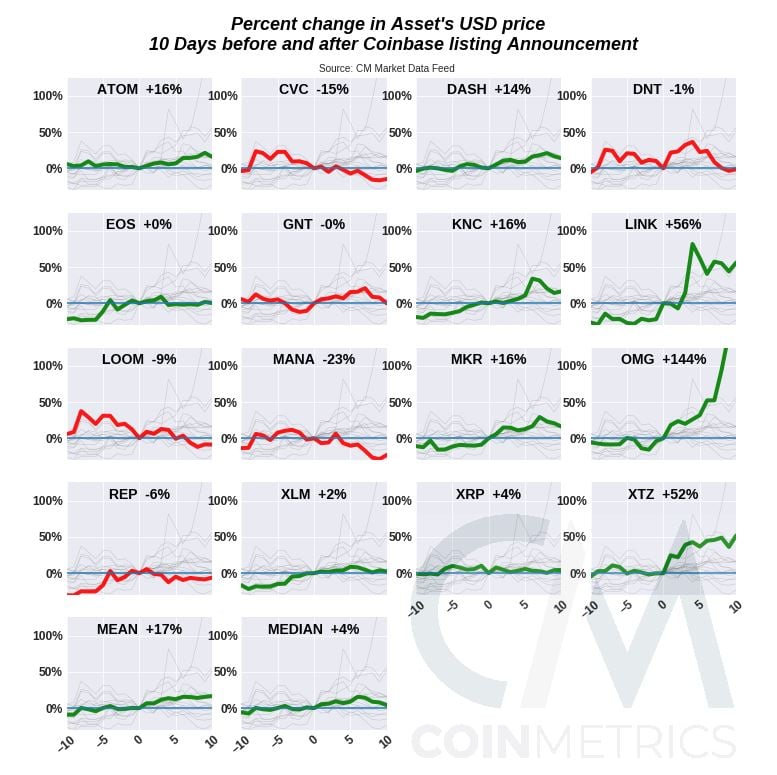

From metrics assessing coin price behavior against the U.S. dollar in the ten days before and after a Coinbase listing announcement, the price response was anything but consistent.

OmiseGo aside, the Coinbase Effect has been meaningful only for Tezo (XTZ) and Chainlink (LINK). Other projects have enjoyed only minor changes in price, both positive and negative. The mean effect was 17% and the median, 4%.

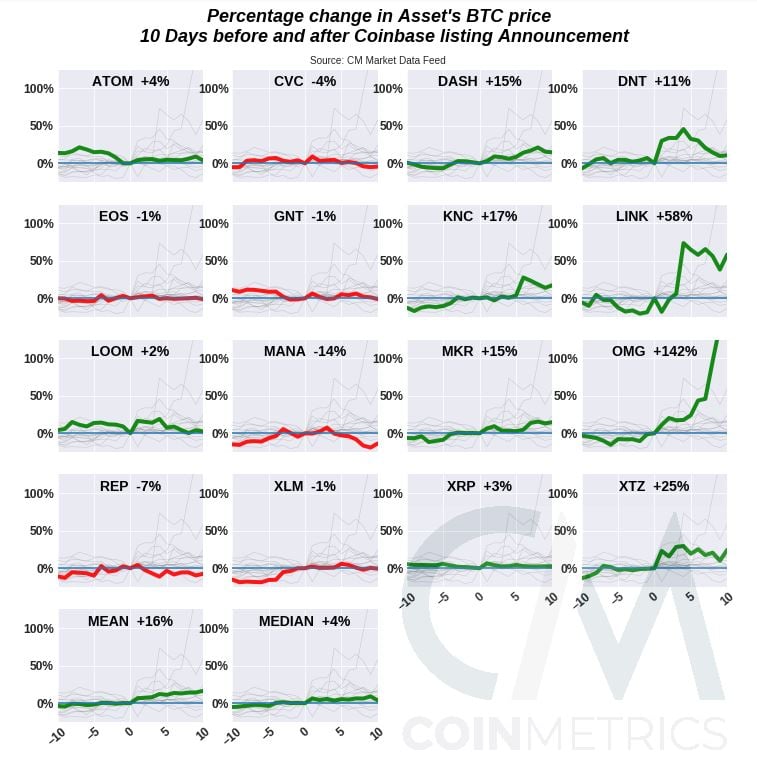

When measured against Bitcoin (BTC), the results are similar.

Priced against Bitcoin, the impact of the Coinbase Effect has still been muted, with a mean of 16% and a median of 4%.

Tezos gains against Bitcoin were half those against the U.S. dollar. And while more tokens get a positive price benefit from a Coinbase listing than a negative one, that ratio is relatively small at two-to-one.

And the gains are often not significant enough to bet on a price boost.

Forget Coinbase, Look to the Markets

Given its retail-facing nature, Coinbase is widely considered as the most accessible onramp from fiat to crypto. A listing on the exchange means a coin becomes, theoretically, available to a more significant number of buyers. It also gains the exposure and stamp of approval from a compliant American exchange.

But according to CoinMetrics’ analysis, broader market sentiment is the most significant determinant of the impact a listing is likely to have on a token.

The Coinbase Effect, in other words, is either muted or enhanced by broader crypto market conditions. CoinMetrics data suggests that the “short-term, 10 day, price changes tend to be temporarily skewed toward the broader market trend at the time of the event.”

CoinMetrics identified three market conditions that have a bearing on the extent and direction of the Coinbase Effect. Decentraland (MANA) and Loom (LOOM), for example, were both listed on the exchange in December 2018, when the digital asset markets were in the grip of a prolonged bear market.

They dropped 23 and nine percent, respectively, in the 20 days surrounding the listings.

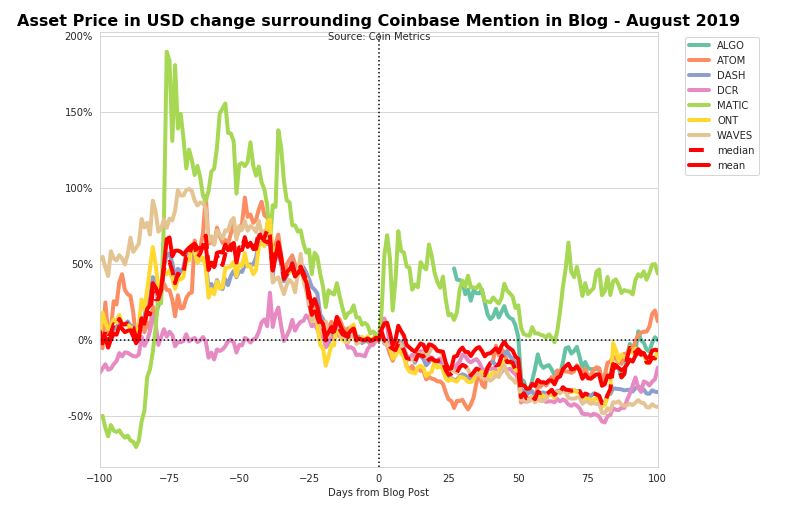

In August 2019, when the market was flat and choppy, eight assets were listed on Coinbase. Immediately following the announcement, “on average these assets saw a brief bump in price around 10%.”

MATIC, for example, saw a healthy rise in price immediately following the announcement, before trending erratically downward over the following 50 days.

June 2020 “Melt-up” Market Impact

During the recent listings of June 2020, the generally euphoric sentiment surrounding DeFi, in particular, played into the hands of Coinbase-listed DeFi tokens, such as Aave’s LEND token and REN.

According to CoinMetrics:

“The most recent group, announced in June 2020, has the largest positive trend of any of the groups reviewed so far, with the mean and median price changes of the assets rising 20%-40% going into the announcement and continuing to appreciate roughly another 20% in the 10 days following.”

The nod from the giant exchange has a positive impact on a token’s price more often than not.

But that impact is significantly affected by the market mood at the time of listing. The findings in this analysis show there is a Coinbase Effect, but much like crypto prices, it is substantially buffeted by the market.

Share this article