Maker Posts Massive Gains After Listing on Coinbase

Maker continues enjoying an impressive rally fueled by "Coinbase Effect" after getting listed on the San Francisco-based exchange.

Key Takeaways

- Maker is up nearly 30% over the past two days as Coinbase Pro announced that its order books are in full-trading mode.

- Different on-chain and technical indexes suggest that MKR could be bound for a further upward advance.

- Turning the $730 level into support may send the DeFi leader towards $880.

Share this article

Stablecoin DAO Maker is up 110% in the last two weeks after listing on Coinbase Pro, and different metrics show that MKR is poised to keep gaining.

Maker Gets a Boost from Coinbase Listing

The “Coinbase Effect” is a phenomenon where a token’s price skyrockets after being listed on the San Francisco-based exchange. Maker, an Ethereum-based DAO, is one of the latest to benefit.

Last week, the price of the DeFi leader surged over 45% after Coinbase Pro revealed that it would be listing the token on its retail platform. Now that the MKR/USD and MKR/BTC order books are in full-trading mode on this cryptocurrency exchange, its price has done nothing but shoot up.

Maker rose by nearly 30% over the past 34 hours. Its price went from trading at a low of $550 to retest mid-February’s high of $730.

Despite the significance of the sudden bullish impulse seen in the last few weeks, different metrics suggest that Maker could have more gas in the tank.

MKR Has More Room to Grow

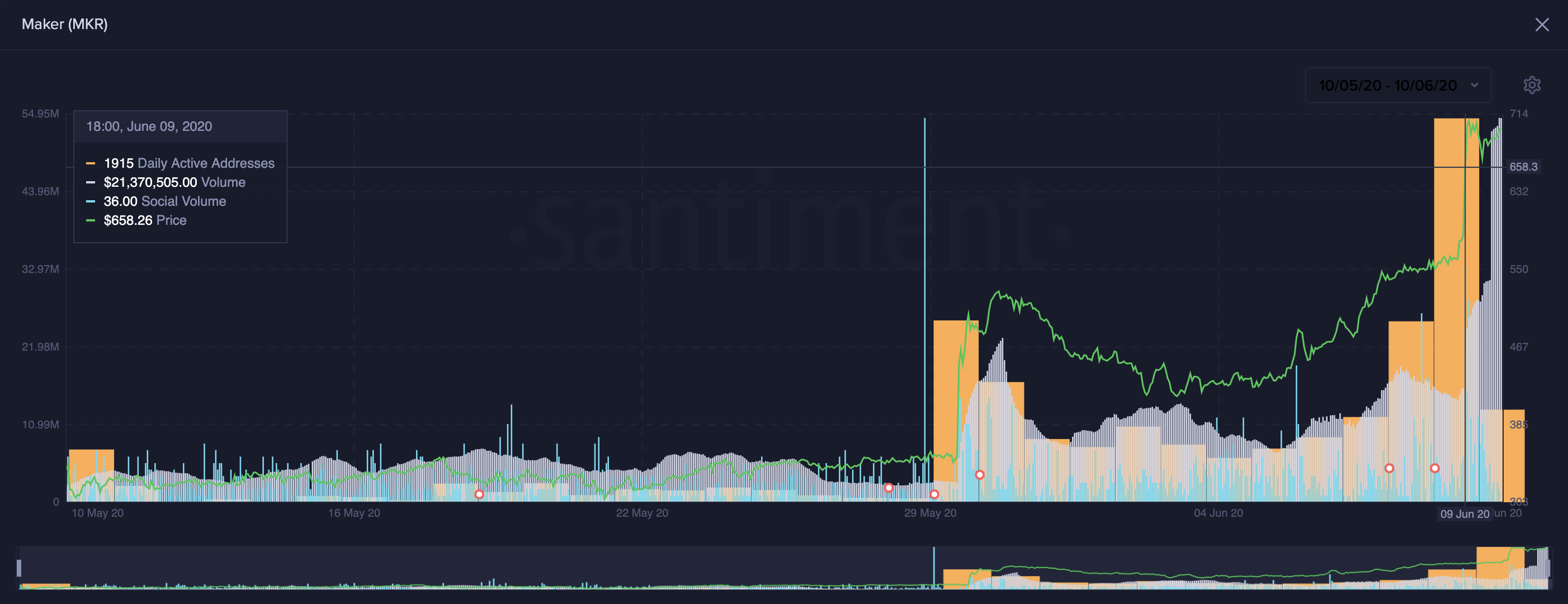

On-chain volume, along with daily active addresses and social volume, is a “great triple threat to track,” according to Santiment. These fundamental metrics help determine whether a given cryptocurrency is poised for a further advance. The behavior analytics platform maintains that when these three indexes rise together that it is a reliable sign for positive price movement.

After Coinbase announced it would add support for MKR, these gauges started trending up. On-chain volume surged to levels not seen since January 2019, daily active addresses reached a new all-time high of 1,915, and social volume is making a series of higher highs. If the trend continues, this utility token may be poised to post further gains.

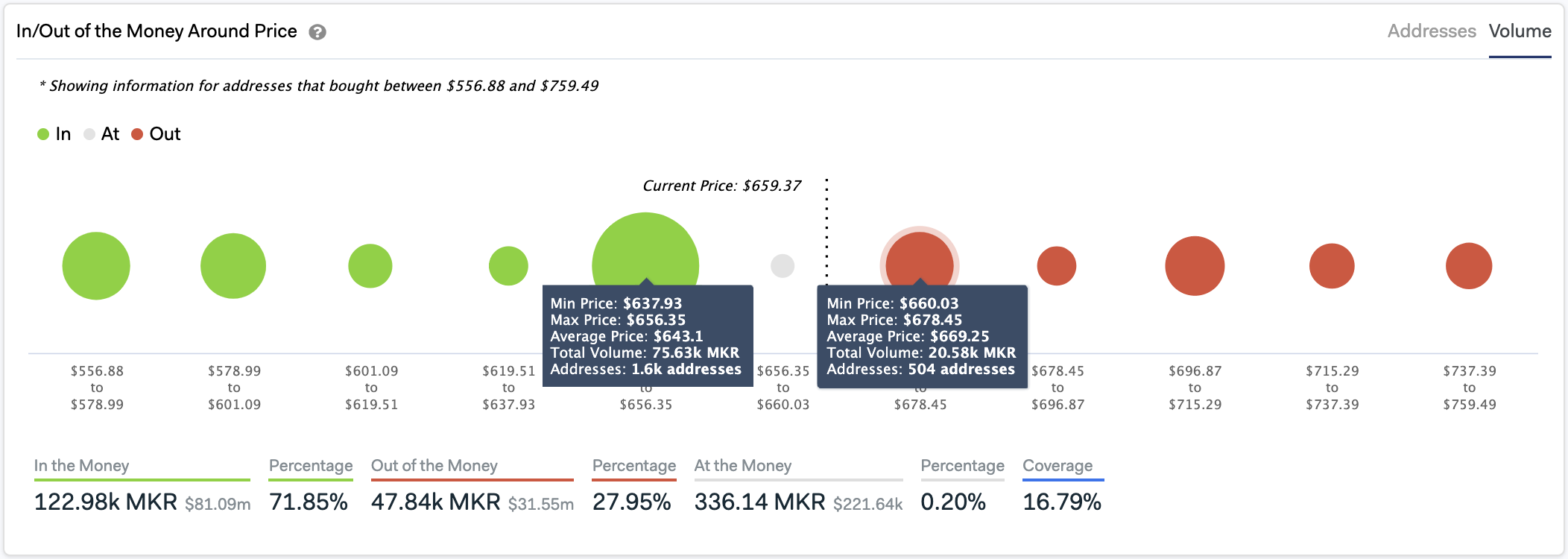

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model adds credence to the bullish outlook. Indeed, Maker currently sits on top of a massive supply barrier that would absorb downward pressure.

The IOMAP cohorts reveal that 1,600 addresses bought nearly 76,000 MKR at an average price of $643. The $638-$656 price level would likely contain the DeFi leader from a steeper decline in the event of a correction.

On the flip side, there is not any significant resistance wall that could prevent a further advance towards $760. From a technical perspective, however, Maker’s upside potential looks even brighter. If this altcoin can turn the $730 level into support, it could rise towards the 127.2% Fibonacci retracement level. This level of resistance sits at $880.

A sudden bearish impulse could see MKR plunge to the 78.6% Fibonacci retracement level at $610. Moving past this supply barrier might trigger a sell-off that pushes Maker to the next support zones around the 61.8% or 50% Fibonacci retracement levels. These critical areas of support lie around $520 and $450.

Despite the bullish signs that the different metric previously analyzed show, it is still essential to implement a robust risk management strategy. The “Coinbase Effect” has benefitted Maker, but sooner than later, its impact will fade, and investors will begin to take profits from the recent rally.

Share this article