Cardano Has Reached #3, But Price Gains Are Limited

The blockchain is making technical progress, but investors are waiting for a resistance barrier to break.

Key Takeaways

- Cardano recently carried out its "Mary" update, enabling developers to issue custom tokens on top of the blockchain.

- Cardano's ADA token is now the third largest cryptocurrency.

- However, ADA's price gains have been diminished, and investors appear to be cautious about a steeper correction.

Share this article

Cardano (ADA) has introduced support for custom assets and become the third largest cryptocurrency. However, investors seem reluctant to purchase the token at current prices.

Cardano Introduces Custom Tokens

Cardano recently released a new protocol update, “Mary,” which will boost the blockchain’s utility by allowing developers to issue new custom cryptocurrencies on top of the blockchain.

Cardano creator and IOHK CEO Charles Hoskinson called the move “historic,” as it marks the first time the protocol will support customized digital assets. “I have no doubt we will see hundreds of assets, most worthless, some very prominent, launched on the Cardano network,” said Hoskinson.

The upgrade is part of Cardano’s “Goguen” roadmap, which will introduce smart contract features and allow the blockchain to compete more closely with Ethereum.

Waiting on the Sidelines

In the days following the announcement, Cardano has become the third largest cryptocurrency. Its ADA token gained 9.5% over the past seven days, reaching a market cap of $38 billion.

However, despite the significance of the announcement, Cardano’s potential price gains have been supressed, as market participants seem cautious about a steeper crypto market-wide correction.

On-chain data reveals that Cardano’s weighted social sentiment on Twitter has decreased in the week following a recent Bitcoin crash that caused BTC prices to drop as low as $46,700.

From a counter-sentiment approach, the fact that investors are quite pessimistic about ADA despite the recent developments could be considered a positive sign. Historically, prices have tended to trend upwards when social perception is low.

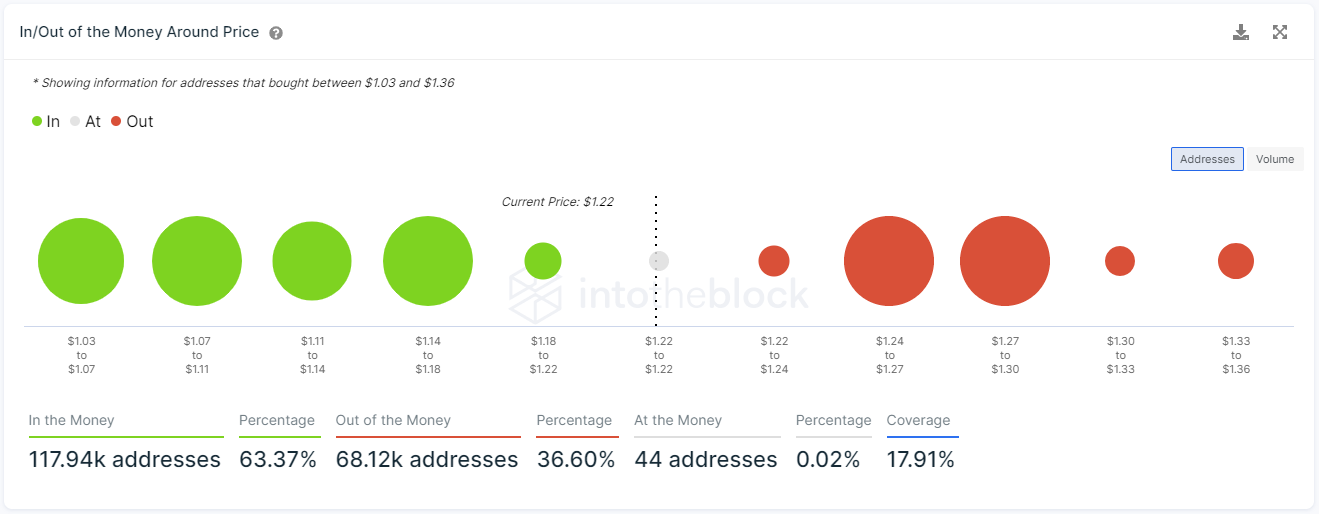

Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, Cardano’s token sits on top of stable support. Approximately 116,000 addresses had previously purchased over 2.60 billion ADA between the prices of $1.00 and $1.18.

Such a significant demand barrier could absorb a sudden spike in selling pressure and keep Cardano afloat. Holders within this price range will likely do anything to keep their investments “In the Money.” They may even buy more tokens to allow prices to rebound.

While the odds seem to favor the bulls, IOMAP cohorts show that ADA faces stiff resistance at $1.27. Roughly 65,000 addresses hold 2.9 billion ADA around this price level, meaning that it will take a significant amount of buying pressure to send prices to new highs.

If Cardano manages to break through this supply wall, it will likely resume its uptrend towards $2.00.

Disclosure: At the time of writing, this author held Bitcoin and Ethereum.

Share this article