Cardano Prepares to Retrace as Shelley Excitement Fades

Cardano surged after announcing its roadmap to proof-of-stake with its Shelley upgrade. After outperforming most of the crypto market, Ada is getting ready to retrace as hype around the Shelley fades.

Cardano soared as speculation over its transition to proof-of-stake after its planned Shelley upgrade turned euphoric. But now, as the launch date approaches, investors are taking profits on Ada and turning their attention to other altcoins.

Hype Around Shelley Fades

Cardano captured the market’s attention after founder Charles Hoskinson released the official Shelley roadmap in late May. Since then, the so-called “Ethereum killer” skyrocketed over 160% to reach a new yearly high of $0.14 recently. Now that the much-anticipated hardfork is only a few days ahead, the hype around Ada seems to be fading.

Data from LunarCRUSH reveals that Cardanos’s social engagement activity dropped quickly after its price peaked in early July. The number of social interactions about the token plunged from over 19.6 million to 5.5 million engagements. Engagements include favorites, likes, comments, replies, retweets, quotes, and shares on social media.

Despite the excitement around Shelley, Cardano could still very well fail against other smart contract offerings in the market. Traders may realize this and minimize their risk by taking profits. The sudden 70% drop in social activity is likely a leading indicator of soon to be falling prices and trading volume.

Cardano Poised to Retrace

Indeed, the TD sequential indicator presented a sell signal on ADA’s 3-day adding credence to the pessimistic outlook. The bearish formation developed as a green nine candlestick anticipating a one to four candlesticks correction. A red two candlestick trading below a preceding red one candle could serve as confirmation that Cardano is poised to drop further.

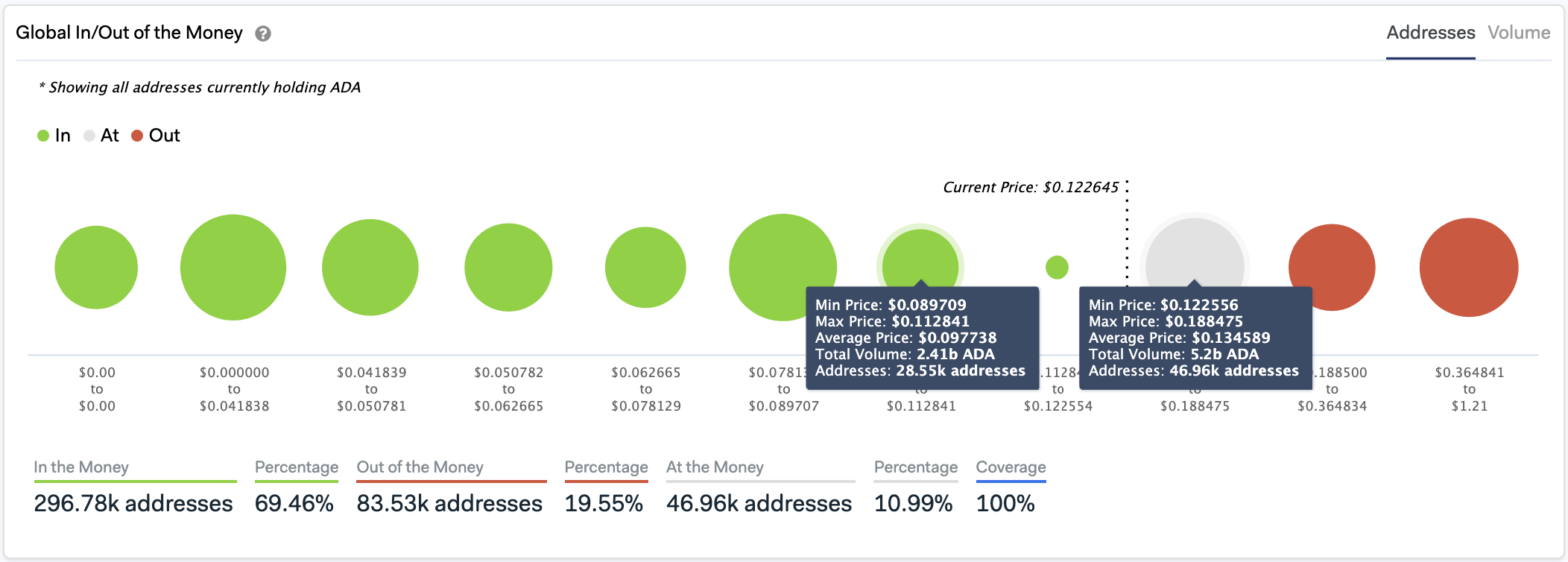

IntoTheBlock’s “Global In/Out of the Money” (GIOM) model reveals that if sell orders begin to pile up, then there isn’t a considerable support wall that will prevent Cardano from dropping to $0.097, which is where the next significant supply barrier sits to prevent further retracement.

The GIOM cohorts show that roughly 29,000 addresses had previously purchased over 2.4 billion ADA between $0.089 and $0.113. Such an important area of interest may have the ability to hold the price of Cardano in the event of a correction. Holders within this range will likely try to remain profitable. They may even buy more ADA to avoid seeing their investments go into the red.

Given the high levels of speculation around Cardano over the past three months, the bullish outlook cannot be disregarded. Therefore, a spike in social engagement metrics could be considered the first signal that this cryptocurrency is poised to rebound. But moving past the $0.13 resistance level may spark FOMO among investors and propel ADA towards new yearly highs.

Is trading around the Shelley hardfork an example of “buy the rumor, sell the news?” Time will tell.

Earn with Nexo

Earn with Nexo