Cardano and Tezos Face Stiff Resistance Ahead of Their Ascent

Two of the supposed "Ethereum killers," Cardano and Tezos, have made impressive upwards price movement. Though, to continue this performance they'll need to break through several tough supply walls.

Cardano and Tezos posted impressive gains over the last few weeks, but stiff resistance could pose problems for their ascent.

Cardano Might Hit a Wall

One of the so-called “Ethereum killers,” Cardano, has been on a tear over the last couple of weeks. Intense buying pressure was fueled by speculation around its upcoming Shelley upgrade, which will begin to roll out at the end of July.

Investors are accumulating Ada in anticipation of staking rewards on Cardano for when they transition to proof-of-stake. Data from IntoTheBlock reveals that the number of addresses with a balance in ADA continues to rise steadily.

Since the beginning of the month, the total number of addresses holding this cryptocurrency rose by 3.4% to reach a new all-time high of 418,400 addresses. This uptrend is a clear sign of confidence and user adoption, according to Lucas Outumuro, a senior analyst at IntoTheBlock.

“Overall, Cardano appears to have hit an inflection point with its Shelley upgrade. Whether ADA’s price drops with a case of ‘buy the rumor, sell the news’ following the hard fork on July 29 is still unknown, but on-chain indicators point to holder optimism and network growth as the date approaches,” said Outumuro.

The optimism surrounding Cardano is observable based on social media data. LunarCRUSH reported that roughly 74% of the 73.5 million social engagements recorded over the past week were bullish about this altcoin. Still, there is a tough resistance barrier ahead of the cryptocurrency that could prevent it from reaching higher highs.

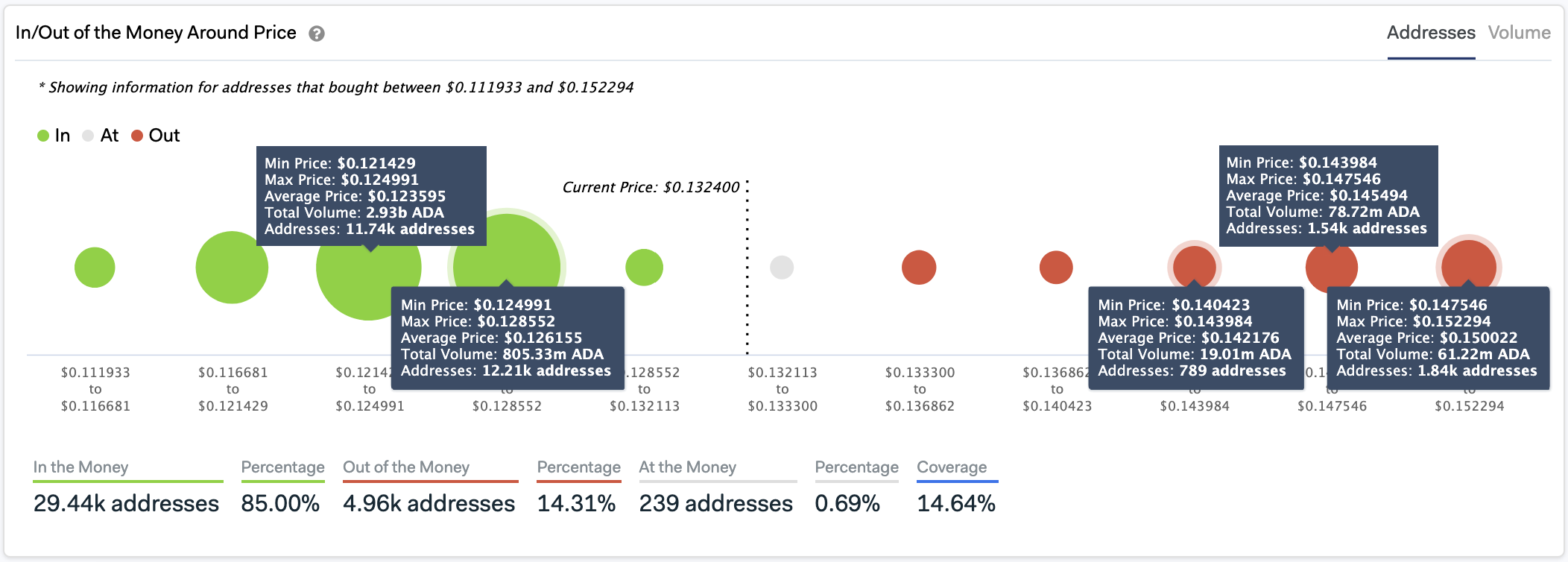

The area between $0.123 and $0.154 represents a significant hurdle for Cardano’s uptrend based on historical data. Around these price levels, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that approximately 4,200 addresses hold nearly 160 million ADA.

This supply barrier could reject any upwards price movement because holders within this range would likely try to break even in the event of an upswing. If this were to happen, an increase in sell pressure could ignite a correction.

On its way down, the IOMAP cohorts show the area between $0.12 and 0.13 will serve as a strong support barrier. Here, roughly 24 million addresses bought over 3.73 billion ADA.

It is worth noting that turning the $0.154 resistance level into support could be the catalyst that sends Cardano towards the next major barriers that sit around $0.20 and $0.30.

Tezos Sits at a Make-or-Break Point

The bulls have taken control of Tezos’s price action over the past week. Over that period, its price has appreciated by over 40%. Regardless, the smart contract token remains contained within a narrow trading range that began to develop in late April.

Since then, XTZ has mostly traded between the $2.3 support and the $3 resistance level with no clear indication of where it will go next.

Recent price action signals that Tezos is preparing to resume its historic uptrend as it tests the strength of overhead resistance. However, only a clear daily candlestick close above this critical hurdle will determine the trend’s direction.

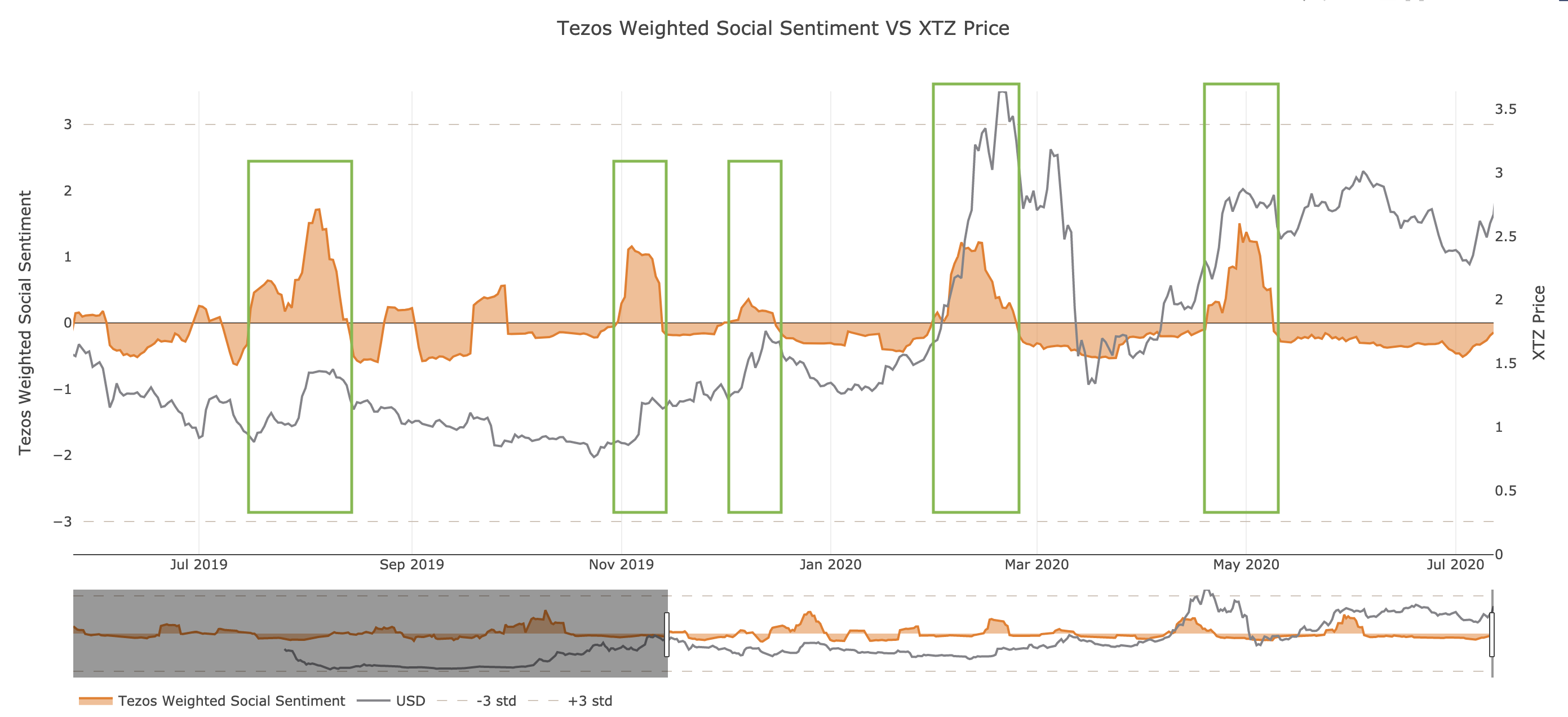

Given the possibility of a bullish breakout, Santiment’s Social Sentiment index reveals that the Twitter chatter around Tezos is starting to get bullish. Since the beginning of the month, the behavior analytics firm saw that sentiment volume for XTZ surged from -0.46 to -0.14.

If the trend continues, this fundamental metric will finally turn positive, which could be followed by a further price increase. Data reveals that each time Tezos’s social sentiment moves above 0, its price tends to surge.

In early February, for instance, the price of this altcoin took rose over 135% after its weighted social sentiment surged to 1.2. A similar phenomenon occurred in late April, which saw XTZ’s price appreciate by more than 46%.

If history repeats itself and XTZ-related mentions on social media turn positive, then Tezos might be able to break above its overhead resistance. Moving past this supply barrier could see its price march towards mid-February’s high of nearly $4 or even reach a new yearly high.

The Crypto Market Moves Forward

Over the last quarter, lower-cap cryptocurrencies have managed to post outstanding gains despite Bitcoin’s lackluster price action. Remarkable altcoin momentum seems to indicate a new altseason could be getting started.

While investors remain concerned about what the future holds due to the ongoing global pandemic, the best opportunities tend to emerge when “fear” reigns the market. For this reason, market participants must pay close attention to the different resistance levels mentioned earlier. Breaking above these supply walls could propel Cardano and Tezos to reach higher highs.

Earn with Nexo

Earn with Nexo