Crypto Briefing’s CB10 Index Ends First Quarter With 86% Returns

The first-quarter results of our editorial experiment with a crypto index are out.

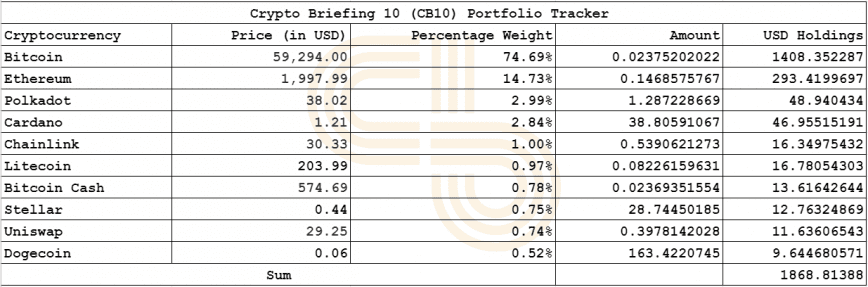

Crypto Briefing’s CB10 yielded 86.8% by Apr. 2, compared to Bitcoin’s 84.6% and ETH’s 98.9% returns since the index’s formation at year’s beginning.

CB10 Performace So Far

The CB10 index is based on the weighted market capitalization of these cryptocurrencies, their availability on U.S.-based exchanges like Gemini and Kraken, and certain other market risks. The inception of the index took place on Jan. 5, 2021, to provide an educational tool for crypto investing.

The index’s monthly returns stand at 18.6% compared to the valuation at last rebalancing on Mar. 4. The index’s performance during previous monthly rebalancing schedules was 8% (for January) and 44% (for February).

The compounded return of the index for Q1 is 86.8%, while the sum of each month’s individual returns is 70.6%. Meaning, if one had taken out profits every month from the index at the time of rebalancing and reinvested only the initial principal amount, the total return would be 70.6%. Booking profits quarterly may be an efficient strategy as well.

For experimental purposes, our index will feature compounding investment until year-end.

Visible Trends in Crypto Markets

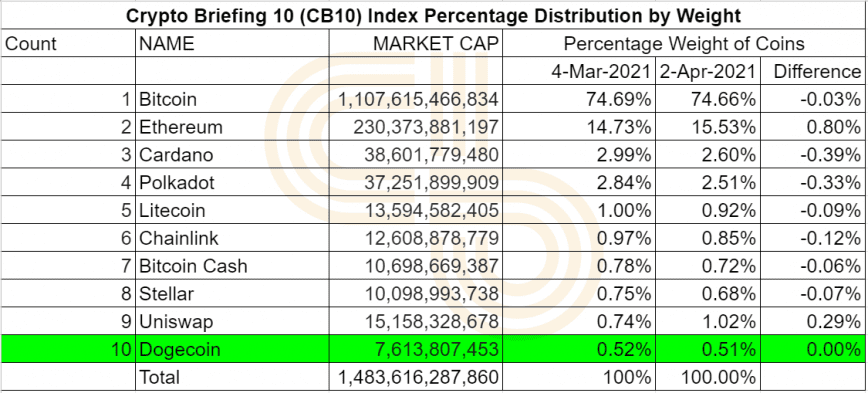

Bitcoin’s dominance over the altcoin market fell from 61.9% at the beginning of March to below 59.5% this morning.

Ether’s bullish revival after VISA’s announcement for hosting payments via Ethereum has seen a 0.8% increase in ETH allocation.

Nevertheless, other altcoins in the index saw slight dips, suggesting that liquidity flowed towards low-cap tokens. The rise of Theta Network, Filecoin, Terra, and others is proof of the above trend.

The progress in the layer-2 application also saw a lack of excitement across “Ethereum killer” platforms like Cardano and Polkadot. Notably, Binance’s native token rose thanks to Coinbase’s stock listing development and broader growth in the DeFi ecosystem.

Payment-centric cryptocurrencies took a beating as Bitcoin Cash dropped to the bottom of the index, with Dogecoin getting eliminated.

Rebalancing Event

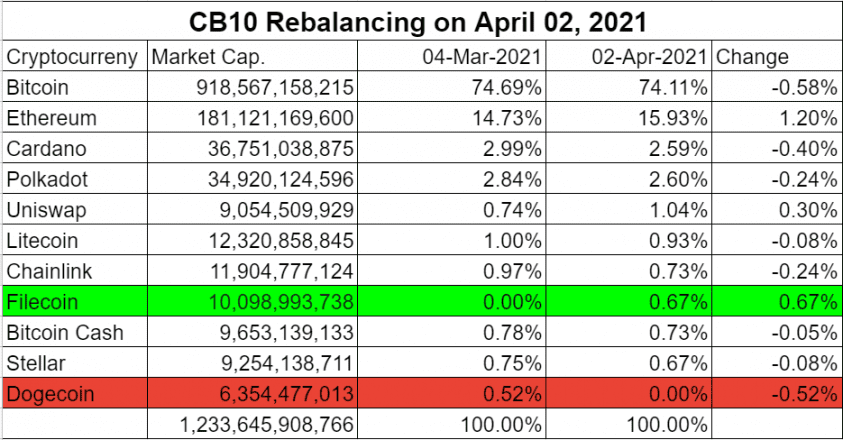

The third CB10 monthly reconstitution was successful at 10 am EST on Apr. 2. The live stats of the portfolio and distribution for this month can be found here.

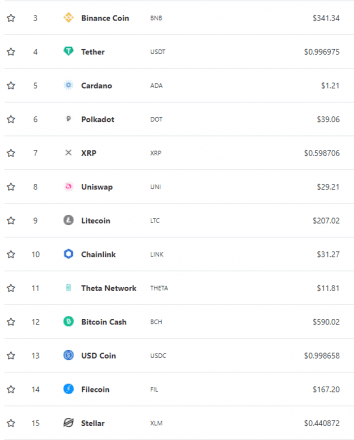

Barring the top two cryptocurrencies, the other tokens in the top 15 are prime candidates for the index.

Since Binance Coin is not listed on U.S. exchanges like Gemini and Kraken, it was excluded from the index. Theta Network’s THETA token will not enter the index for the same reason.

The decision to whether or not to include Filecoin was the deciding factor in Dogecoin elimination for April.

In the last 21 days, Filecoin (FIL) has risen by 450%.

The market risk for investing in Filecoin is primarily coming from the almost vertical rise in its price. However, the recent addition in Grayscale Trust and Bitwise’s crypto index brings the token to the front seat for institutional investment.

Moreover, the percentage of investment in FIL is considerably less in CB10. Thus, following the market trend, Filecoin joins the index at eighth position.

Uniswap’s UNI governance token and Chainlink’s LINK token continue to be the only DeFi and oracle tokens in the mix.

Investors can sell all cryptocurrencies for a stablecoin like USDT, USDC, or USDB or trade them using Bitcoin pairs to rebalance their portfolios. The detailed procedure is explained in the first rebalancing update after January.

Earn with Nexo

Earn with Nexo