Crypto Markets Remain Nervous While Ravencoin Stocks Up

Craig Wright is back in the spotlight.

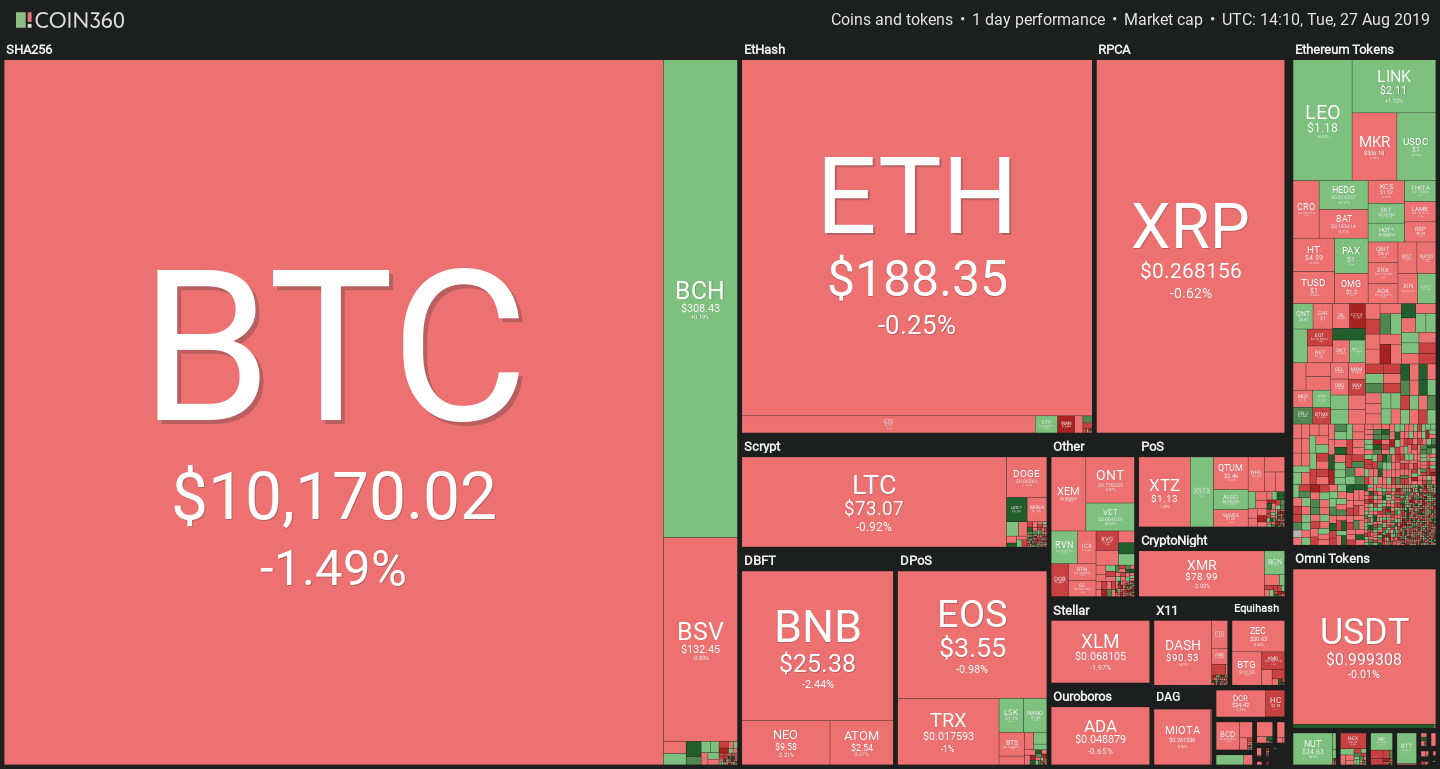

Cryptocurrency markets remain lethargic, with slight drops across the board. While most charts are in the red, the majority of altcoins are still within a few percentage points of yesterday’s price. Meanwhile, Bitcoin has fallen back below $10,200.

The biggest news came from Craig Wright, who recently lost his landmark case against the Kleiman estate. Dave Kleiman was Wright’s business partner, and they had jointly mined more than 1.1 million BTC – worth approximately $11bln at current prices. According to some present in the courtroom, Judge Bruce Reinhart rejected Wright’s testimony and accused the Australian billionaire of having perjured himself.

Defeated but not vanquished, Wright attempted to claim victory anyway. In an interview with the Modern Consensus, Wright said that Ira Kleiman, the brother of the deceased, would need to sell 40% of his stake as inheritance tax, thereby causing a dump in the BTC price.

Regardless of the merits of his claim, markets appear to have reacted. Bitcoin is down slightly, while Bitcoin SV saw a nearly instant 4% surge which nearly recovered from earlier losses.

Ravencoin flies above a flat landscape

RVN is up 3.44% today, the highest gain of any top-50 cryptocurrency. The move was likely due to a positive mention by the new interim CEO of Overstock.com, who specifically called out Ravencoin as a possible future payment method.

Technical Analysis: Nathan Batchelor on Bitcoin

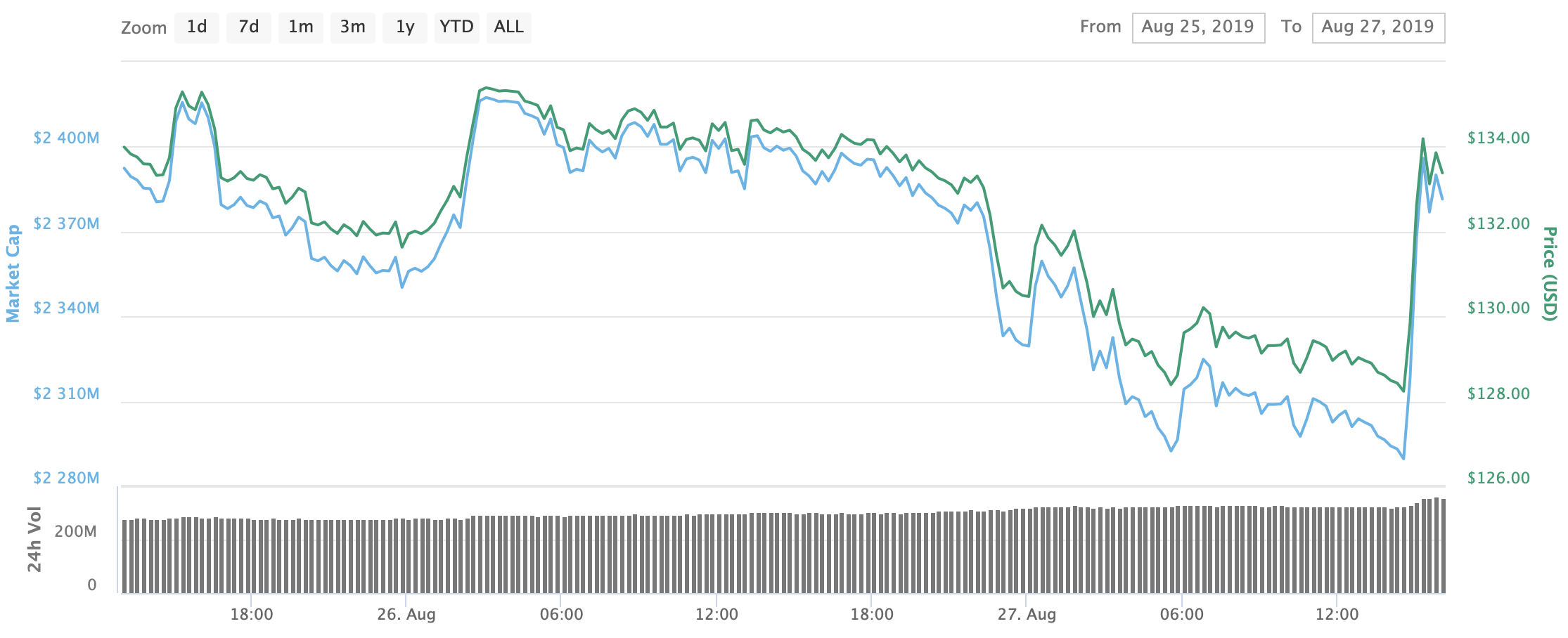

Bitcoin appears to be weakening as we move into the U.S trading session as the cryptocurrency continues to erode its early week trading gains. The major altcoins also look primed for further downside, as they struggle to stage an uptrend from fairly depressed levels as we move closer to the monthly price close.

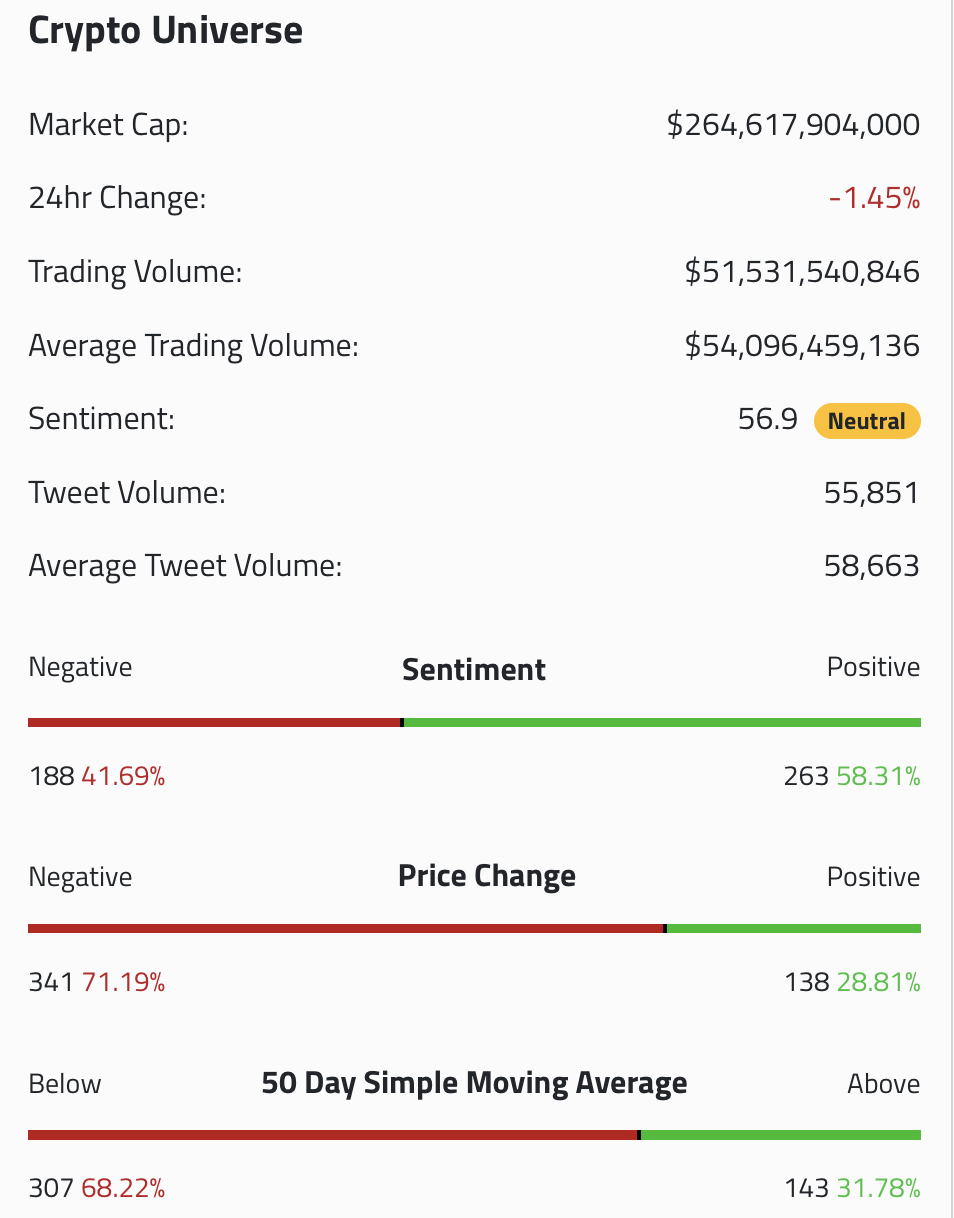

At current trading levels, Bitcoin is largely unchanged on a month-on-month basis, while the number one cryptocurrency’s nearest rivals, Ethereum and XRP, are currently nursing fairly severe double-digit monthly declines. This is a theme I will continue to monitor closely, especially if we see a potential breakout in Bitcoin’s overall market dominance above the 70 percent threshold.

Very little has changed from a technical perspective over the last twenty-four hours, with the crypto market still waiting for a trading catalyst to emerge. Looking at the MACD indicator on the weekly time frame, we can observe that the MACD histogram has turned bearish for the first time since early February this year.

With this in mind, we should monitor lower weekly price closes, as the MACD indicator helps confirm possible negative or positive trend changes in Bitcoin. While false signals certainly do occur when using the MACD indicator, it certainly suggests that the next big directional move is not far away, and Bitcoin will either sink or swim as September draws nearer.

*Bearish warnings are littering Bitcoin’s price chart across various time frames, which further highlights how important it is that bulls defend the $10,000 to $9,900 area.*

SENTIMENT

Intraday bullish sentiment for Bitcon has taken a big hit, and has fallen to 30.00%, according to data from TheTIE.io – while the long-term sentiment indicator has increased to 70.19% positive.

The decline in intraday bullish sentiment certainly appears to correlate with the current pullback we are seeing in Bitcoin’s price as move into the U.S session.

UPSIDE POTENTIAL

Bitcoin has two very distinct short-term resistance levels bulls need to tackle in the short-term, located the $10,440 and $10,680 levels. While the $10,870 level is the strongest intraday resistance area, prior to the $10,985 levels.

If we attach a trendline to all three of the recent price peaks Bitcoin has made since June, starting at the current yearly trading high, we find that major trendline resistance is located at the $11,700 level, which is also the neckline of an extremely large bullish pattern.

DOWNSIDE POTENTIAL

The downside potential for Bitcoin is fairly straight-forward, with the $9,100 level the likely target of any sustained bearish moves under the $10,000 to $9,900 support area.The downside for Bitcoin has the potential to open-up dramatically if the $9,100 level is breached, this would likely trigger a wave of selling in the entire crypto space.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.