DeFi Testing Ethereum’s Transaction Limits, These Solutions Offer Hope for Scaling

Ethereum has been pushed to its limits as DeFi projects grow in popularity. Will the network’s poor scalability hinder ETH's growth?

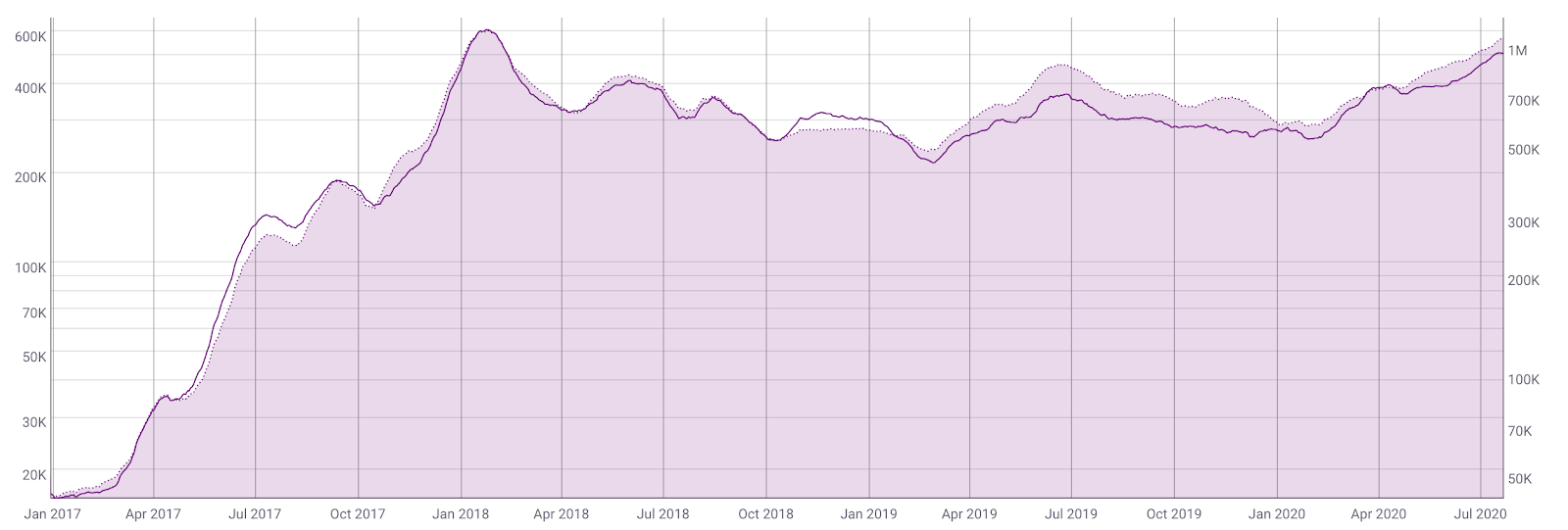

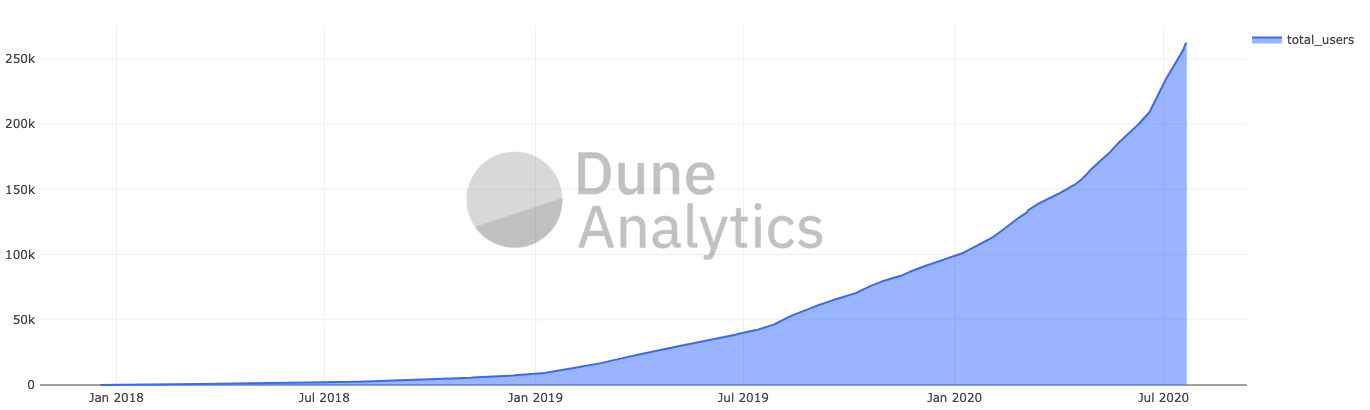

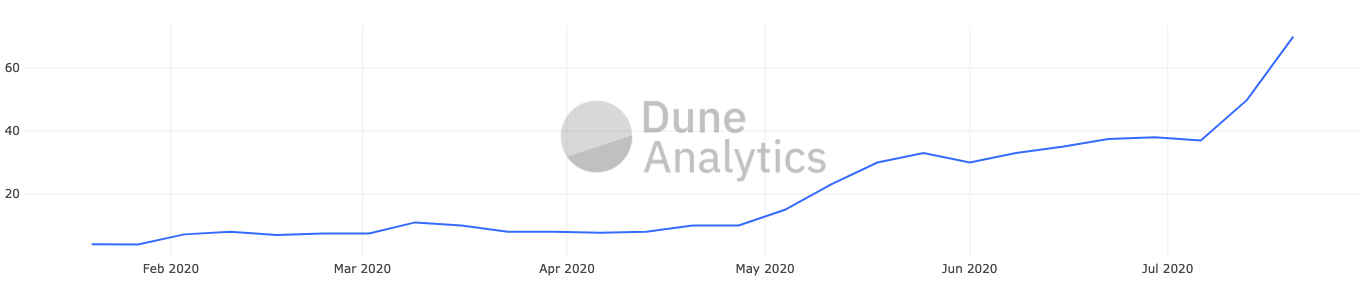

On-chain activity on the Ethereum network has been surging in 2020 to the levels previously seen amid the 2017-2018 bull run. Data suggests that it’s likely due to the rapid expansion of the DeFi sector.

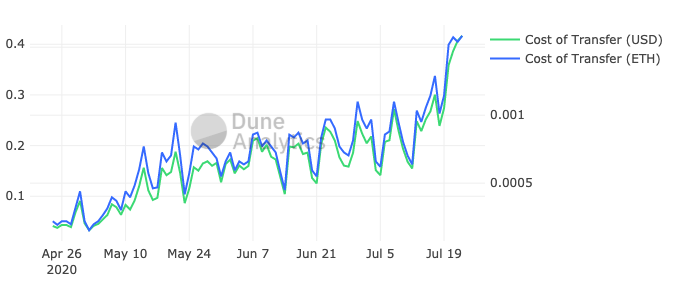

While the growth of on-chain activity is beneficial for Ethereum, it’s low throughput can cause high transaction fees under heavy network load. Expensive transactions, in turn, are prohibitive for DeFi usage.

Etherum 2.0 could solve many of the network’s current scalability issues, but it’s unlikely to come anytime soon. In the meantime, there are several already available scalability solutions to accommodate the network’s rising activity.

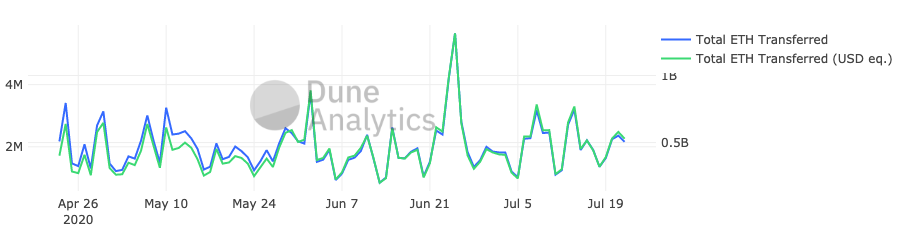

The numbers of daily active addresses and daily transactions have been enjoying steady growth in 2020, suggesting that more people come to use the network. Importantly, people mostly move around ERC-20 tokens, while the number of ETH daily transactions has stayed around 2 million over several months.

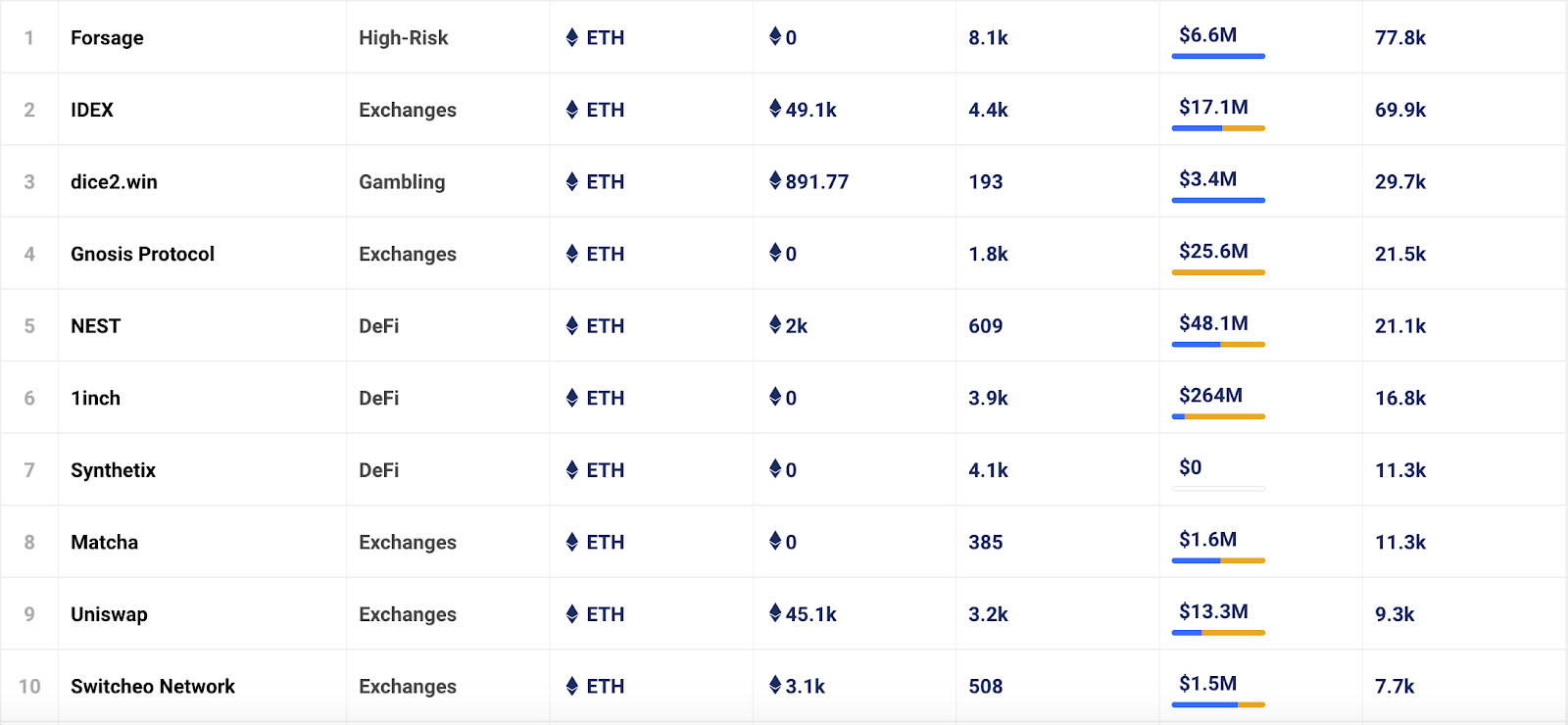

Many of the platforms with the highest number of transactions, like 1inch.exchange, Synthetix, and Matcha, all belong to the DeFi sector, indicating the decentralized finance movement is responsible for the surge in on-chain activity.

As the on-chain activity increases, the network becomes congested. As a consequence, transactions become more expensive.

Miners fill blocks with transactions from a transaction pool. If the pool receives transactions too fast, users have to pay higher fees to push their transactions to the front of the queue. If a fee is set too low, a transaction may hang in the pool for a long time. This delay can be disastrous for traders on the hunt for ever-changing and lucrative yields.

The pool for pending transactions can get filled fast, given the low network’s throughput of 14 transactions per second (TPS). As the queue grows, the premium for pushing a transaction to the front increases as well. As a result, the network becomes inefficient and expensive under a substantial load. Examples of this dynamic include Crypto Kitties and FCoin, which have caused considerable congestion in the past.

To solve this bottleneck, developers in the Ethereum community are working to transition the network form a Proof-of-Work (PoW) to a Proof-of-stake (PoS) consensus algorithm. A PoS algorithm would offer users a cheaper and more efficient Ethereum experience.

Unfortunately, the transition to Ethereum 2.0 has been delayed time and again. And without these upgrades, the DeFi boom may be capped due to the low TPS barrier and, thus, high transaction costs.

Ethereum 2.0 Isn’t the Only Solution

The primary reason behind Ethereum 2.0’s delayed roll-out is risk. With so much on-chain value and activity, the stakes are high to get it right. Thus, to help cater to current bottlenecks, developers have launched an “Ethereum 1.x” initiative, which focuses on improving the existing network while building Ethereum 2.0 in parallel.

Several teams are working on various Ethereum 1.x-related proposals. The list includes Ethereum Improvement Proposal EIP-1108, EIP-1844, EIP-2028, and EIP-2200.

The improvements mentioned above were able to lower on-chain transaction fees and created advantages for implementing off-chain solutions.

The most sensible way to significantly scale Ethereum before version 2.0 becomes functional is moving some transactions off-chain. Although Layer 2 networks, like Lightning Network on Bitcoin, don’t enjoy the same level of security as the underlying layer, they are relatively safe and practical.

Ethereum developers have been experimenting with off-chain setups for a while. One use case for off-chain transactions includes state and payment channels. These allow several users to lock up ETH on Layer 1 and transact or change state on Layer 2 fast and without congesting the network.

The Plasma network, for instance, resembles state and payment channels, except that the Layer 2 chain serves users in general.

The major downside of state channels and Plasma is that they don’t have strong support for smart contracts, limiting their usage. Another popular alternative is optimistic rollups, which can provide a substantial increase of 1,000 TPS with smart-contract support.

I think we'll see stuff move to l2 very soon.

USDT + OMG

DeFi + optimistic rollups— eric.eth (@econoar) July 23, 2020

Optimistic rollups offer a similar setup to PoS. There are off-chain aggregators acting like validators (nodes).

All the transactions that happen on Layer 2, including smart-contract interactions, are periodically summarized by nodes with stakes and submitted to Layer 1. These submissions are verifiable by anyone, so nodes risk to lose their stakes if they act maliciously.

Another way to put computation off-chain is by using zero-knowledge (ZK) proofs. ZK proofs enable a party performing computations to prove that they’ve actually done them without revealing how. Instead of providing the entire operation history, ZK proofs create mathematical proofs of this history. These proofs are much smaller in size and thus offer more efficient use of blockchain space while still guarding the data’s integrity.

Such an approach is useful for setups like decentralized exchanges (DEXes). These trading platforms can move order processing off-chain to preserve the Ethereum network’s bandwidth and make DEXes comfortable to use.

State channels, Plasma, Optimistic Rollup, and ZK proofs are the building blocks of Ethereum’s scalability.

Who’s Building?

Ethereum indisputably has the largest developer community in the blockchain space. Developers come because of the large user base, so they have to overcome the platform’s limitations to provide services under the current TPS restriction.

Raiden Network, Perun Network, State Channels, Celer Network, Machinomy, FunFair, and Liquidity Network are all building Ethereum state channels. The state channel niche is rather small and not widely popular. For example, Raiden Network was once making headlines but now occupies 300-400 rank on CoinMarketCap.

Plasma is more popular, given that some of the top-100 CoinMarketCap projects like Matic Network and OMG Network are using it. Importantly, Matic uses a modified version of Plasma along with PoS-based side chains, which enables it to host dApps. Such a solution has a potential value for DeFi projects.

Optimistic rollups have probably received the most attention from DeFi projects. The pilot implementation, Unipig, was jointly built by Plasma Group and Uniswap exchange, one of the top Ethereum DeFi dApps.

Optimistic Rollup is an incredibly exciting L2 solution that scales interoperable, fully general Solidity smart contracts on Ethereum.

Unipig was built to demonstrate both the capabilities and huge UX benefits of Optimistic Rollup.

DeFi can and will scale

2/

— Uniswap Labs 🦄 (@Uniswap) October 8, 2019

Following Unipig launch, Synthetix tapped into Optimistic rollups. The exchange is famous for tokenizing traditional financial instruments like commodities and Forex and making them available for trading against cryptocurrencies. Synthetix demoed an optimistic rollup implementation, which showed subsecond transaction confirmation times, putting user experience on par with centralized players like Binance.

ZK proofs in the form of ZK-STARKS have been lately adopted by DeFi projects as well. ZK-STARKS are developed by StarkWare, which received $4M with 6K ETH Performance-based bounties from the Ethereum Foundation.

ZK-STARKS enable ZK proofs in trustless setups. DeversiFi, a decentralized exchange formerly known as Ethfinex, became the first DEX to implement ZK-STARKS. The platform can now achieve over 9,000 TPS.

Besides scalability solutions, there is also Chi Gastoken introduced by 1inch, a highly-popular DEX aggregator. The token allows users to buy and store gas when prices are low. The major downside is that if the network is continuously congested, Gastokens minted earlier get used up, and there is no opportunity to mint the new tokens because gas is expensive. As a result, this solution doesn’t always work as expected.

Closing Thoughts on Ethereum Scaling

Although Ethereum is unlikely to shift to a fully functional PoS network anytime soon, DeFi and other dApps are far from doomed. The Layer 2 scalability workarounds have practical value given their adoption by popular DeFi projects. The blockchain space is still small, so an extra few thousand TPS and smart contract support should be enough for Ethereum to take advantage of the DeFi boom in the medium-term.