Fed's Inflation Target Is Good for Bitcoin, But Investors Will Have to Wait

There's never been a better time to say "Bitcoin fixes this."

Key Takeaways

- The Federal Reserve is trying to kickstart the economy by keeping interest rates low and pushing inflation higher.

- Bitcoin will benefit from higher inflation as it will cause the dollar lose more value.

- Investors are flocking to Bitcoin and gold as money printing starts to scare even the staunchest dollar maximalists.

Share this article

On Thursday, Federal Reserve Chairman Jerome Powell announced the central bank’s desire to increase inflation. Bitcoin’s price didn’t respond immediately, but the next decade looks bright for the digital currency and uncertain for the dollar.

What the Fed Is Doing

Bitcoin is set to embark on a multi-year run against the dollar as the Federal Reserve all but confirmed that mass money printing would continue. In his highly anticipated speech at Jackson Hole, Fed Chairman Jerome Powell laid bare the central bank’s plan for the economy and dollar.

Per Powell’s comments, the United States will continue to harbor low-interest rates for the considerable future. The Fed will try to grow the economy by targetting 2% inflation.

For short periods, the central bank will entertain inflation moderately above 2%.

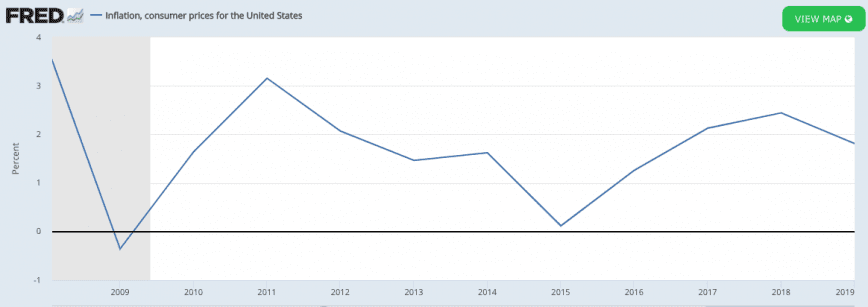

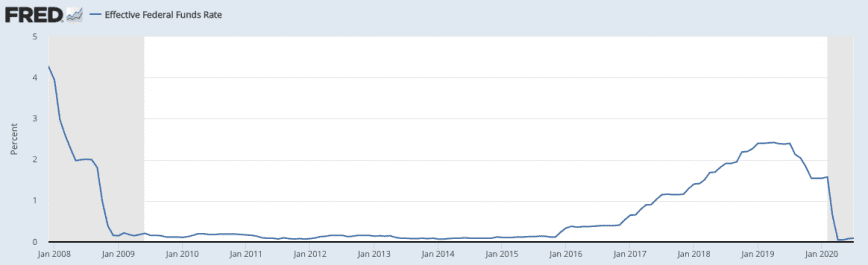

There’s a strong correlation between inflation and interest rates. Between 2011 and 2015, the United States consumer price inflation (CPI) decreased year-on-year. The Fed’s target rate was 0% during the entirety of this period.

When inflation started to rise at the end of 2015, the Fed raised its benchmark rate above 0% – the first rate hike in nearly a decade.

The Fed’s decision to artificially suppress interest rates and seek higher levels of inflation is a strong move to provoke economic growth. However, this will further weaken the dollar.

Bitcoin’s Role as the Dollar Fades

The de-facto head of the global monetary system said that the goal is to devalue the dollar further.

While this seems to be the right move for what’s a fairly complex economic dilemma, a weaker dollar is inherently bullish for Bitcoin.

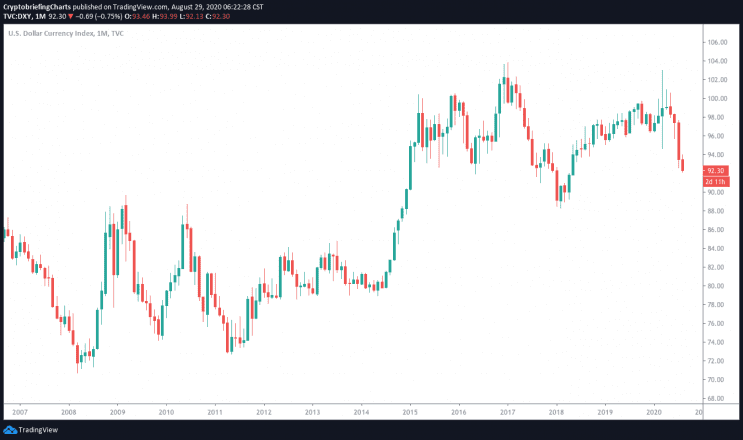

Bitcoin, gold, and even stocks will benefit from the Fed’s inflation policy, as they will see a relative increase in value through a weaker dollar. The massive rally for crypto, metals, and stocks since the March flash crash is a direct result of a dollar crash.

In July 2020, the dollar index (DXY) fell by 4.03% – its worst month since April 2011.

Money printing concerns are only exacerbating the dollar’s woes. Even Goldman Sachs, whose financial empire is built on the dollar-backed financial system, recognizes the risk of the dollar debasing as the printing press chugs along.

Amidst this havoc for the economy, there’s a ray of hope in the form of Bitcoin and decentralized currencies.

BTC’s hard coded monetary policy creates a rules-based approach to money. It’s fixed supply renders it one of the few forms of “hard money” in existence.

As the United States heads for higher inflation, Bitcoin’s hedging properties will be put to the test.

Bitcoin is already the foremost political hedge. Establishing its place as an inflationary and recessionary hedge will further solidify Bitcoin’s investment thesis for years to come.

Share this article