What Bitcoin Holders Should Expect from Fed Chairman Jerome Powell's Speech This Week

Fed Chairman Jerome Powell’s ambitions to target average inflation of two percent could see the central bank raise targets above that level in the short to medium term.

Key Takeaways

- The Fed is expected to announce plans to increase inflation

- Powell wants to target average inflation of 2 percent, meaning a push to drive it higher than that target to average figures out over time

- The historic moves signal that unprecedented monetary debasement lies ahead

Share this article

Chairman of the Federal Reserve, Jerome Powell, is expected to announce measures to drive up inflation at Thursday’s Jackson Hole Economic Policy Symposium.

Powell Set to Continue Fed’s Easy Money Policies

After a 12-month exploratory process among central bank officials, Powell is expected to unveil on Thursday at the Fed’s annual Jackson Hole, Wyoming, conference the bank’s Monetary Policy Framework Review.

The review will outline plans targeting average inflation of two percent.

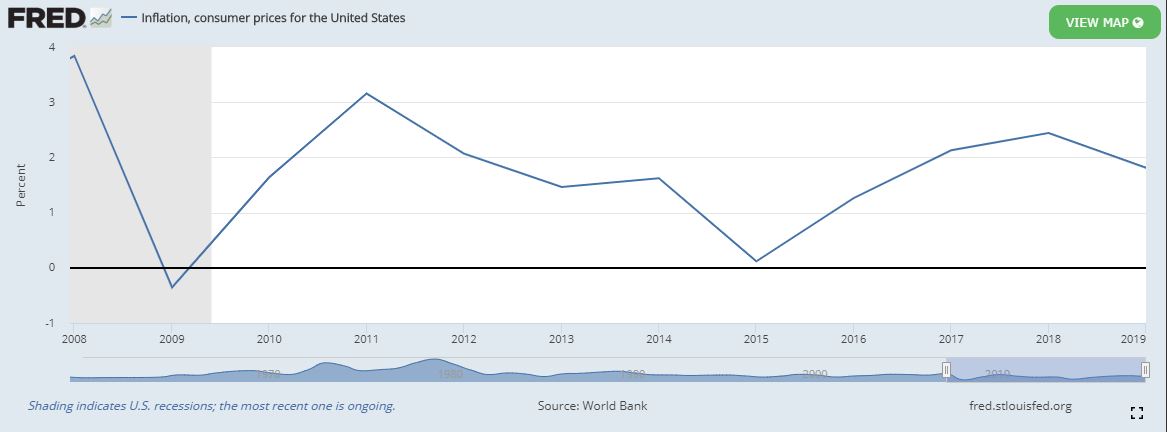

Given inflation has barely breached that target over the past decade, the Fed is set to target a rate above that, to drag the average up.

Evercore ISI head of global policy and central bank strategy Krishna Guha told CNBC:

“Heading into Jackson Hole we are confident Chair Powell will use his speech Thursday to tee up a profoundly consequential and risk-friendly move to soft inflation averaging at the Fed’s upcoming September meeting.”

Observers view the expected Fed stance to forge a path that enables the U.S. to avoid the long-term growth and price stagnation that has plagued Japan for decades.

Fed Accommodates Stocks, Employment

With Powell continue a monetary policy accommodative to achieve its employment and inflation targets, some wonder if the moves represent yet another stint of overreach.

The Fed could maintain its expansionary position well into the expected economic recovery, with interest rates held near zero for the foreseeable future.

Minutes from the Jul. 28 to 29 meeting indicate concerns over the impact of the coronavirus pandemic are likely to keep interest rates low over the medium term:

“… the ongoing public health crisis would weigh heavily on economic activity, employment, and inflation in the near term and was posing considerable risks to the economic outlook over the medium term.”

The Economy Is Rebounding, Regardless

The U.S. economy is rebounding strongly.

The unemployment rate has fallen from post-pandemic highs of over 14 percent to around ten percent. Stocks have regained all of their losses. Despite evidence the economy is recovering, the Fed appears to want to end the decade-long trend of sluggish price growth.

The Fed’s commitment to endless monetary expansion could put further pressure on the greenback.

When it announced an “infinite” amount of money supply through asset purchases and other quantitative easing measures in March, both gold and Bitcoin surged 11 percent and 25 percent, respectively.

The dollar has also fallen around ten percent against a basket of currencies since March. If, as expected, Powell indicates a willingness to continue propping up the economy even as it enters a likely period of growth, hard assets like gold and Bitcoin could see persistent strength.

Peter Boockvar, chief investment officer at Bleakley Advisory Group, warned that “it’s time that they rationalize the continuation of these facilities that may have been necessary in March but are no longer necessary now.”

It doesn’t appear Powell is prepared to heed those warnings. Bitcoin could be the ultimate beneficiary.

Share this article