Grayscale CEO Says He Is Bullish on Bitcoin

CEO Michael Sonnenshein suggests GBTC is doing better than ever.

Grayscale CEO Michael Sonnenshein told CNBC today that his firm is witnessing six times the inflow that it saw last year, coming from some the largest institutional investors in the world.

Inflow Increased Six-Fold

Sonnenshein said that “Grayscale’s flows are probably up 6x of what they were last year” and added that “the types of investors putting capital to work are some of the world’s largest investors, making bigger allocations than ever.” He also said that timeframe for these allocations is in the “medium to long term.”

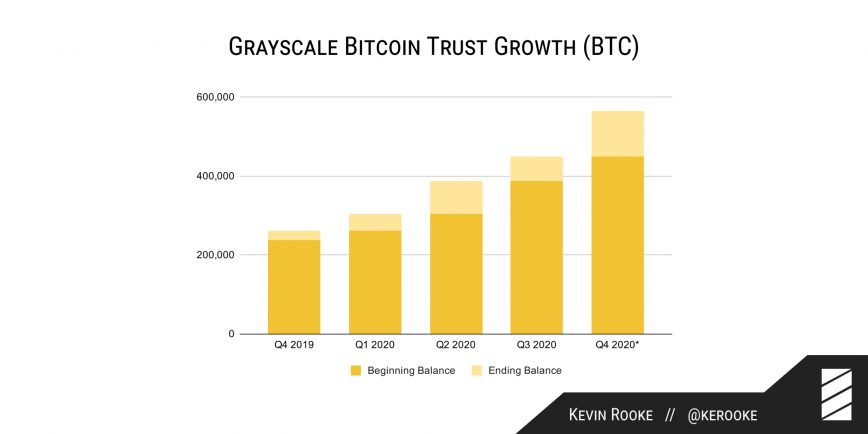

Since the beginning of November, Grayscale’s Bitcoin Trust (GBTC) has grown by $5 billion. In Q4 2020, GBTC added 115,236 BTC, about 48% of which was added in the last week of Bitcoin’s dip. The fund currently manages at least $12 billion of Bitcoin for its customers.

Grayscale’s Crypto Shares

Grayscale’s Bitcoin shares are registered with the US Securities and Exchange Commission. This adds certain conditions to the investment. Investors who purchase those shares can include them in their 401(k) to get tax benefits, but the shares are locked for six months before investors can sell them on the market.

Many institutions have goals and intentions that bias their investments towards arbitrage trading rather than Bitcoin as an asset. As such, Grayscale’s Bitcoin fund is just one of many options.

Nevertheless, large allocations near all-time highs with a six-month lock-up imply continued bullish expectations for Bitcoin. Grayscale’s asset management firm holds close to 570,000 Bitcoin, accounting for 3% of cryptocurrency’s entire circulating supply.

At the time of writing this author held Bitcoin and less than $15 of altcoins.