It’s Baaaaaaack! Bitconnect 2.0 Causes Waking Nightmares In Cryptosphere

Bitconnect is back... and even Chucky runs scared.

Just days ago, we cast our minds back to the altcoin season of 2017, musing that Bitconnect is one of the projects now long dead after flying high only two years previously. Perhaps we spoke too soon… because news emerged over the weekend that crypto’s legendary Ponzi scheme is set to stage a return. Bitconnect is back.

According to its website, we can expect to see Bitconnect 2.0 launch in July. The refreshed website displays a helpful countdown timer and… well, very little else.

Seasoned crypto enthusiasts have either been howling with dismay or breaking open the popcorn at this news. But if you’re one of the more recent entrants to the crypto market, you’d be forgiven for wondering what all the fuss is about.

So, for the benefit of the uninitiated, here’s a brief roundup of Bitconnect’s history.

All About Bitconnect – A True Ponzi Project

Bitconnect started life in 2016, when it staged an ICO for its open-source coin with the ticker BCC. The offering of the company was a piece of Bitcoin price volatility software. The concept was that investors in the BCC token would lend their funds to the Bitconnect investment pool. The software would manage those funds, making investment decisions on behalf of the community.

BCC investors would receive interest on their investments. Bitconnect guaranteed a minimum of 1 percent return, compounded daily, which is where the first alarm bells started to sound. After all, no seasoned investor expects guaranteed returns.

Another issue was the black box of Bitconnect’s software. The ‘company’ never disclosed how the software works, allegedly to protect its competitive edge.

Even if none of the above seemed fishy, the fact that the team behind Bitconnect also chose to remain invisible was a further indicator that all was not as it seemed. (It’s still not entirely clear who, precisely, was behind the decentralized initiative, although several companies and entities used the name.)

A feature of Ponzi schemes is how they are marketed — a practice known as “pyramid selling.” Bitconnect offered heavy incentives to users for referring new members to the program, creating an unsustainable pyramid effect where rewards are funneled up to those who referred the most.

Which is perhaps what motivated investor Carlos Matos to deliver a presentation on Bitconnect that became one of the most abiding memes in crypto history… (watch at your own risk, it’s pretty cringeworthy).

The BCC Token

During much of 2017, the price of BCC soared, outpacing even Ethereum. However, respected figures in the crypto community such as Litecoin creator Charlie Lee started to call out Bitconnect as a Ponzi scheme.

I’ve been asked what I think about BitConnect. From the surface, seems like a classic ponzi scheme. I wouldn’t invest in it and wouldn’t recommend anyone else to.

I follow this rule of thumb:

“If it looks like a ?, walks like a ?, and quacks like a ?, then it’s a ponzi.” ?

— Charlie Lee [LTC⚡] (@SatoshiLite) November 30, 2017

Despite this, BCC continued to draw speculation, eventually reaching a peak of nearly $450 in mid-December.

Only weeks later, everything fell apart. By early January 2018, the states of Texas and North Carolina accused Bitconnect of illegally selling securities, and the UK also issued a notice for the company to prove its legitimacy. In mid-January, the company closed its doors and the value of BCC plummeted a staggering 87% in a single day.

In its defense, Bitconnect did extend some loan repayments to investors. The only catch? The repayments were made in BCC, at the exchange rate of $363, at a time when the actual value was worth less than $40.

More recently, the FBI announced in February this year it was seeking to interview those who invested in Bitconnect. Tellingly, the Bureau chose to use the word “victims” rather than investors.

Can Bitconnect Now Resurrect?

With the benefit of hindsight, it’s easy to see why Bitconnect has become a cautionary tale for crypto enthusiasts. So, what about this sudden resurrection? What can we expect from Bitconnect 2.0?

The honest answer is that nobody yet seems to know. As things stand, countdown timer aside, there’s little information apart from a tweeted claim that the new version of the BCC token will be listed on Binance.

Bitconnect2.0 meets #ethereum ???

Buy now on https://t.co/rrfkmzRvYT

— Bitconnect2.0 (@Bitconnect2_0) May 19, 2019

So far, nobody from Binance has either confirmed or denied this claim, suggesting that the tweet could have been a cynical attempt to plug somebody’s referral link. The CEO, Changpeng Zhao, has been his usual active self on Twitter since the news about the alleged listing.

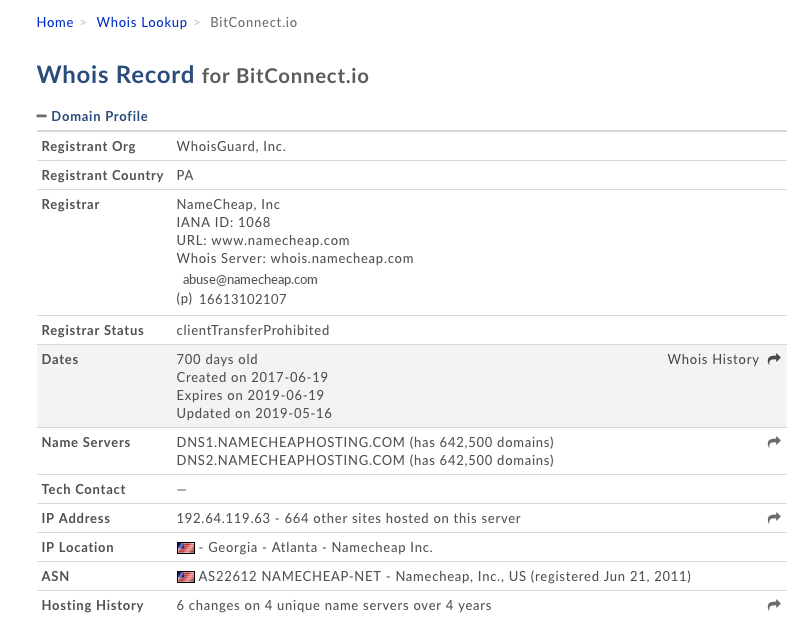

Tellingly, a quick “Whois” domain search shows that the current domain registration for the Bitconnect site will expire in June – before the date of the relaunch. So unless the registrants renew the domain, perhaps we won’t even get to see what Bitconnect had planned.

Of course, you should always do your own research and make your own investment decisions.

But if it looks like a duck, walks like a duck, and quacks like a duck… coming to a decision should be child’s play.