Photo: Meta

Meta Ready to Double Down on Its NFT Bet: Report

Meta’s new head of fintech, Stephane Kasriel, has said that the media giant has no plans to steer away from its NFT-focused strategy despite the recent sharp downturn in the market.

The diminishing interest in NFTs hasn’t discouraged Facebook parent company Meta from pursuing its big strategic bet on the technology.

Meta Keeps Course as NFTs Lose Floors

Despite the downward trend in the market, Meta has signaled unwavering conviction in its strategic bet on NFTs.

In a Wednesday interview with the Financial Times, the social media giant’s new fintech lead Stephane Kasriel said that the company would be sticking with its plans for NFTs and the digital collectibles economy. “The opportunity [Meta] sees is for the hundreds of millions or billions of people that are using our apps today to be able to collect digital collectibles, and for the millions of creators out there that could potentially create virtual and digital goods to be able to sell them through our platforms,” Kasriel said, adding that he thinks the firm could build its own $3 trillion economy from virtual goods over the next decade.

Last October, Mark Zuckerberg’s firm signaled its strategic pivot toward the virtual world and the digital assets economy by changing its name from Facebook to Meta to realign its brand image with its ambitions for the Metaverse. Zuckerberg later announced in March that the company had plans to bring NFTs to its photo-focused social media platform, Instagram. The company also filed five trademark applications for its payments product, Meta Pay, hinting at a potential leap into the crypto space with a Web3 wallet and cryptocurrency exchange.

Of all the household names in Big Tech, Meta has so far been the most aggressive in its embrace of the new digital collectibles economy, with Kasriel now only reaffirming the company’s stance on the issue.

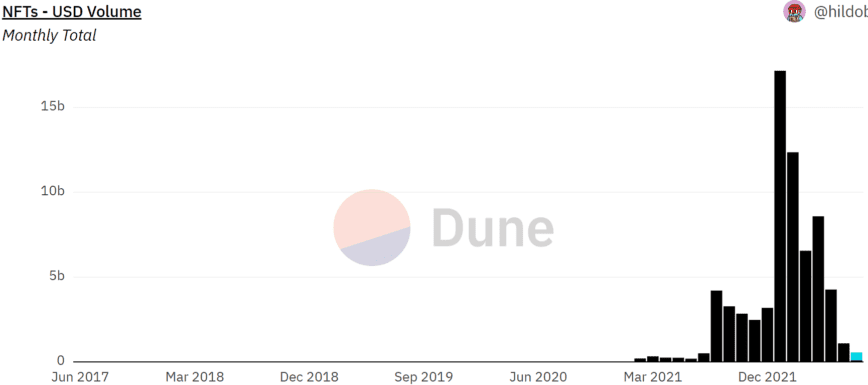

According to Dune data, the monthly NFT trading volume—a benchmark indicator for investor interest in the asset class—has fallen from its record high of $17.16 billion in January to around $1.1 billion in June. This month trading volume is forecasted to hit $460 million.

Commenting on the waning interest in the market, Kasriel acknowledged the reality of the crypto “hype cycle” and said there were “a lot of things that are not going to survive.” Despite the cyclical nature of the market, he reaffirmed that the firm is sticking with its plans to take NFTs mainstream by making them inexpensive and easy to buy and trade.

Having learned from its previous failed attempt to launch the global stablecoin called Diem, Meta is now proceeding with caution. “We’re trying to figure out what the regulatory landscape is so that we don’t invest in things that are ultimately going to become super-controversial or get shut down,” Kasriel said, adding that the company is making investments with added realism about the nascent nature of the industry and technology.

Disclosure: At the time of writing, the author of this article owned ETH and several other cryptocurrencies.