Shutterstock cover by martin_hristov

NFTs Soared in 2021. Now They’re Sinking

High-value NFT projects are falling in price as trading dries up on marketplaces like OpenSea.

The NFT market appears to be suffering from the bearish sentiment prevailing in the broader crypto and traditional markets. Trading volumes on the largest NFT marketplace OpenSea are trending down, while floor prices of many so-called blue-chip NFTs keep falling.

Blue Chip NFTs Suffer in Market Drawdown

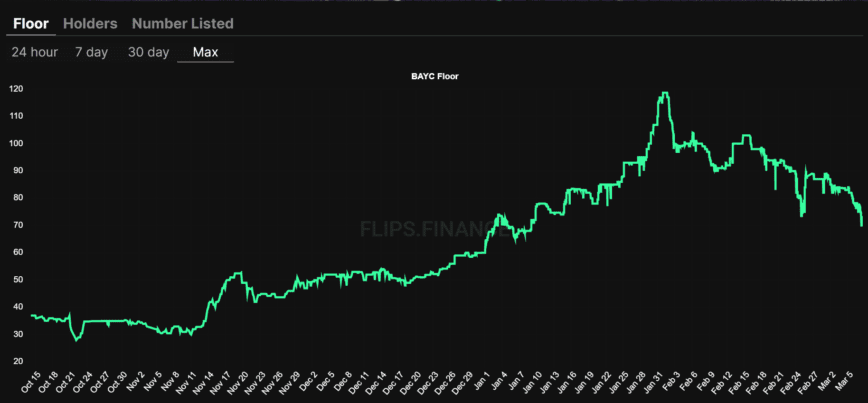

After a mainstream explosion throughout 2021 and the beginning of this year, the NFT market is bleeding in the latest crypto downtrend. The floor prices of many high-value NFTs have dipped since hitting all-time highs around the end of January.

Despite a strong start at the beginning of the year, the floor prices for most of the top blue chip NFT projects fell throughout the entirety of February. Bored Ape Yacht Club, arguably the most sought-after NFT project of all, is among the hardest hit, tanking roughly 40% in Ethereum-denominated terms since the beginning of February.

In dollar-denominated terms, the recent price action for Bored Ape Yacht Club NFTs is even worse. At the all-time high prices reached at the end of January, the cheapest JPEG from the cartoon monkey collection would’ve set buyers back 118 Ethereum worth around $436,000 at the time. The floor price for the collection today is around 72 Ethereum, or $182,000. That’s a 58% decline in dollar terms.

CryptoPunks, the second most valuable NFT project by market capitalization, hasn’t fared any better. The Larva Labs collection hit an all-time high floor price of around 123 Ethereum in October and is currently trading at around 66.5 Ethereum. As Ethereum is also down since October, CryptoPunks have lost around 60% of their dollar value.

Other in-demand, albeit newer and less-established projects like Doodles, Azuki, and Invisible Friends also experienced price drops over the last 30 days. Doodles is down to 10.35 Ethereum after hitting a high of 16.25 Ethereum, while Azuki and Invisible Friends have both also tumbled.

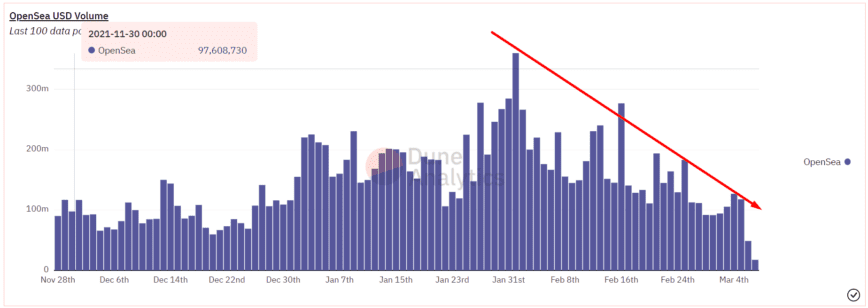

The plunge in floor prices for blue-chip NFTs also coincides with a similar reduction in trading volumes. Per Dune Analytics data, the largest NFT marketplace, OpenSea, hit a peak of $4.95 billion in volume in January, but activity slowed in February with the total volume hitting $3.5 billion.

Looking at daily volumes, the chart shows a consistent downtrend. Yesterday, for example, OpenSea saw its slowest day of trading activity over the last 100 days, with volume at around $48 million. For comparison, on Jan. 31, the best day for the marketplace over the same period, OpenSea saw almost $360 million in trading volume for the day.

The second-largest NFT marketplace and direct OpenSea competitor, LooksRare, also saw its trading volume sink in the second half of February, despite orchestrating an aggressive liquidity mining event to attract as many NFT traders to its platform as possible. The platform’s trading activity has subsided from staying consistently above $400 million in daily volume in the first half of January to an average daily volume of around $70 million over the last ten days.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.