Shutterstock cover by Vivienstock

OlympusDAO Fork Snowdog Hit By 90% Crash

Snowdog has lost over 90% of its value since the protocol’s planned token buyback.

Snowdog, a self-styled decentralized reserve meme coin, has been accused of pulling the rug on its community after crashing over 90%.

Snowdog Plummets 90%

SnowdogDAO has sent investors reeling this Thanksgiving.

The Avalanche-based OlympusDAO fork plummeted over 90% Thursday night after the protocol’s planned token buyback resulted in a huge selloff.

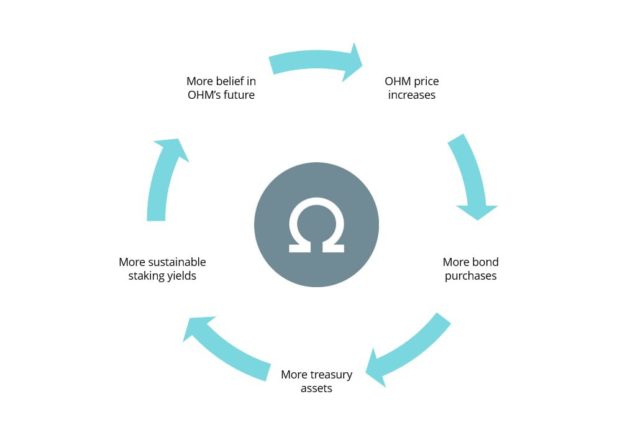

Snowdog, which styles itself as a “decentralized reserve meme coin,” allowed users to mint SDOG tokens at a discounted rate by depositing other assets as collateral. Snowdog attracted liquidity in much the same way as OlympusDAO, the first protocol to utilize the so-called “liquidity flywheel” model. In recent weeks, many OlympusDAO forks have emerged on Ethereum and other blockchains amid growing interest in the protocol.

Snowdog differed from other OlympusDAO forks in that it only planned to be active for eight days. The protocol announced on launch that it would use all of the assets in its treasury after eight days to orchestrate a “massive buyback” of Snowdog tokens ahead of transitioning into a meme coin by fractionalizing each SDOG token by a factor of one billion.

The planned buyback resulted in many holders accumulating SDOG tokens in anticipation of a substantial price increase. However, when the buyback started late Thursday, the Snowdog token instead plummeted, eventually losing over 90% of its pre-buyback value.

The price crash caused many in the Snowdog community to accuse the developers of “pulling the rug” by using the buyback to exit their positions first, leaving other investors stuck in their positions as prices crashed.

However, others have refuted this accusation, stating that the transaction data does not show any evidence of foul play.

Early Friday morning, the Snowdog team published a post-mortem report detailing why the SDOG token crashed. The developers apologised for failing to clearly state how the buyback would likely affect prices. An excerpt of the report read:

“We wanted to orchestrate an event that could capture the attention of the crypto ecosystem while procuring entertainment to people watching it from the sidelines… For the $SDOG price to be above market price before buyback (~$1200), sellers needed their $SDOG to be part of the first 7% of the supply being sold.”

With only 7% of the SDOG supply having the potential to be sold at a profit during the buyback, many holders were forced to sell below market price or face further losses, resulting in a 90% drawdown.

The post-mortem also outlined future plans for the SDOG token, detailing how the team aims to create long-term value for holders. However, many community members have declared that they have lost interest in the project following the crash. Whether the Snowdog community will be able to recover from the incident remains to be seen.