THETA’s Price Action Reveals “Free Money” Arbitrage Opportunities Across Crypto Exchanges

THETA's price exploded after launching an upgraded version of its mainnet and bringing Google Cloud on board.

Volatility is back in the cryptocurrency market, and Theta Network has been one of the primary beneficiaries. THETA’s wild price action across multiple exchanges presents different opportunities to profit.

Theta Network’s Price Action Goes Wild

Theta Network made headlines after announcing that Google Cloud would serve as a node operator and cloud provider.

As speculation mounted around Theta’s 2.0 mainnet launch, the recent news helped propel the token’s price further up.

This cryptocurrency skyrocketed over 390% since the beginning of the month. But the high levels of FOMO among market participants triggered a 50% correction over the past two days.

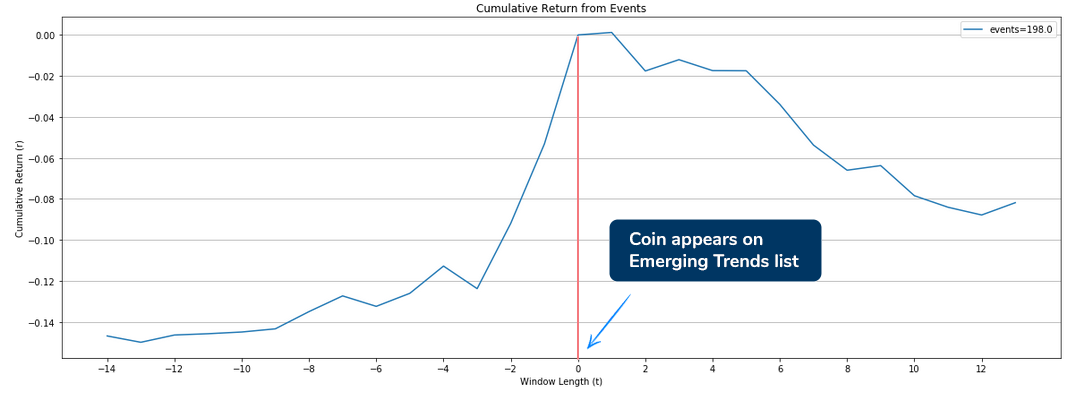

Data from Santiment reveals that a massive spike in social volume ignited the severe pullback. The upswing pushed Theta Network to the second spot in the firm’s “Emerging Trends” indicator, which is usually seen as a negative sign.

Dino Ibisbegovic, head of content and SEO at Santiment, maintains that steep declines often follow extreme spikes in a cryptocurrency’s social mentions.

As the hype begins to peak, large investors may start dumping their holdings, sparking a corrective period.

“On average, the coins that gained more than 15% in 2 weeks before appearing on the Emerging Trends list. The moment they show up on the list, the dump begins. In the second week since appearing on the Emerging Trends list, the coins we backtested have, on average, lost a massive 8% of their total price. And this is on a sample of 200 coins,” said Dino.

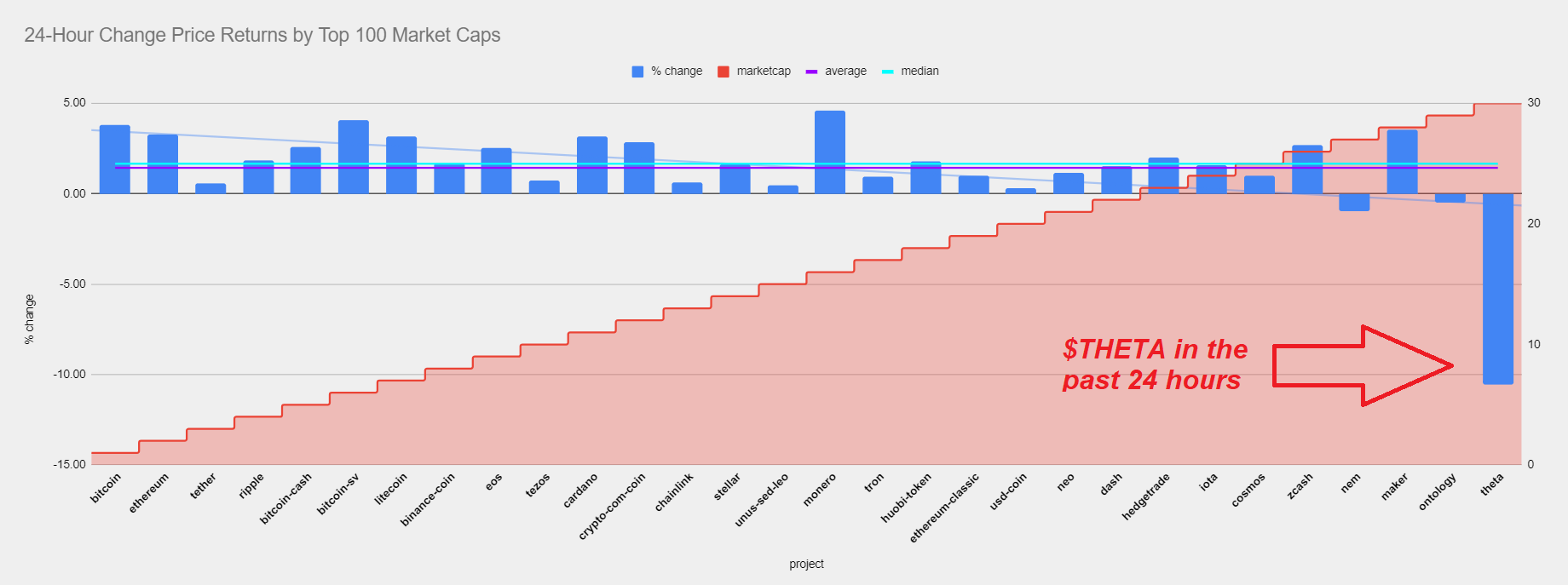

THETA’s steep correction made it the only project in the top 30 that dipped more than 1% in the past 24 hours.

Investors can interpret this as a clear sign that the token could be poised for a sharp rebound and follow the rest of the market, according to Santiment.

Although there might be a chance to profit from a potential rebound, several exchanges are reporting different prices for THETA. The price variation could open opportunities for arbitrage.

Buying Here, Selling There

A look at Binance, OKEx, and Huobi shows that Theta Network’s price is quoted differently across these cryptocurrency exchanges. The current spread between Binance and Huobi is around $0.07, while OKEx and Huobi have a spread of $0.05.

Investors who buy $10,000 worth of THETA in Binance for $0.32, for instance, could transfer it to Huobi and sell it for $0.37. Through this simple operation, one can net an easy $1,500.

Mitchell Dong, managing director of Pythagoras Investment Management, maintains that this type of trading strategy is essentially a “license to print free money.”

Since an asset can be bought for a nominally low price and sold somewhere else for higher, it is a quick and easy way to make returns.

Nonetheless, the best gains are made with large sums of money put on the line. And nothing guarantees that there will be enough demand to sell all tokens at a profit or that the wide margin in price will remain the same.

Arbitrage is a well-known and established trading technique in both crypto and traditional financial markets.