Free Money: How Crypto Arbitrage Made Firms Millions Last Week

Share this article

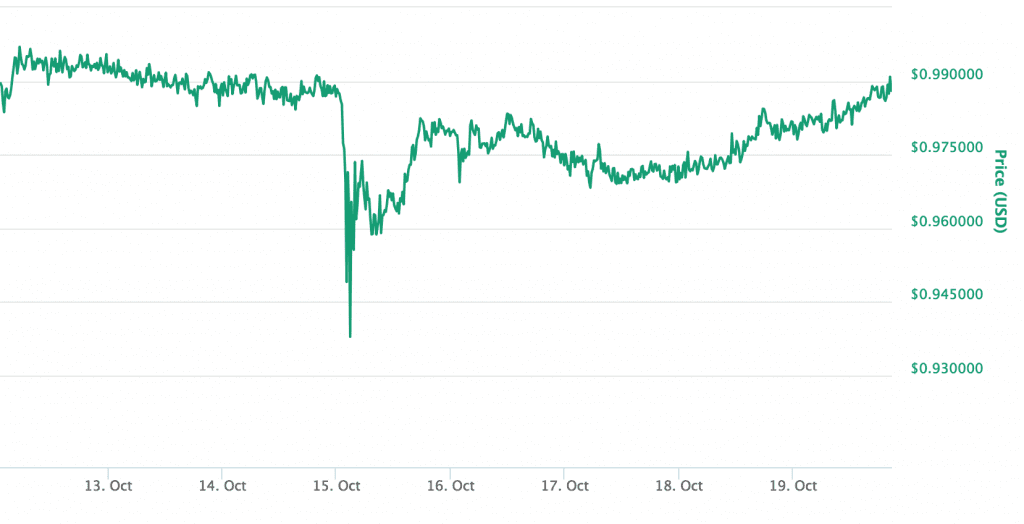

The market started feeling a little queasy last week. The Tether (USDT) price had unaccountably lost its peg to the US dollar. Different exchanges were reporting different prices, but some were going as low as $0.85 per token.

Some worried that the multi-billion dollar stablecoin was on the verge of liquidation, but it didn’t come to that. At the time of writing, Tether was nearing parity again with the US dollar. Fears over a sudden meltdown have been allayed, for now anyway.

But where most smelt fear, some saw an opportunity. Individuals from the private finance world began to buy up as much USDT as they could, paying bottom prices from panicky USDT holders who wanted out, fast. Exploiting the widening disparities between the exchanges, these guys sold their discounted Tether anywhere quoting a higher price.

In the space of a week, they used basic crypto arbitrage to make millions in pure profit.

Tether price drop: a crypto institutional opportunity

Mitchell Dong is the Managing Director of Pythagoras Investment Management. Based in New York City, he’s spent the last 13 years investing in hedge funds and private equity; he also develops quant models for trading cryptocurrency in Asia, Europe, and North America.

Dong explained to Crypto Briefing that Pythagoras began buying Tether early on Monday morning (ET). At around 2 AM local time, he noticed the range between USDT prices quoted on different exchanges was widening. With a team of six spread across North America and Asia, he alerted the Singapore based team and instructed mass purchases of USDT, using Bitcoin (BTC).

“Some people say they saw as low as $0.86. but the lowest I ever saw was $0.88,” Dong said. “We would buy from low and convert it quickly over to Bitfinex to sell”.

Although Pythagoras buys the underlying asset, it hadn’t bought Tether until last week. It had focused instead on the new stablecoins including True USD (TUSD), the Gemini and Huobi Dollar (GUSD; HUSD), as well as the Pax Standard Token (PAX). They made a lot of money, but Dong wouldn’t give an estimation of just how much they made in a week.

Pythagoras wasn’t the only firm that spotted this opportunity. One trader, who asked that himself and his firm remain anonymous, described how one entire team devoted the whole of last week to exploiting the Tether price disparity. “A $0.15 spread across the market is a wide margin”, he said. “We were essentially given a license to print free money.”

Crypto Arbitrage

Arbitrage is a well-known and established trading technique, not just in crypto but also within mainstream financial markets. If you can buy an asset for a nominally low price and sell it somewhere for higher, it’s a quick and easy way to make returns. A no-brainer.

But not everyone agrees. Simon Tobelem from ARIE Capital, a UK-based venture capital firm, felt such tactics brought the sector into disrepute. His main fear was it could harm relationships with regulators and the established players.

He pointed out that the authorities were already starting to crack down on many of last year’s non-compliant ICO projects. “Quick profiting is the type of behavior regulators are particularly worried about”, he explained. “It’s not like the Wild West, actors need to behave”,

“[Arbitrage] is great if the only objective is to keep crypto a very tiny industry, with a small number of players pulling all the strings, but it won’t go any further; it will put off the mainstream”, he added.

Dong disagreed. He said that there was a legitimate place for arbitrage within the sector, as it created incentives to buy and sell tokens, keeping the market liquid. He also suggested that it would close the price disparity between the different exchanges.

Although simple, crypto arbitrage is exclusive. Theoretically, anybody can do it, but the returns will probably be negligible at the scale most retail investors operate at. This is a game played by the institutions, for the institutions.

The rest of the market is left nervously holding their tokens, waiting for the prices to stop fluctuating.

The author is invested in BTC, which is mentioned in this article.

Share this article