Shutterstock cover by el_cigarrito

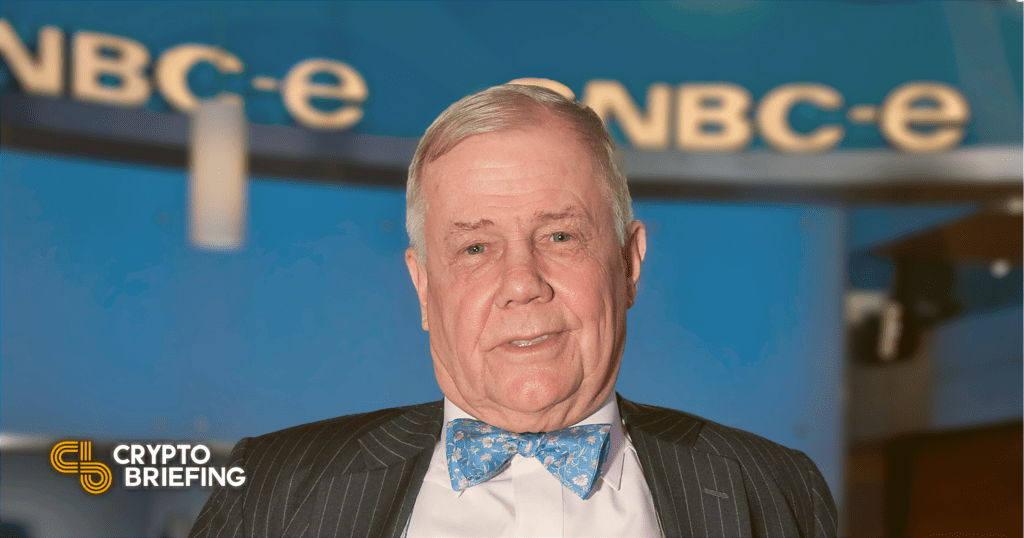

Veteran Investor Jim Rogers Regrets Not Buying Bitcoin, Fears Regulation

Veteran investor Jim Rogers regrets not buying Bitcoin early.

“I wish I had bought Bitcoin,” said 78-year old investment manager Jim Rogers as he suggested a bubble in stocks and bonds.

Key Investment Takeaways From Jim Rogers

Jim Rogers, the co-founder of the Quantum Fund and Soros Fund Management, which holds $5.2 billion assets under management, said that stock and bond markets are in a bubble.

According to him, too many people are getting involved with stocks; making money via stock investment has become “easy and fun,” which is an alarming signal. He added:

“This isn’t my first rodeo. I’ve seen this movie before.”

To Rogers, Chinese stocks are more interesting because they’re cheaper and quick rehabilitation from the coronavirus pandemic.

Rogers predicts that gold and silver will go through the roof and said that he owns gold.

The hedge fund mogul expressed regret for not buying Bitcoin early. He sees a unilateral focus on Bitcoin in cryptocurrencies among many that “have disappeared and gone to zero.”

Citi bank’s analysts recently stated that Bitcoin has reached a “tipping point” and could soon become the currency for international trade. Rogers reiterated similar ideas, however, added that:

“If Bitcoin ever becomes a viable currency instead of a trading vehicle, they can outlaw it. Governments don’t want to lose control; they like their monopoly.”

Interestingly enough, Dr. Michael Burry of “The Big Short” fame had also echoed the regulatory concerns around Bitcoin’s mainstream adoption in a now-deleted tweet.

Disclosure: The author held Bitcoin at the time of press.