Will Chainlink Bounce Back From Its Slump? Major Supply Wall Ahead

Chainlink is up 10% in the past two days as it tries to make a comeback after its price took a 23% nosedive.

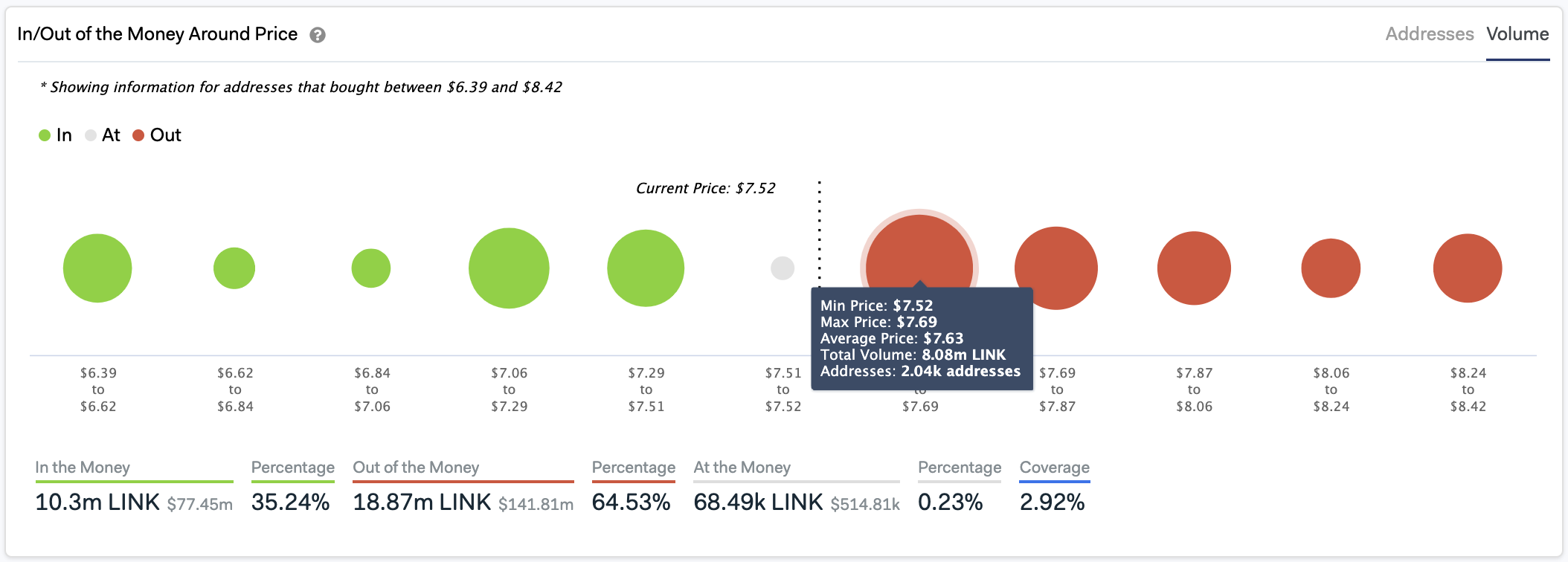

Chainlink is recovering after a steep correction, but data shows a giant supply wall ahead that will pose problems for bulls.

Chainlink Tries to Resume Uptrend

After reaching a new all-time high of nearly $9 on July 15, Chainlink took a 23% nosedive. The bearish impulse appears to have been triggered by whales which took advantage of the price action. As a result, LINK dropped to a low of $6.9, but this support level was strong enough to send it back above $7.4.

From a technical perspective, it seems like the 23.6% Fibonacci retracement level held the decentralized oracles token from a steeper decline. Meanwhile, the TD sequential indicator presented a buy signal on LINK’s 12-hour chart, which may have been confirmed by the recent upward pressure.

This bullish formation developed in the form of a red nine candlestick. The TD setup estimates that Chainlink is now bound to rise for as many as four 12-hour candlesticks, but there is a massive supply barrier ahead of this altcoin that may reject its price from a further advance.

Indeed, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that over 2,000 addresses had previously purchased more than 8 million LINK between $7.5 and $7.7. This crucial supply wall may have the potential to hold in the event of an upswing. Holders within this price range will likely try to break even in their long positions if prices continue to rise.

Under such circumstances, the mounting sell-side pressure could push Chainlink below the 23.6% Fibonacci retracement level. Moving past this support level would likely see LINK plummet towards the next considerable hurdle represented by the 38.2% Fibonacci retracement level that sits at $6.

Around this price level, the IOMAP cohorts show that nearly 13,000 addresses bought over 21 million LINK. Such a significant supply barrier may have the ability to hold and allow Chainlink to rebound towards higher highs.

It is worth mentioning that Chainlink’s market value seems to correlate with the activity of addresses holding 10,000 to 100,000 LINK. Each time the number of these large investors increases, LINK prices tend to follow. Conversely, the altcoin’s price slumps as the number of large holders decline.

Sidelined investors trying to get back into the market should pay close attention to Santiment’s holder distribution chart. Looking at the activity of whales has proven to provide great opportunities to enter and exit long positions on Chainlink.