After Reaching All-Time Highs, Chainlink Poised for Fresh Losses

The decentralized oracles token, Chainlink, made headlines this week after rising to new all-time highs. Now, it looks like LINK is in for a correction.

Key Takeaways

- Chainlink surged to a record high of $8.5 after nearly $1 billion were injected into LINK.

- Despite the massive gains posted, LINK looks bound for a steep correction.

- One of the most significant support barriers underneath this token sits at $6.50, which may have the ability to hold.

Share this article

After reaching new all-time highs, Chainlink’s native LINK token recently suffered a significant pullback. Now, according to different metrics, the mooning token looks like it will continue dropping.

Chainlink Rises to New All-Time Highs

Chainlink stole the crypto spotlight after surging to new all-time highs on Monday. Once the decentralized oracles token entered price discovery mode on July 5, the buying pressure behind it skyrocketed.

Data reveals that nearly $1 billion were injected into this cryptocurrency. The massive buying pressure behind it led to a 72% upswing in a matter of seven days. Chainlink went from breaking above early March’s high of nearly $5 to hit a record high of $8.5.

LINK’s meteoric price action did not go unnoticed, either. The number of Chainlink-related mentions on social media increased as investors entered a state of FOMO.

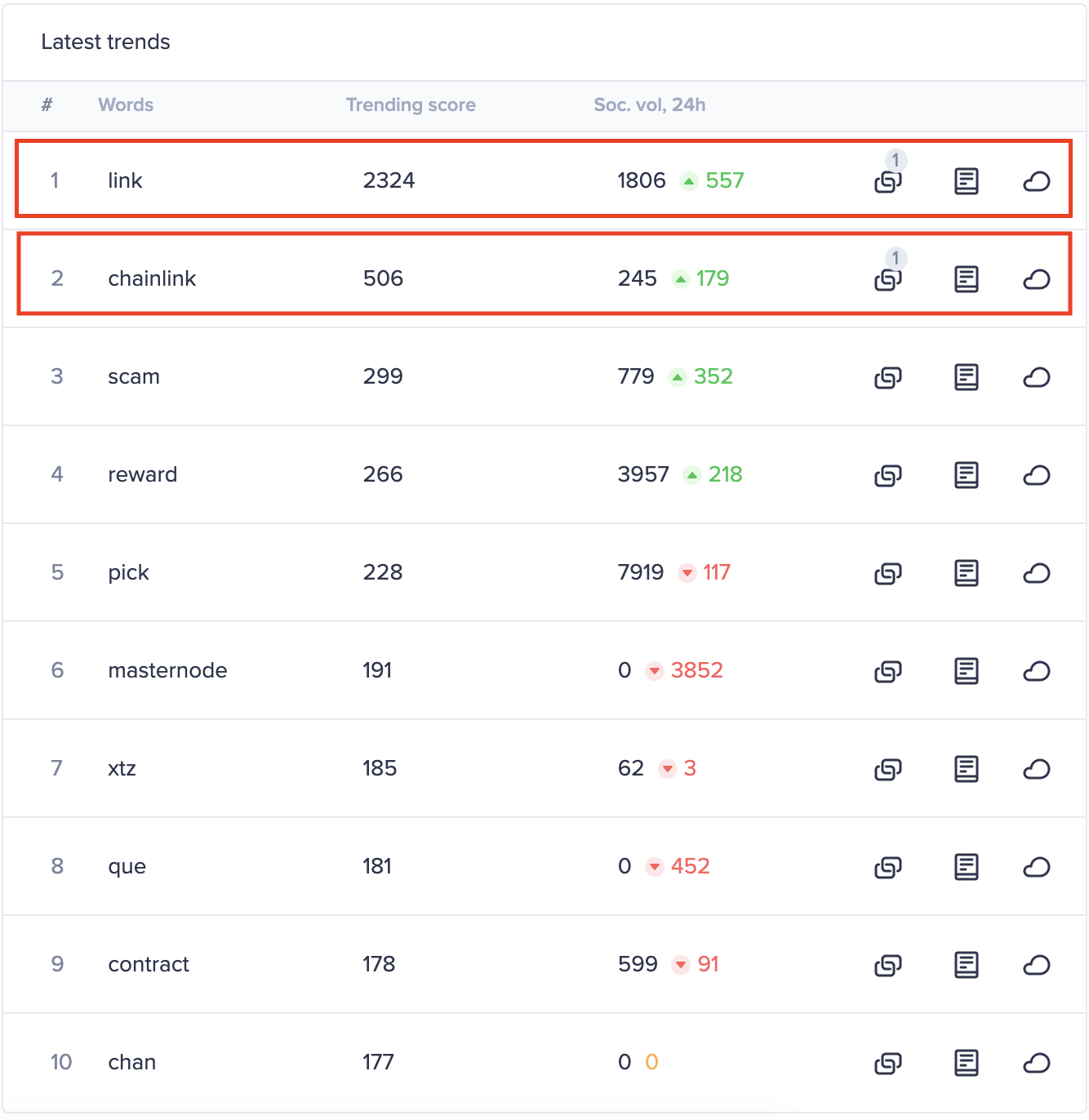

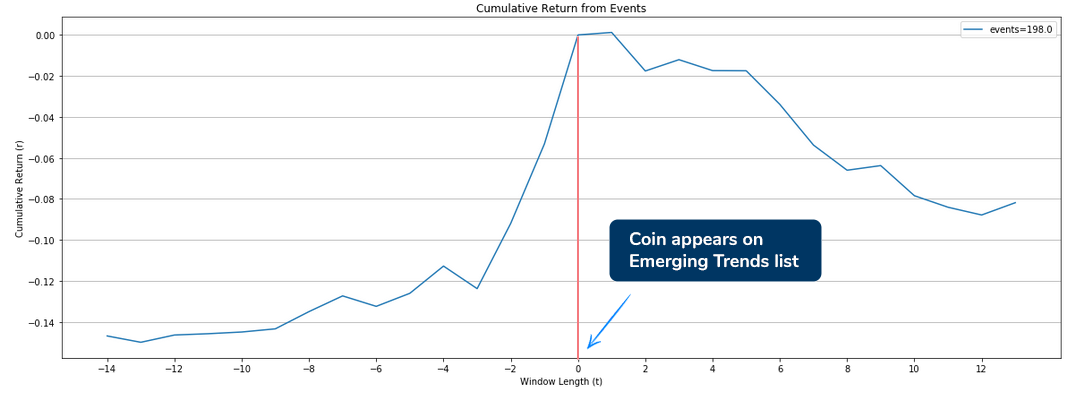

The rising chatter around this cryptocurrency allowed it to move to the top of Santiment’s Emerging Trends list, which is a historically negative sign.

Dino Ibisbegovic, head of content and SEO at Santiment, maintains that when the crowd pays increased attention to a given cryptocurrency because of an ongoing pump, it is usually followed by a pullback.

“Within the next 12 days after a coin claims a top 3 position on our list of Emerging Trends, its price drops by an average of 8.2 percent. Based on our study, once the increased crowd attention subsides (which usually happens in a matter of hours/days), a short-term price correction – or consolidation – is often a likely outcome,” said Ibisbegovic.

Indeed, Chainlink reached an exhaustion point after investors became overwhelmingly bullish about LINK’s price action. This altcoin took a 19.8% nosedive over the past few hours to hit a low of $6.85, but it managed to bounce back above $7.

A Steep Correction Ahead

Now, the TD sequential index estimates that there are more losses to come.

This technical indicator is currently presenting a sell signal in the form of a green nine candlestick on LINK’s 3-day chart. The bearish formation forecasts a one to four candlestick correction before the continuation of the uptrend.

Given the TD setup’s accuracy to time local tops on Chainlink’s trend, the current sell signal must be taken seriously despite the losses already incurred.

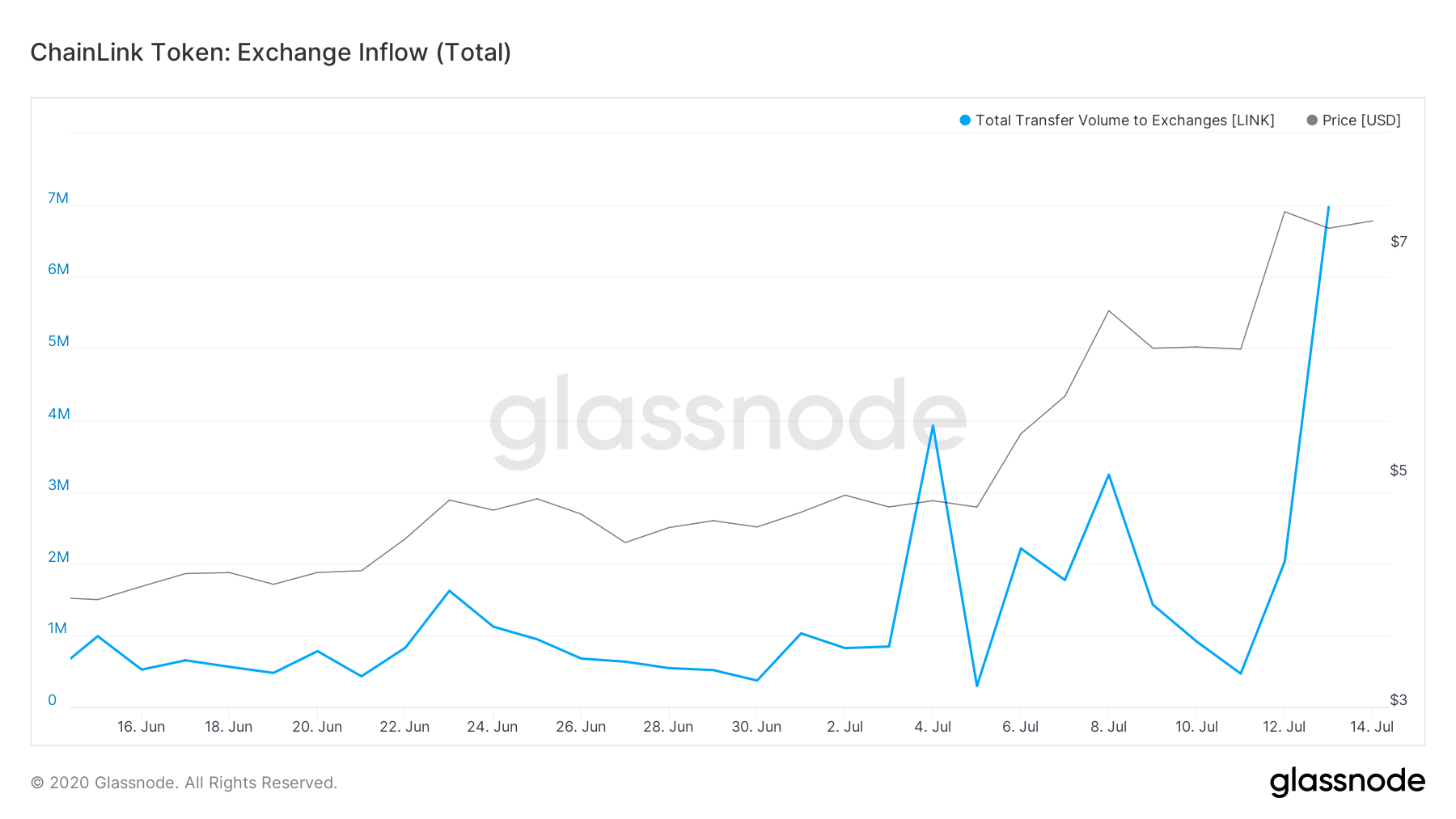

When looking at activity across top cryptocurrency exchanges, this thesis holds.

Glassnode, an on-chain data and intelligence platform, reveals that nearly $7 million worth of LINK tokens have been transferred to different exchanges over the last 24 hours.

The considerable spike in the number of tokens transferred to exchanges can be considered a sign of mounting selling pressure behind LINK.

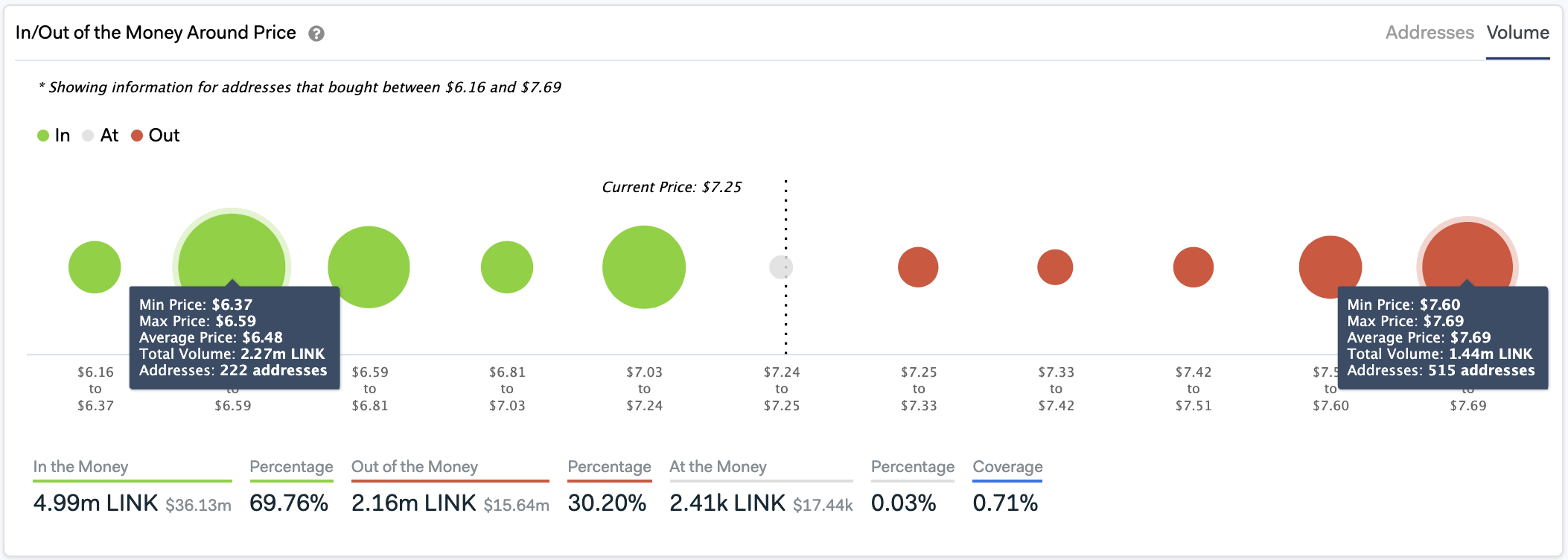

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) shows that the $6.5 support level may have the ability to hold in the event of a sell-off. Roughly 222 addresses had previously purchased over 2.27 million LINK around this price level.

This critical supply wall could prevent Chainlink from a steeper decline since holders within this price range will try to remain profitable. They may even buy more LINK to avoid seeing their investments go into the red.

It is worth remembering that Chainlink is currently in price discovery mode, so the probability of a further advance cannot be taken out of the question.

If buy orders begin to pile up, this cryptocurrency may rise towards the next significant resistance barrier sitting at $7.7. Here, the IOMAP cohorts indicate that 515 addresses bought over 1,400 LINK.

Moving past this hurdle could send Chainlink to re-test the recent high of $8.5 or make new all-time highs.

Share this article