Photo: CNN

Binance Faces SEC Scrutiny Over 2017 BNB Coin Offering

The Securities and Exchange Commission is investigating whether Binance broke securities laws with its 2017 BNB coin offering.

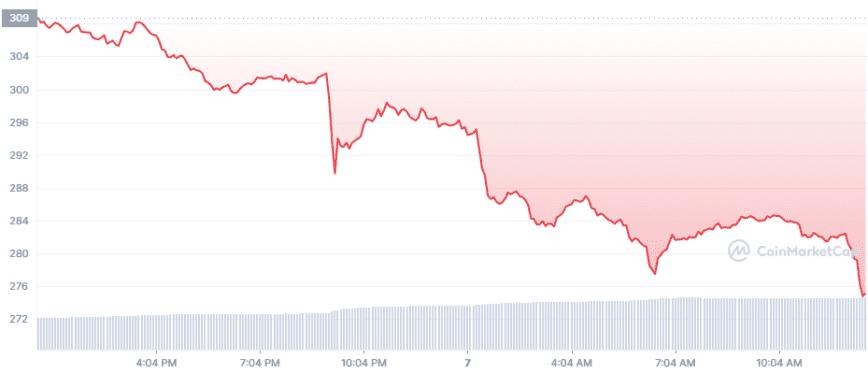

BNB has fallen 8.5% since the news first surfaced.

Binance Hit by SEC Investigation

The Securities and Exchange Commission is investigating Binance over its BNB initial coin offering.

Per a Monday Bloomberg report, Binance Holdings Ltd. is facing an investigation from the SEC over whether the firm’s initial coin offering amounted to the sale of a security. According to people familiar with the matter, the SEC’s probe aims to ascertain whether BNB should have been registered with the agency before being offered to U.S. citizens for purchase in 2017.

Since the news broke late last night, Binance’s BNB has traded down with the broader crypto market. The exchange’s flagship coin has lost around 8.5% of market value and currently trades at around $275.

In a statement commenting on the news, Binance neither confirmed nor denied that it was under investigation from the SEC, stating that “it would not be appropriate for us to comment on our ongoing conversations with regulators, which include education, assistance, and voluntary responses to information requests.”

The alleged SEC probe would not be the first time Binance has come under scrutiny from U.S. regulators. In March 2021, the Commodity Futures Trading Commission began investigating Binance to determine whether the exchange had illegally facilitated trading for U.S. residents. Two months later, the exchange faced further investigations from the Internal Revenue Service and the Department of Justice over money laundering and tax evasion matters.

Just yesterday, Binance became embroiled in yet more controversy after a Reuters investigation accused the exchange of turning a blind eye to more than $2.35 billion worth of money laundering between 2017 and 2021. Representatives from Binance have since responded to the money laundering claims calling them “skewed” and stating that they “disregard facts to get an agenda across.”

Although the SEC’s investigation into Binance’s initial coin offering seems all but confirmed, BNB’s relative stability may indicate that the crypto market isn’t particularly concerned. This is likely due to the SEC’s ongoing case against Ripple, which claims the XRP coin is a security rather than a commodity. Although the Ripple case has not yet concluded, the current consensus is that the SEC will likely lose, and XRP will not be deemed a security. If this scenario does indeed play out, it will set a powerful precedent that similar crypto coins should also be viewed as commodities instead of securities.

Disclosure: At the time of writing this piece, the author owned ETH and several other cryptocurrencies.