As Bitcoin Prepares For A Polar Plunge Below $9k, Traders Look For Silver Lining

The market has a full bear breakdown on its hands.

Cryptocurrency markets are in the midst of a significant sell-off, with top digital assets losing over five percent in value over the past twenty-four hours. As the Bitcoin price has now fallen through two key support levels, analysts are predicting further losses, with BTC likely to fall below $9,000.

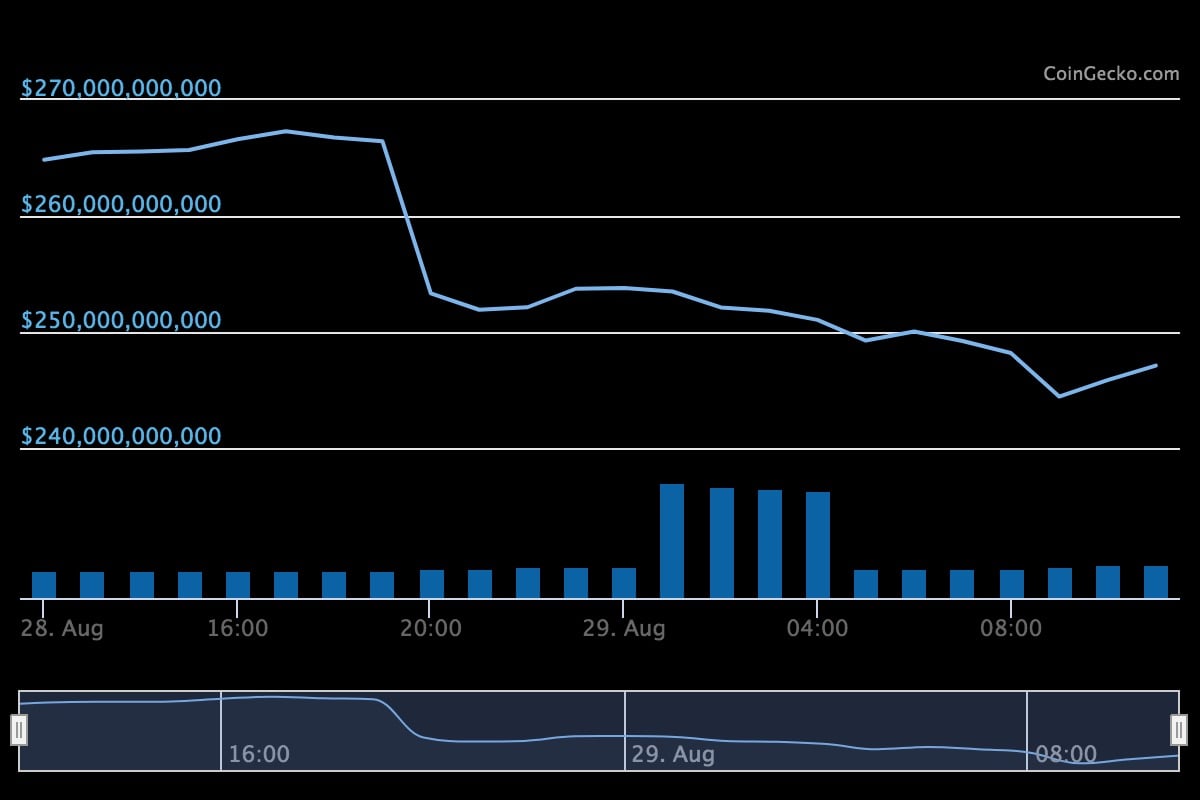

Cryptocurrencies experienced a sharp drop at around 18:00 BST Wednesday, taking crypto’s total value down by more than $20bn. The market cap stood at $245.8bn at press time, down 7.5% from its valuation just before the sell-off.

Explanations for the market plunge are mixed. Some suggest it may be a reaction to Bakkt opening deposits next week.

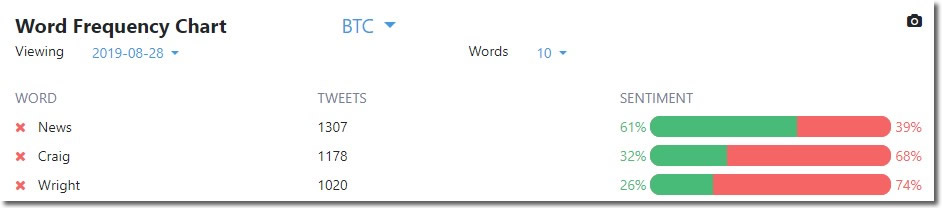

Others believe that it could be due to concerns surrounding China’s cryptocurrency, or rumors surrounding Craig Wright’s $5bn court loss. That may sound unlikely, but Twitter was alight yesterday with the news – and the vast majority of sentiment around it was negative. In fact, two of the words most commonly-mentioned in association with Bitcoin yesterday were ‘Craig’ and ‘Wright’, according to TheTie.

But Bobby Ong, COO of crypto data site CoinGecko, believes the drop is a technical move. “Bitcoin has been trading in a very tight range for the past few days,” he explained in an email. “Most technical indicators are suggesting that price will fall and today it breached the 10k support and has further breached the $9.6k support level.”

“We may expect further price drops in the near future,” he added. A bear breakdown could take the Bitcoin price below $9,000 and spell the end of a rally which has continued without interruption since the start of April.

Technical Analysis: Nathan Batchelor on Bitcoin

Bitcoin finally made the much-anticipated drop under the $10,000 level that many indicators have been flagging for the last few days, with the decline so far extending down towards the $9,300 technical area. Aside from the bearish head and shoulders pattern and negative weekly MACD that recently formed, the trigger behind the actual the move is intriguing for a variety of reasons.

According to data from the CME exchange, a total of fifty percent of all Bitcoin CME futures contracts are scheduled to expire this week. Yesterday alone, we saw a grand total of $144 million Bitcoin longs being liquidated on the BitMEX exchange.

Yesterday, the number of Bitcoin futures contracts traded on a monthly basis had risen by 132 percent against the same period last year. So it is certainly fair to suggest this could have been the main catalyst for yesterday’s decline.

Where does Bitcoin go from here ? The technicals once again are telling the story before it unfolds. If Bitcoin breaks below the $9,260 level it will signal a major triangle breakout on the daily time frame, and we should expect a test of Bitcoin’s former monthly trading low, at $9,100.

If the $9,100 level is broken, it really sets a bearish precedent going into September, because it will then signal the second consecutive monthly close lower for the cryptocurrency.

Bitcoin’s 21-week EMA, at $8,970, is then the only notable form of technical support prior to the $8,000 level.

On the flipside, a false break under the $9,260 level and failure to take out the July monthly low and Bitcoin bulls could easily force price back up towards the $10,000 level. So all to play for going into the U.S session.

SENTIMENT

Intraday bullish sentiment for Bitcoin is extremely weak, to 23.00%, according to data from TheTIE.io – while the long-term sentiment indicator remains steady, at 69.10 % positive.

UPSIDE POTENTIAL

The sudden drop in Bitcoin on Wednesday has created a few pockets of untested demand, at $9,600 and $9,720. The 5-minute time frame also highlights notable areas of yet untested demand around the $9,900 and $10,100 levels.

Bulls ideally need to move price above the former monthly trading low, at $9,450 to reduce technical pressure. Any sustained moves above the former weekly trading low, at $9,750 and the BTC/USD pair could easily start to regain the $10,000 level.

DOWNSIDE POTENTIAL

The downside potential is huge for Bitcoin if bulls can take-out the $9,100 level and storm past the 21-week exponential moving average just below. As I previously noted, technical support is extremely limited until the $8,000 level and even then I see that as just a temporary stop before the $7,300 to $7,100 area is tested.

In the near-term, traders will be watching the triangle pattern on the daily time frame, it really is a big deal for technical analysts and something to monitor closely during today’s U.S session.

Déjà Vu

The market has been here before. Bitcoin moved within an equally tight range back in October, with support around $6,300. Many traders placed sell-orders beneath this level, which caused a cascading sell-off when they executed in mid-November. The sell-off ultimately halved the BTC price.

As Crypto Briefing has previously argued, BTC tends to follow a trend of extended periods of relative stability followed by periods of significant volatility. November was one such example, and so was the initial ‘Bitcoin boom’ in early April when BTC rose above its $4,200 resistance level.

The market may be about to enter a period of price correction. In a note seen by Crypto Briefing, Ajay Patel, Head of Sales at crypto brokerage firm GlobalBlock, suggested that the market was looking for a “corrective target between $7,500/8500”.

As the chart below highlights, the Bitcoin price could continue to fall for the next couple of weeks before regaining ground again towards the end of September.

“If you’re fundamentally bullish,” Patel concluded, “[there’s] suggestion that anything under $10k represents reasonable value longer term.”

Every bear has a silver lining, right?

Daily Bitcoin Analysis is delivered to SIMETRI Research subscribers earlier in the day along with Nathan’s calls. For more information, click here.