Bitcoin Primed to Consolidate Before Price Movement

Bitcoin seems stable after a high volatility period without clarifying where it is headed next.

Key Takeaways

- Bitcoin’s aSOPR indicator has reset, providing a bullish signal.

- However, the cryptocurrency also faces stiff resistance ahead that may keep rising prices at bay.

- Only a 4-hour candlestick close outside of the $31,000-$33,500 range will determine where Bitcoin is headed next.

Share this article

Bitcoin remains dormant after experiencing a high volatility period. While some on-chain metrics have begun to turn bullish, the technicals point to more consolidation ahead.

Bitcoin Presents Ambiguous Outlook

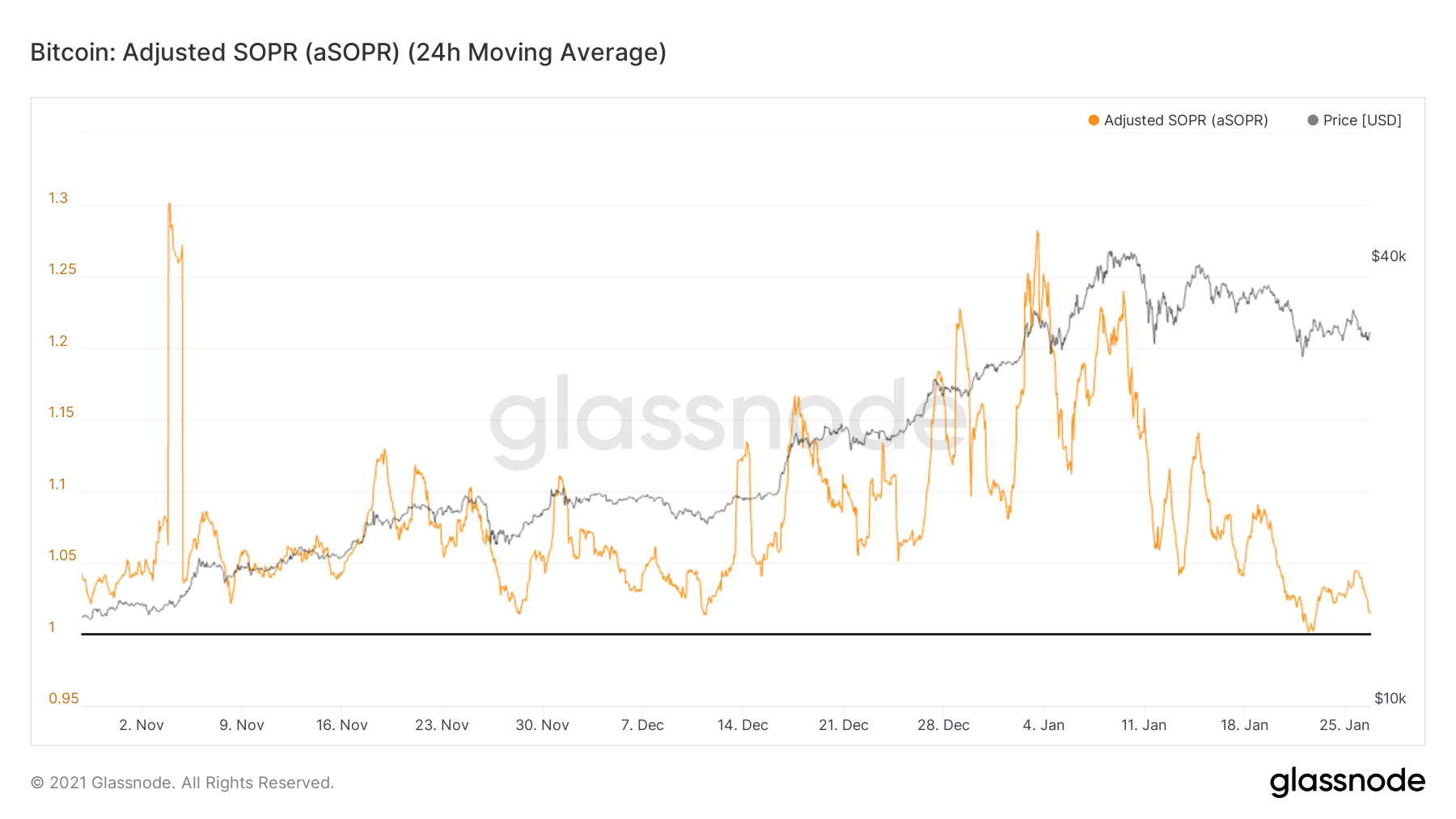

With Bitcoin’s impressive bull run to a new all-time high of $42,000 on Jan. 8, the Adjusted Spent Output Profit Ratio (aSOPR) indicator rose to a value of 1.28. The behavior seen in this on-chain metric suggested that BTC’s uptrend had reached exhaustion.

What came next was a 31.60% pullback that pushed Bitcoin’s market value below $29,000.

According to Glassnode, Bitcoin’s downward price action helped the aSOPR reset for the first time since mid-December 2020, indicating that the recent corrective period has come to an end.

“Bitcoin’s aSOPR has reset… [meaning] that coins moving between investors per hour (24h MA) are, on average, no longer being sold at a profit,” Glassnode suggests. “In order for SOPR to go lower, investors would have to be willing to sell at a loss, which is unlikely given the current shape of the market.”

Nonetheless, Bitcoin continues to consolidate within a descending triangle on the 4-hour chart.

From a technical perspective, the recent reset of the aSOPR index may help Bitcoin rebound from the triangle’s x-axis to the hypotenuse at $33,500. But due to the significant resistance ahead, rejection may occur, pushing BTC back to the $31,000 support level.

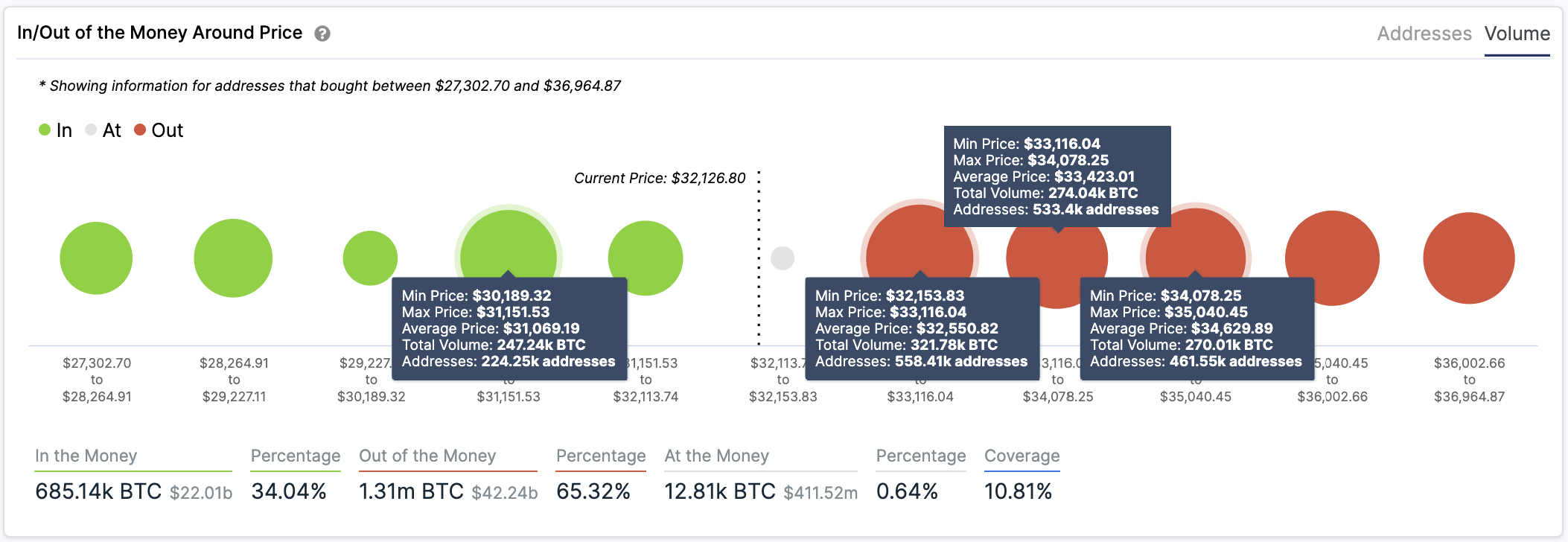

The thesis about further consolidation holds when looking at IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model.

Based on transaction history, roughly 1.40 million addresses had previously purchased over 860,000 BTC between $32,550 and $34,630. Such a significant supply barrier may have the strength to keep Bitcoin’s rising price action at bay.

It is worth noting that while resistance seems stiff, support looks weak. IOMAP cohorts show that the most significant demand wall underneath Bitcoin sits at $31,000. Here, approximately 224,000 addresses are holding nearly 250,000 BTC.

Therefore, only a 4-hour candlestick close above or below the $31,000-$33,500 range will determine where Bitcoin prices are headed next.

Moving past the overhead resistance could see it reclaim $40,000 as support and lead to higher highs. Meanwhile, slicing through the underlying support could trigger panic selling among investors pushing Bitcoin’s market value towards $22,500.

Disclosure: At the time of writing, this author held Bitcoin and Ethereum.

Share this article