Parroting The Negative: Bitcoin Volume Pushing Up The Daisies

Volume is hitting lows even on LocalBitcoins.

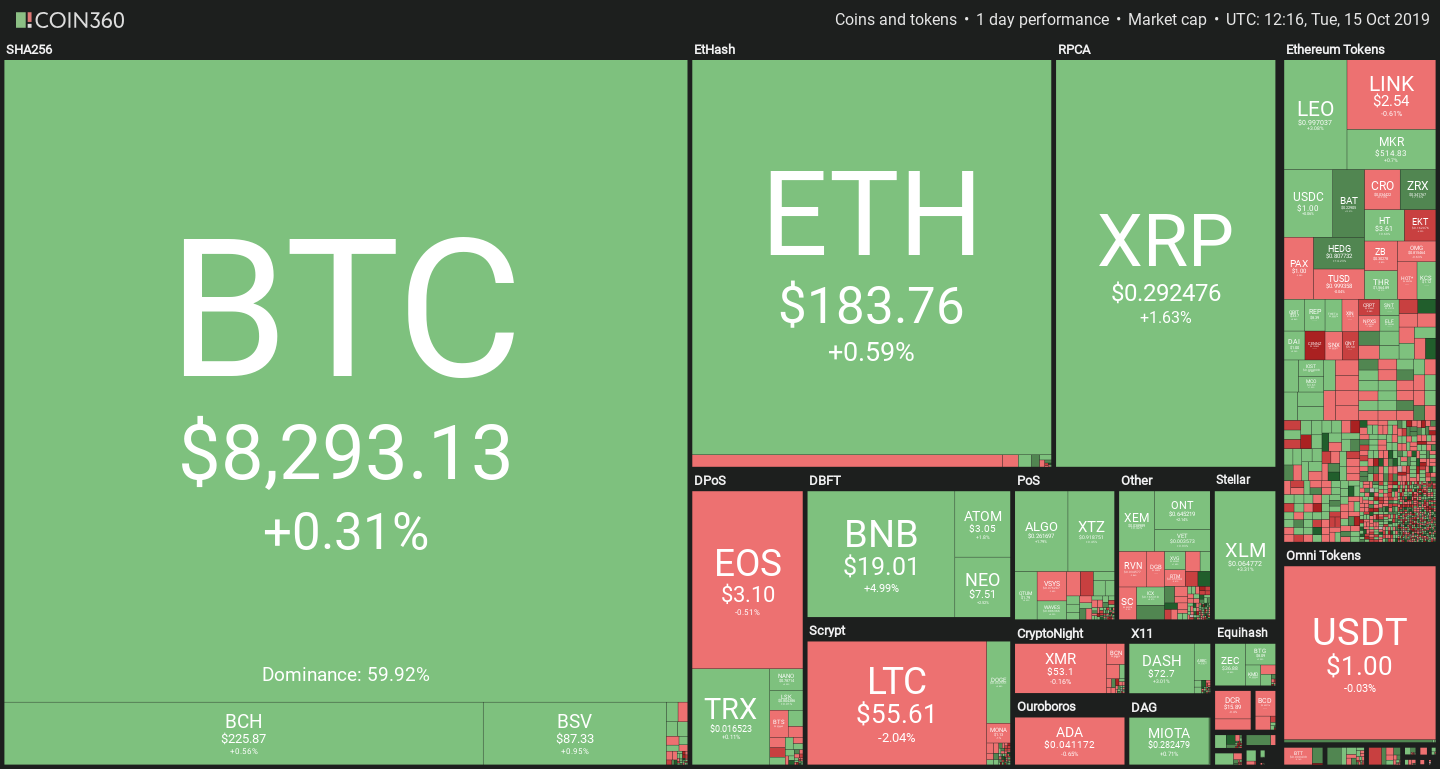

Bitcoin remains stagnant today, still trading within a few points of the $8,300 level. Diversification in altcoins continues, with most of them showing little action. Exceptions are BNB (up 4.5%), BAT and 0x (both up 12.5%), while Litecoin is one of the low performers with -2%.

Binance Coin’s rise could be easily attributed to today’s news of a partnership with Amun, which launched a BNB Exchange Traded Product. An API update allowing multi-network withdrawals for interoperable tokens provided the colloquial cherry on top.

Bitcoin’s volume is plummeting

As highlighted by eToro Senior Analyst Mati Greenspan in a Twitter thread, BTC volume is posting new lows across the board. Volume on reputable exchanges has fallen below $200M, Bakkt’s performance fell to a dismal 6 BTC in contracts, while LocalBitcoins volume is also contracting.

On the top 10 exchanges, bitcoin has traded less than $200 million. This is from data compiled by @MessariCrypto. During the peak a few months back, this number easily reached $4 billion. pic.twitter.com/7FsNBZpivA

— Mati Greenspan (@MatiGreenspan) October 15, 2019

Greenspan concluded the thread with a bittersweet statement. “Yes, this is a giant lull in crypto volumes across the board,” he acknowledged. “Let’s not forget though that bitcoin is one of the best performing assets this year. After all this action a period of stabilization is more than welcome. Bitcoin is not dead. It’s just resting.”

The reference to the Norwegian Blue may not instill confidence in traders, however. Sideways trading situations tend to result in violent breakouts, as the November 2018 dump and April 2019 pump show.

In both scenarios, bitcoin volume was at rock bottom in the periods preceding the breakouts. In particular, the November 2018 fall was anticipated by a gradually dampening volume that culminated in a week-long yearly low. In short, falling volume seems to be an additional compounding effect to the falling sentiment and negative technical indicators outlined yesterday by Crypto Briefing.

But falling indicators could also be the preamble for a large bear trap, where the asset goes against what most signals would suggest.

Bitcoin Commentary With SIMETRI’s Nathan Batchelor

After briefly trading above the $8,400 level on Monday, Bitcoin is now starting to consolidate under the $8,300 level.

The four-hour time frame is showing that a short-term technical breakout is looming, with the narrowing bollinger bands highlighting that a sustained move away from the $8,420 to $8,230 price range should decide the next directional move.

According to technical indicators on the daily time frame the next directional move is likely to be to the downside. The Balance of Power indicator is showing that sellers are still in control, while the daily RSI indicator is still technically bearish.

It is also worth remembering that the overall trend is still bearish, so further BTC/USD intraday weakness should be expected. The fact that Bitcoin has spent nineteen consecutive days below its 200-day moving averages further underscores this fact.

The daily time frame is currently showing that the $7,930 level is the likely intraday bearish target if we see the BTC/USD pair breakout under the $8,230 level today.

If the BTC/USD pair fails to attract buying interest from the $7,930 level it is possible that the sellers will attack towards the current monthly price low. A break of the monthly price low could see the cryptocurrency falling toward the $7,400 to $7,500 support region.

* ‘Bitcoin is likely to come under technical selling pressure this week while trading below the $8,280 level’.*

SENTIMENT

Intraday bullish sentiment for Bitcoin remains stable, at 58.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is slightly lower, at 61.20%.

UPSIDE POTENTIAL

The four-hour time frame is showing that buyers need to move price back above the $8,420 level today to encourage technical buying towards the $8,550 level.

The daily time frame is currently showing that the BTC/USD pair’s 200-day moving average is located around the $8,750 level. The BTC/USD pair’s former weekly trading high and the $9,300 level currently offer the strongest forms of resistance above.

DOWNSIDE POTENTIAL

Looking at the downside for the BTC/USD pair, sustained weakness below the $8,280 level is likely to encourage short-term sellers to test towards the $8,230 level.

The $7,930 level is likely to come into focus if we see the $8,230 level broken today. Once below the $7,930 level, the $7,715 support level is key, with the $7,400 level the strongest form of technical support below.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.