Should We Fear The Bitcoin Death Cross? Plus, 0x Price Drivers

Death cross? More like meh cross.

Share this article

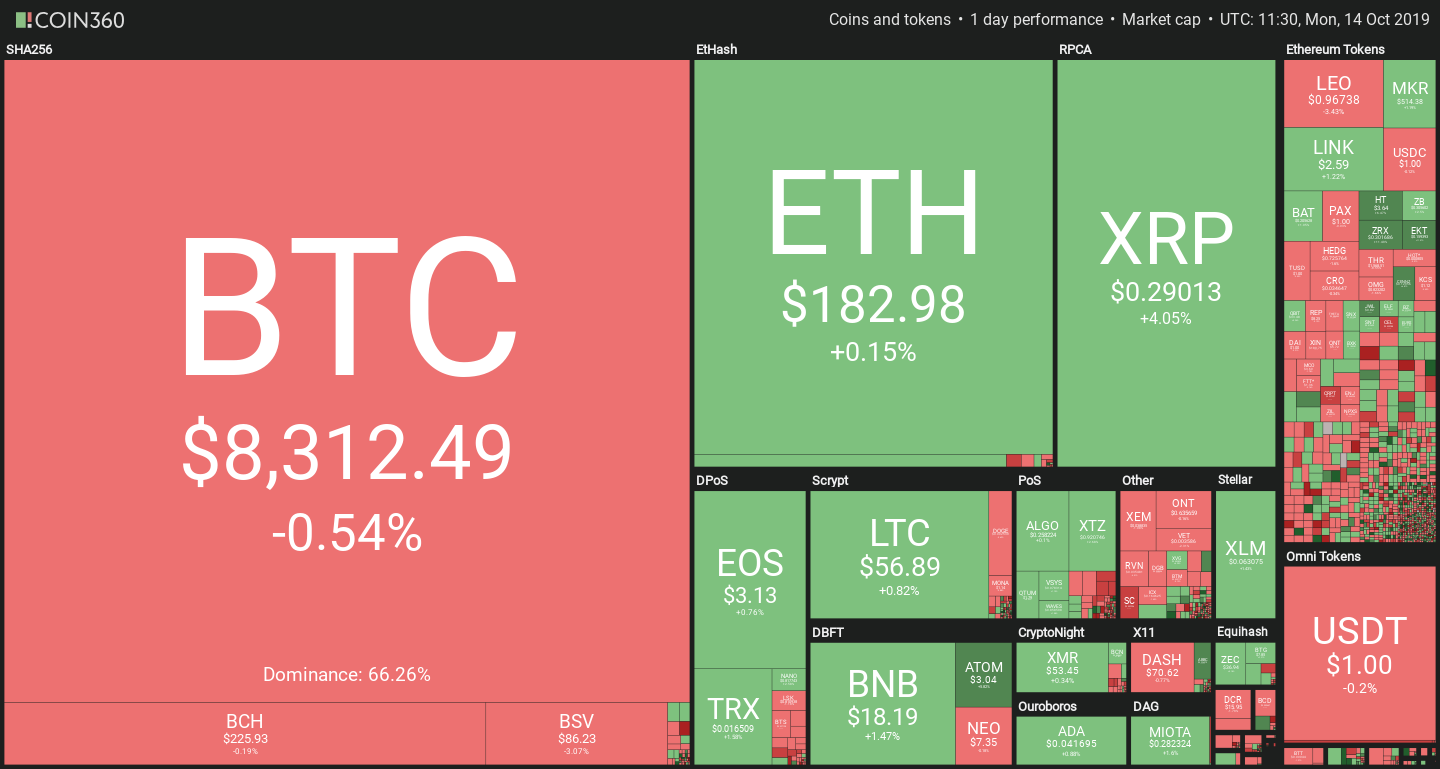

Cryptocurrency markets are remaining fundamentally similar to last week’s landscape. Few movements were seen this weekend, and Monday so far is not proving to be an exception. As before, Bitcoin remains tightly range-bound, trading around the same $8,300 level of the previous week, while altcoin movements are mostly defined by project-specific news.

Notable gainers today are XRP, Huobi Token (HT), 0x (ZRX) and Cosmos (ATOM), posting +4%, +6%, +10% and +6% respectively.

Are we at the cusp of a Bitcoin bear market?

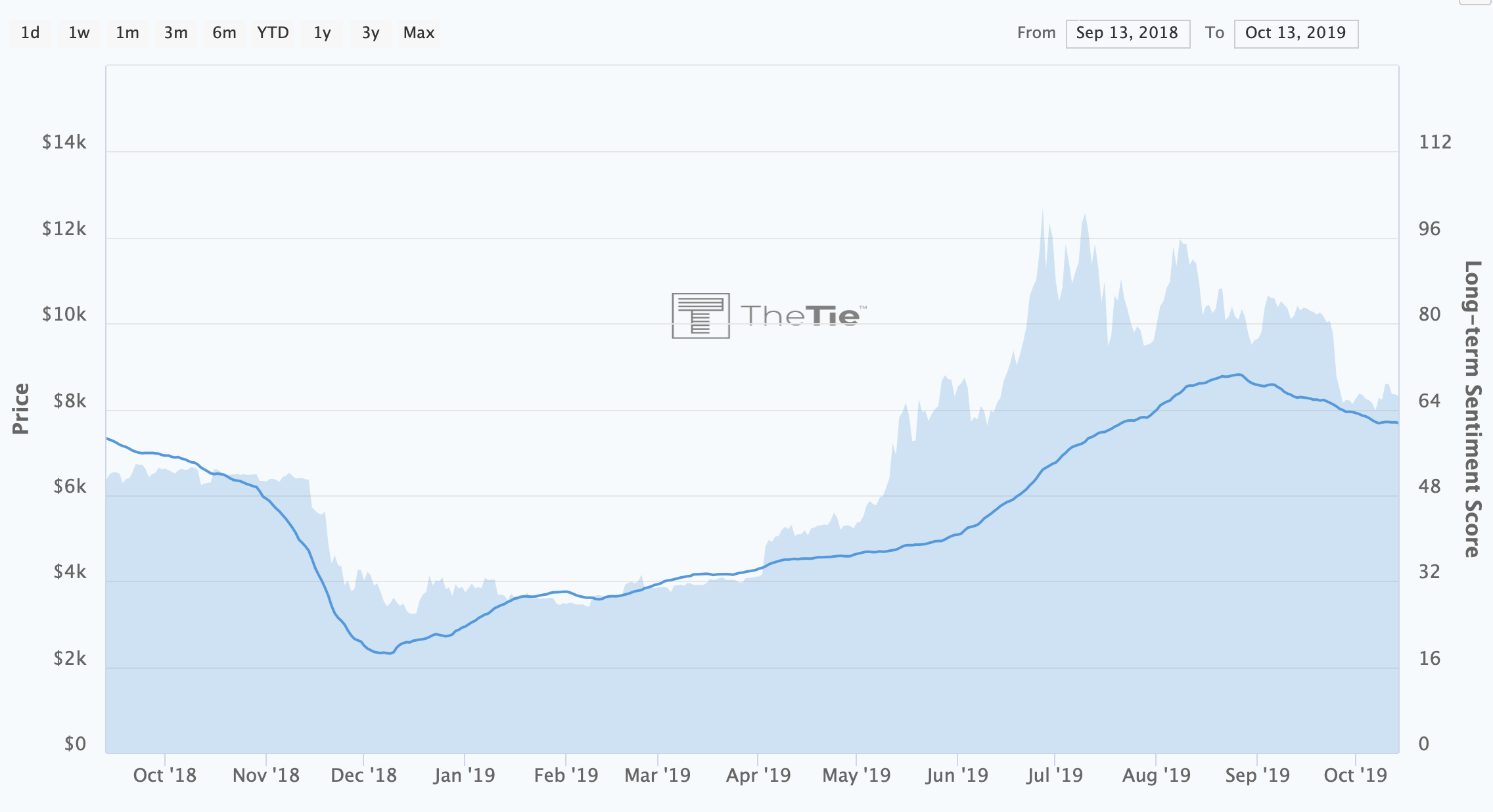

Technical traders are feeling uneasy right now, as the Bitcoin daily chart is looming ever closer to the famed ‘death cross’. That happens when the 50-day moving average crosses below the 200-day average, which signifies a shifting trend in the price dynamics.

There are only two times when this occurred in recent Bitcoin history: late-March 2018 and mid-September 2015.

But during both times, the result was not quite clear-cut. March 2018 was actually followed by a fairly significant upward correction, where Bitcoin briefly touched above the $10,000 level.

During 2015, the death cross occurred right at the end of the bear season, registering the opposite ‘golden cross’ one month later.

Past history is not necessarily a good predictor, but it shows that a death cross does not mean an immediate slide towards $50 for each bitcoin.

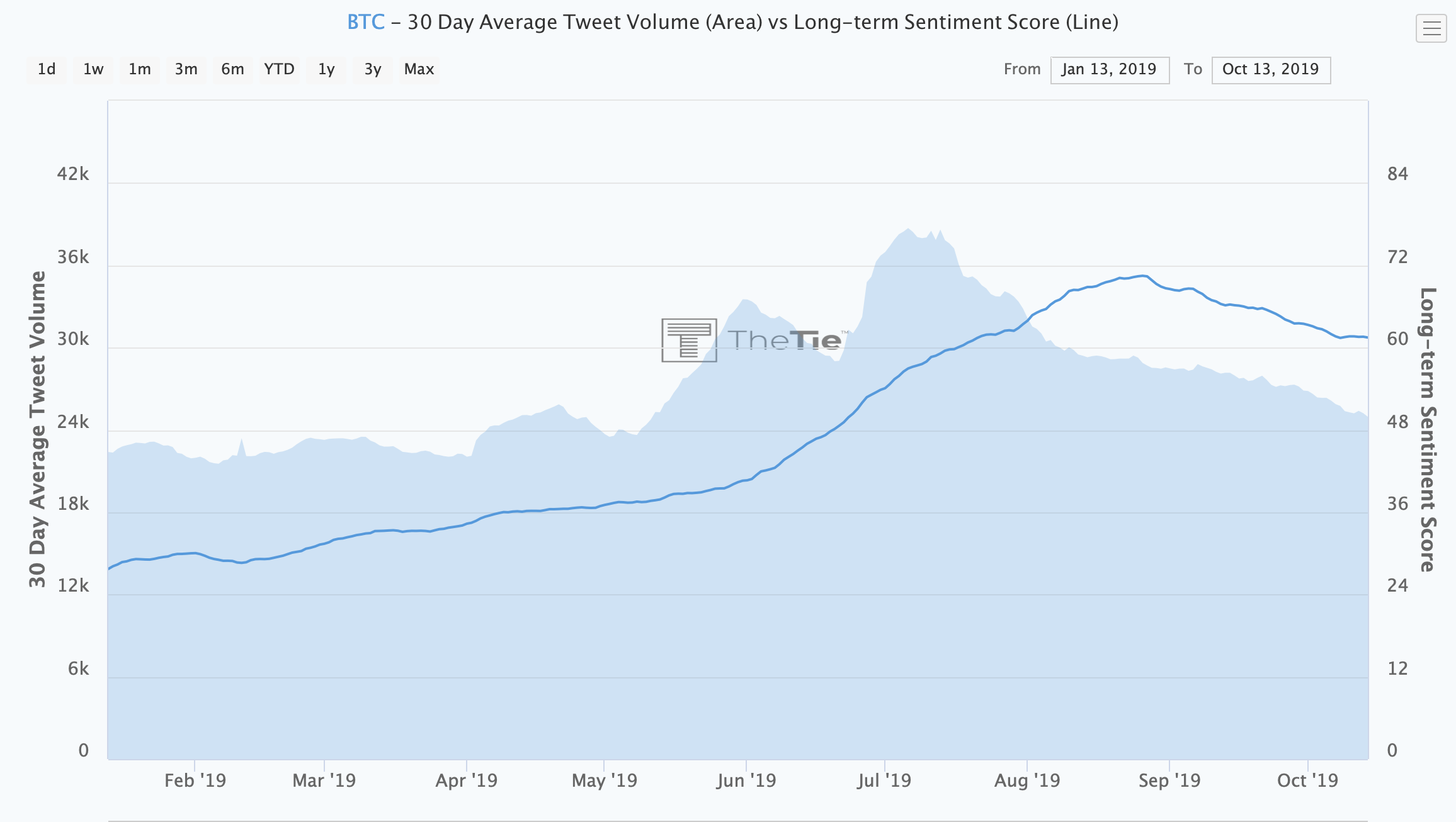

But there is a worrying trend nevertheless. According to data from theTIE.io, interest in BTC is continuing on its downward path.

The long-term trader sentiment for Bitcoin has entered a downward trend since August, and tweet volume is falling precipitously. The sentiment indicator is a remarkably good qualitative predictor of future price movements, generally anticipating the market.

Taken together, the indicators suggest it is likely that Bitcoin will at least complete the death cross in the coming weeks, barring unforeseen bullish news.

0x continues garnering interest

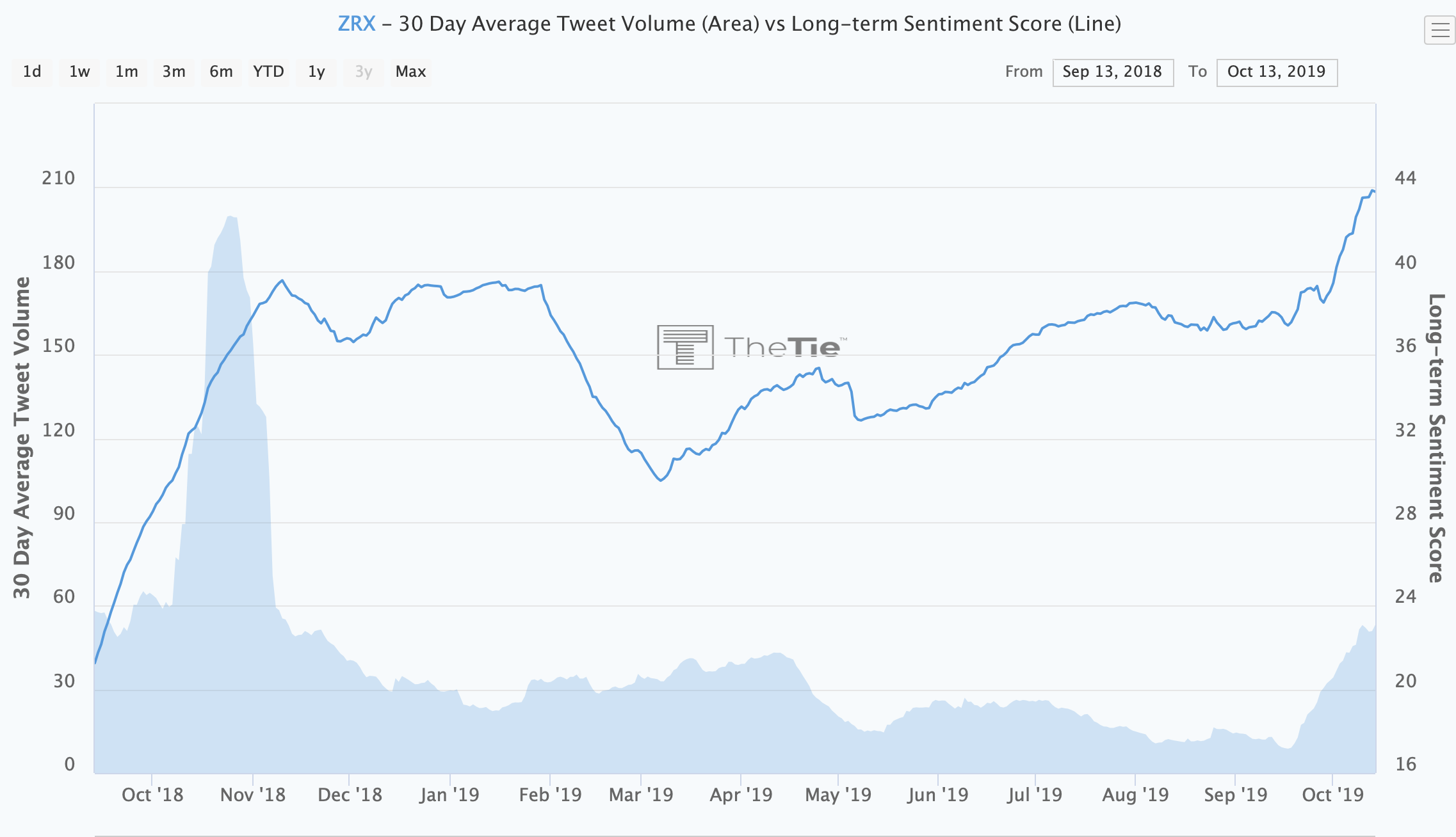

The ZRX token is top gainer for today, but it isn’t due to a reaction to specific news.

Last week was packed with announcements, with 0x teasing an upcoming integration with the Augur prediction markets, before delivering the knockout punch of OpenZKP, the first live Zk-STARK implementation.

But community interest was gaining before and after that, according to sentiment data.

Share this article