Bitcoin Price Unaffected By ETF: OpenLibra To Oppose Facebook

September was bad, is October looking any better?

Share this article

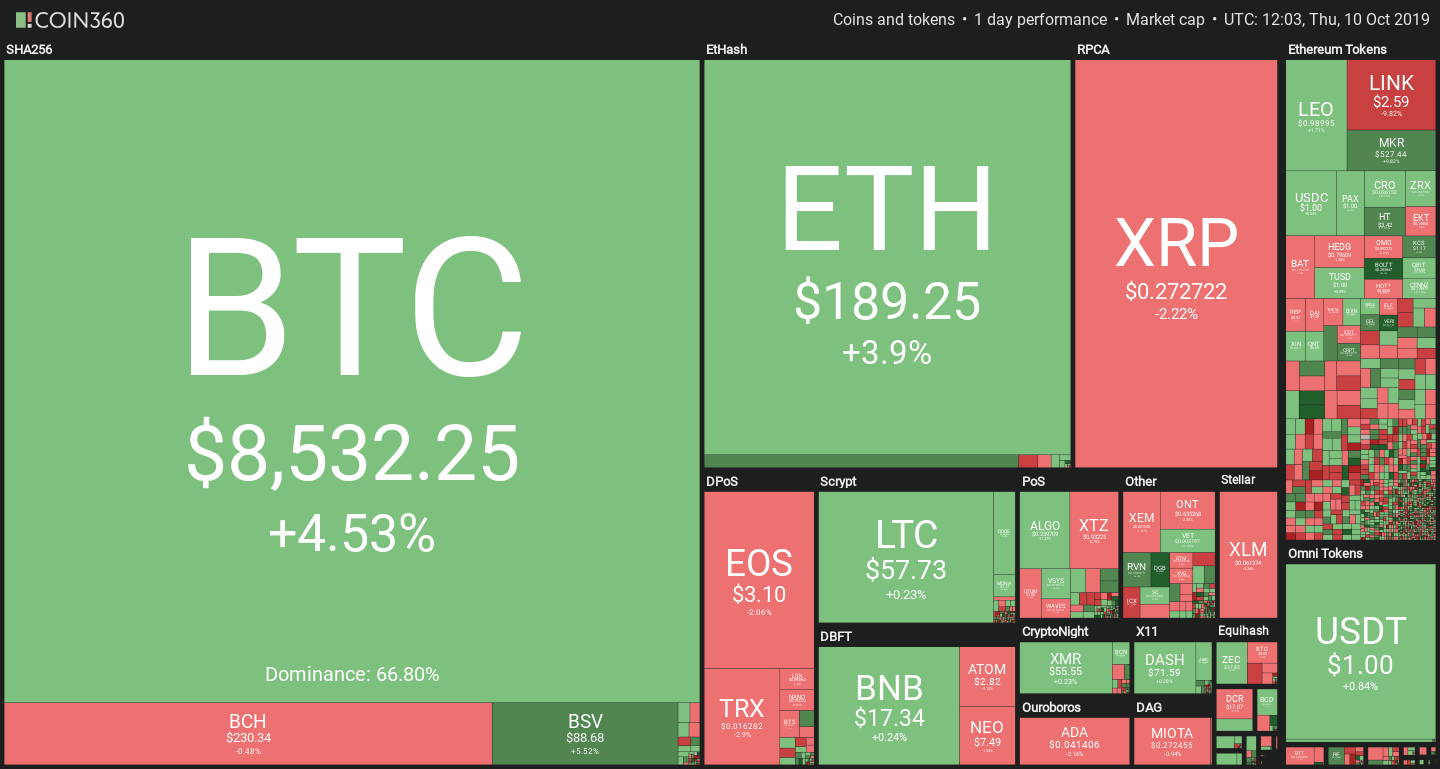

Bitcoin’s price has increased against all expectations. In a sudden surge, the largest cryptocurrency by market cap briefly reached $8,700 yesterday, subsequently stabilizing around the $8,500 price level.

Most altcoins have cooled off, losing a portion of yesterday’s strong gains. Notably, Chainlink (LINK) lost almost 10% after reaching the $1 billion market cap mark, but Ravencoin, Maker (MKR) and Ethereum Classic (ETC) are still up 5-7% from yesterday’s price.

The Bitcoin price surge came without any immediate price drivers, but some of today’s news could be crucial for determining momentum.

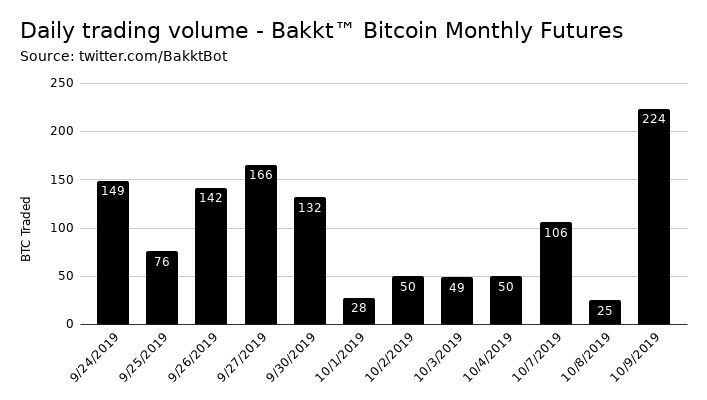

Bakkt’s volume had a strong 10x uptick yesterday, with the total amount of bitcoins traded in contracts amounting to 224 BTC (~$1.9M). While this is a far cry from BitMEX’s $3B+ figure, it is a fairly encouraging sign nonetheless.

The SEC passed judgment on the Bitwise ETF application last night; as predicted by Crypto Briefing, the industry won’t have an ETF this year. While the news is still fresh, markets appear to have had little reaction to it, which shows rejection was likely priced in.

Tech Giants Loomed Over The Bitcoin Price

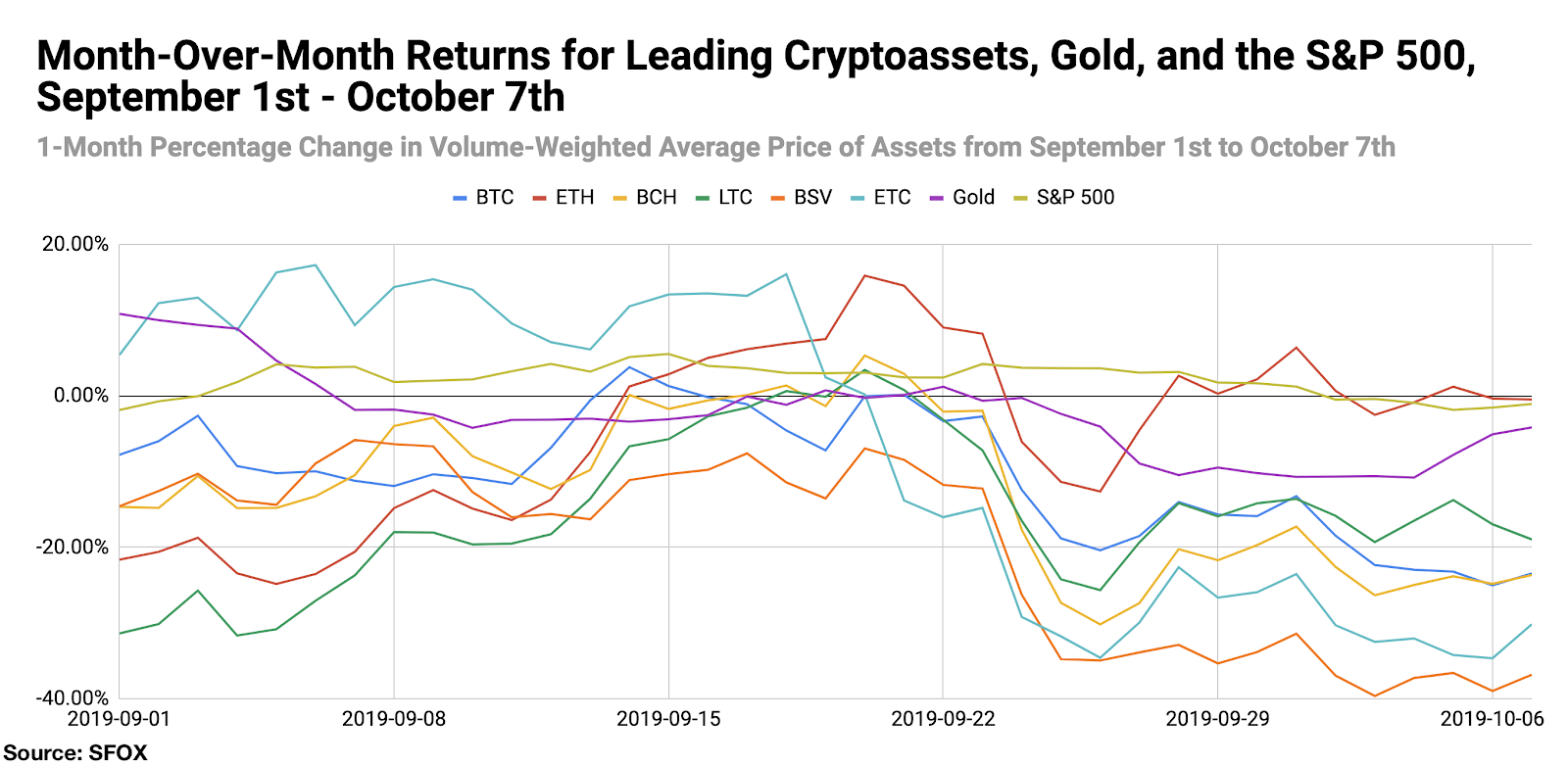

A report published by SFOX analyzed the markets through September and the first week of October. It identified key factors that likely contributed to the lacklustre performance of the crypto market. While the usual suspects, including Bakkt’s underwhelming launch and the Block.One SEC fine, were obviously factors, it also suggested that tech giants’ relation with cryptocurrencies played a role too.

Apple released two somewhat-contradictory statements on cryptocurrency, with Jennifer Bailey of Apple Pay stating that they are “watching cryptocurrency,” only to see Tim Cook reject the idea of an Apple-launched coin a few days later.

SFOX sees this as a sign that “some major companies may remain unsure as to how they will relate to crypto and blockchain technology in the future,” which contributed to overall investor uncertainty. Libra woes were also mentioned, with the consortium losing PayPal in early October.

The report goes on to highlight a moderate correlation between cryptocurrencies and global asset markets. “As of this past Monday, leading cryptoassets, gold, and the S&P 500 all showed negative month-over-month losses. ETH and the S&P 500 lost the least (-0.47% and -1.06%, respectively), while BSV and ETC lost the most (-36.83% and -30.16, respectively),” SFOX writes.

The conclusion, according to SFOX, is that crypto-assets may still present a reaction to global macroeconomic trends and uncertainty, as both gold and the S&P 500 showed losses in tune with cryptocurrency.

OpenLibra announces fork of Facebook-owned project

Announced at Ethereum Devcon 5, a group of companies such as the Interchain Foundation (Cosmos) and the Danish Red Cross will work towards creating a decentralized alternative to Facebook’s Libra.

Dubbed OpenLibra, the project aims to take some of Libra’s redeeming qualities, while removing all of its permissioned aspects, as well as some of the centralized aspects that American politicians took umbridge with during July’s Congressional Hearing.

The Libra project is not without its roadblocks, though. Extreme regulatory hostility has most likely forced Facebook to delay the launch from the proposed 2020 date, and some European countries have openly rejected the Facebook-led coin, but OpenLibra doesn’t believe it’s enough.

“Despite pushback from nation-states, we believe that Facebook is likely to succeed in their goal,” they state on their website. “OECD Governments will be focused on their own outcomes, and in reality have little legislative power to leverage against a transnational force such as Facebook’s Libra.”

It is for “that reason we are creating OpenLibra,” the website concludes.

Nathan Batchelor On Bitcoin

The Bitcoin price is holding firm after yesterday’s impressive range breakout above the $8,500 level, with the weekly high for the number one cryptocurrency extending just above the $8,700 level so far.

Despite the impressive rebound, the BTC/USD pair still remains technically bearish, as buyers failed to close the daily candle above its 200-day moving average.

The same can be said for the total market capitalization of the entire cryptocurrency market, according to Tradingview.com, the 200-day moving average for the entire cryptocurrency market is currently located around the $237,000,000,000 level.

If the total market cap of the entire cryptocurrency market fails to recover above its 200-day, we could start to see sellers moving in and the recovery fading.

The cryptocurrency market, and particularly Bitcoin, has so far failed to react to the news that the SEC rejected the Bitwise Bitcoin ETF proposal earlier this morning.

According to the Securities and Exchange Commission official statement, the U.S regulator rejected the Bitcoin ETF proposal as it failed to meet the necessary requirements regarding possible market manipulation and illicit activities.

The cryptocurrency market has already turned its focus elsewhere, as Bakkt is showing increased trading volume, which has jumped to a twenty-four-hour high of 224 BTC. While this is still fairly low, it is none-the-less a marked improvement on the 50 BTC registered during the previous week.

* ‘Further BTC/USD gains should be expected while the cryptocurrency holds above the $8,500 level’. *

SENTIMENT

Intraday bullish sentiment for Bitcoin has improved, to 66.50%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is unchanged, at 61.50%.

UPSIDE POTENTIAL

The key for further bullish advancement will be the cryptocurrency’s ability to close the daily candle above its 200-day moving average, which is currently located around the $8,600 level. Multiple daily price closes above the 200-day moving average should encourage the next round of BTC buying.

Technical indicators are mixed, as the daily RSI indicator is still bearish and trades below 50, while the MACD indicator on the mentioned time frame is currently generating a bullish trading signal.

DOWNSIDE POTENTIAL

A loss of the $8,500 level would be a bearish development for the BTC/USD pair today, leaving the $8,380 and $8,100 levels as the strongest areas of support.

Traders should also remember that failure to maintain the range break could prompt sellers to test back towards the bottom of the two-week trading range, around the $7,715 level.

Share this article