Market Commentary: Bitcoin Price Strikes Out Again As Regulators Spook Libra

But Kik will not surrender to the SEC.

Share this article

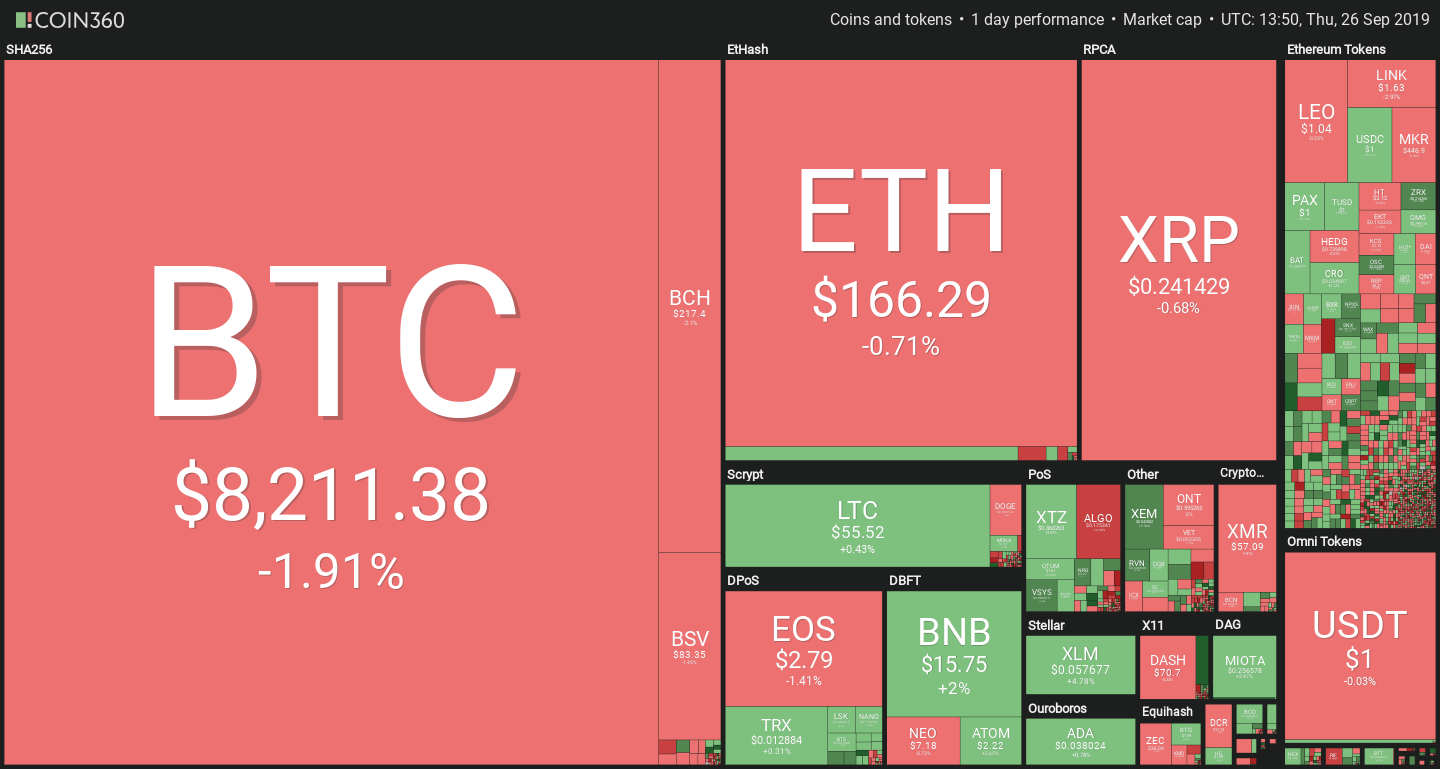

Cryptocurrencies were finally seeing some respite… until a new plunge pushed the leading crypto back under $8,000. The market followed BTC with losses in the 5% range for most top cryptos.

Notably, Stellar (XLM), IOTA and Tezos (XTZ) have posted gains at around 5%, while the rest of the market has largely maintained the same prices as yesterday.

Libra will not be rushed to the market

Libra backlash appears to be weighing on Mark Zuckerberg, who shed some light on the future plans for the currency in an interview given to Nikkei.

Opposition to Libra came from all sides: in addition to the crypto community, regulators were not at all impressed with Facebook’s attempts to insert itself in the global monetary system. The U.S. Congress was largely skeptical of the currency, and some European governments are moving to outright ban the project in their countries.

Zuckerberg is presenting the currency as a way to allow access to the global economy for people in developing countries, but even he had to concede to the many dissenting voices. “A lot of people have had questions and concerns, and we’re committed to making sure that we work through all of those before moving forward,” he noted.

Part of the problem with Libra comes from the fact that Facebook is making it, the company known for misusing stored data in the Cambridge Analytica scandals, among others. Zuckerberg acknowledged that Facebook is facing a lot of scrutiny, and that forces change.

“Part of the approach and how we’ve changed is that now when we do things that are going to be very sensitive for society, we want to have a period where we can go out and talk about them and consult with people and get feedback and work through the issues before rolling them out,” he continued. “And that’s a very different approach than what we might have taken five years ago. But I think it’s the right way for us to do this at the scale that we operate in.”

This new approach will have one likely result: Libra’s 2020 launch date could slip significantly, though Zuckerberg reassured readers that “[we want to] not have this take many years to roll out.”

Considering that Libra was a major component of the the 2019 bull run, this delay could affect other cryptocurrencies as well.

Kik swears revenge on the SEC

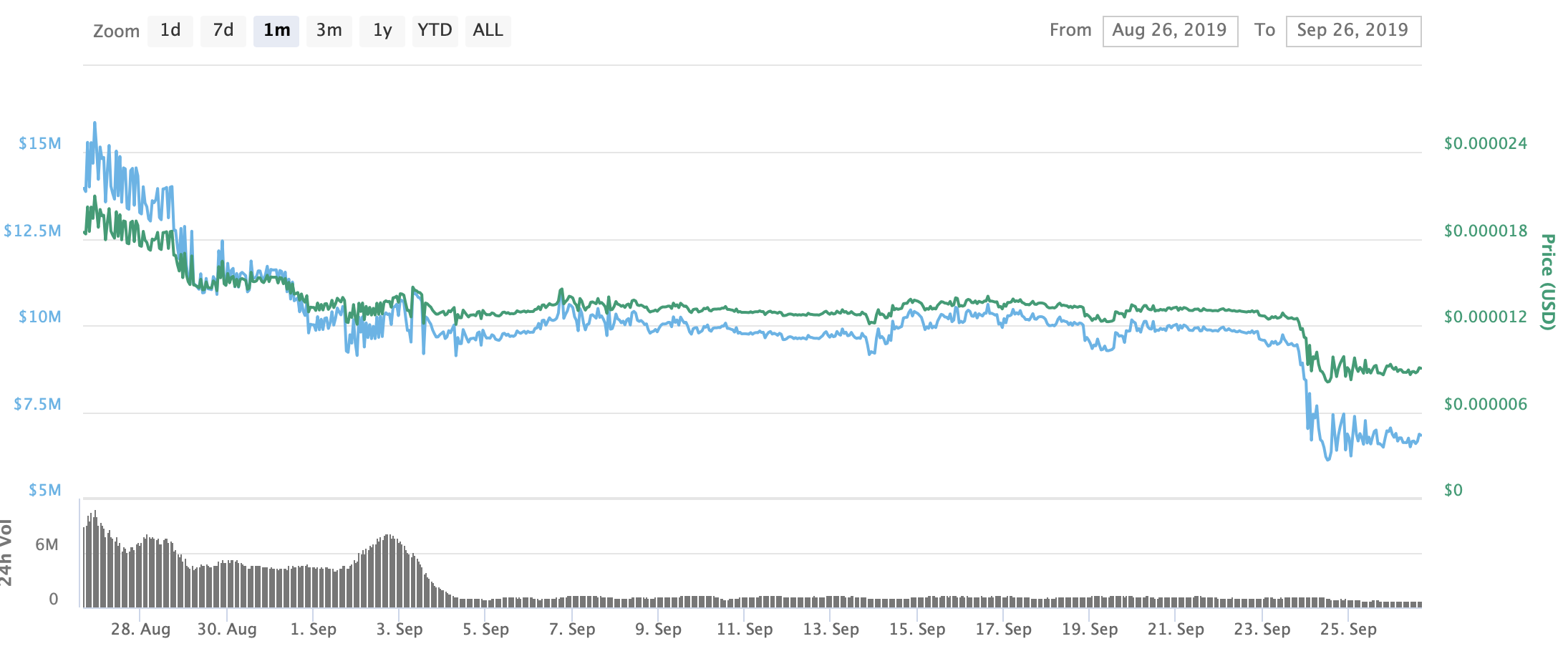

Kin investors may not be so keen on the project anymore, after the company announced that it would shut down the Kik messenger and layoff the majority of its staff.

The cited reason is the SEC: after being singled out by the regulator for conducting what it considers an unsanctioned security sale, Kin now has to focus all its resources in this costly legal battle. Founder and CEO Ted Livingston vowed to keep fighting, stating at Elevate conference that “We have to keep going. Until that’s it, we don’t have a dollar left, a person left. We will keep going no matter how hard it is.”

The market reacted harshly to the news, anticipating the Bakkt sell-off by an entire day. However, the token wasn’t having a great performance before that, having lost more than 90% of value from its all-time high.

Bitcoin Commentary By Nathan Batchelor

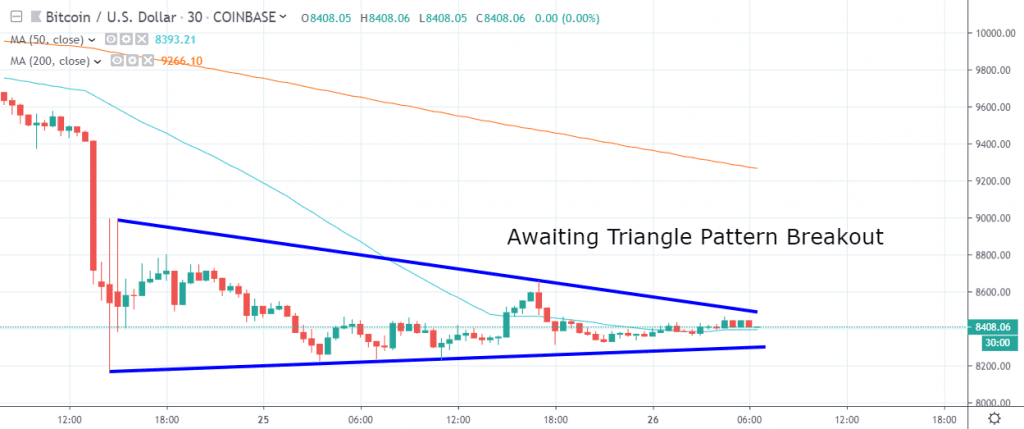

Bitcoin has traded in an increasingly narrow price range over the last twenty-four hours, with sellers failing to build on the recent bearish momentum and hold the BTC / USD pair below its key 200-day moving average.

With the cryptocurrency stuck in consolidation mode towards the lows of the trading month, I will look at the short-term technicals for Bitcoin, which will highlight the possible path ahead for the cryptocurrency today.

The thirty-minute time frame highlights that a short-term technical breakout is nearing, as the BTC / USD pair is trapped within a symmetrical triangle pattern.

Technical analysis shows that a potential bearish breakout from the triangle pattern will take BTC / USD pair towards the $7,500 level. Traders should look out for a drop below the $8,270 level for confirmation of a downside breakout.

Looking at the upside potential, a bullish breakout would take the BTC / USD pair back towards the $8,900 level. The bullish scenario will occur if buyers can hold price above the $8,540 level today.

Interestingly, the daily RSI indicator shows that the BTC / USD pair is now at its most oversold level since November 2018. Generally, when the BTC/USD pair’s RSI indicator has become extremely oversold on the daily time frame we have seen a sharp recovery higher in the price of Bitcoin.

I would also like to point out that if Bitcoin recovers back towards the $8,900 level, then a much larger reversal pattern will form on the lower time frames, which could eventually take the cryptocurrency back towards the $9,750 technical area.

* If the total market capitalization of the cryptocurrency market trades back above the $230,000,000,000 level it should provoke widespread technical buying.*

SENTIMENT

Intraday bullish sentiment for Bitcoin remains bearish, at 28.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency has fallen to 63.90%, but still remains positive.

UPSIDE POTENTIAL

The four-hour time frame is showing that BTC / USD pair will need to recover price above the $9,650 level to reclaim its short-term bullish status.

The descending triangle pattern on the daily time frame remains a key upside technical area buyers need to overcome in the medium-term. The lower-end of the triangle is currently located around the $9,150 level.

DOWNSIDE POTENTIAL

The downside target of the previously mentioned triangle pattern is located around the $7,500 level, which closely aligns with a bearish target I mentioned yesterday, around the $7,600 level.

It is worth reiterating the importance of the 200-day moving average today. Sustained weakness under the 200-day is going to encourage traders to turn bearish towards the BTC / USD pair over the medium-term.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Share this article